For Expats living in Thailand, it was an informative morning at the Pattaya City Expats Club (PCEC) meeting on Wednesday, March 1. Two representatives of Business Class Asia offered advice on matters and arrangements Expats should consider to protect their assets with their wishes clearly known on disposition upon their death. After a break for questions and answers, they then spoke briefly on tax matters that US and UK Expats should be aware of.

Lee Stevens, Area Manager, and Ken Brown, Wealth Management Specialist, began by noting that their company, Business Class Asia, provides many services such as retirement, financial, estate, & tax planning, and other services catering to Expats living in Thailand. Lee has been in the financial industry for nearly 30 years, having worked in the United Kingdom for Midland Bank and then HSBC for ten years. His expertise is in wills and trusts and how they help UK citizens to avoid financial problems when living abroad. Lee previously spoke to the PCEC in 2019 on the subject of how to avoid financial and insurance problems by planning effectively. Ken’s background is in retirement, investment, & trust planning, income protection, and insurance for life, disability, and critical care. He has given many presentations around Thailand.

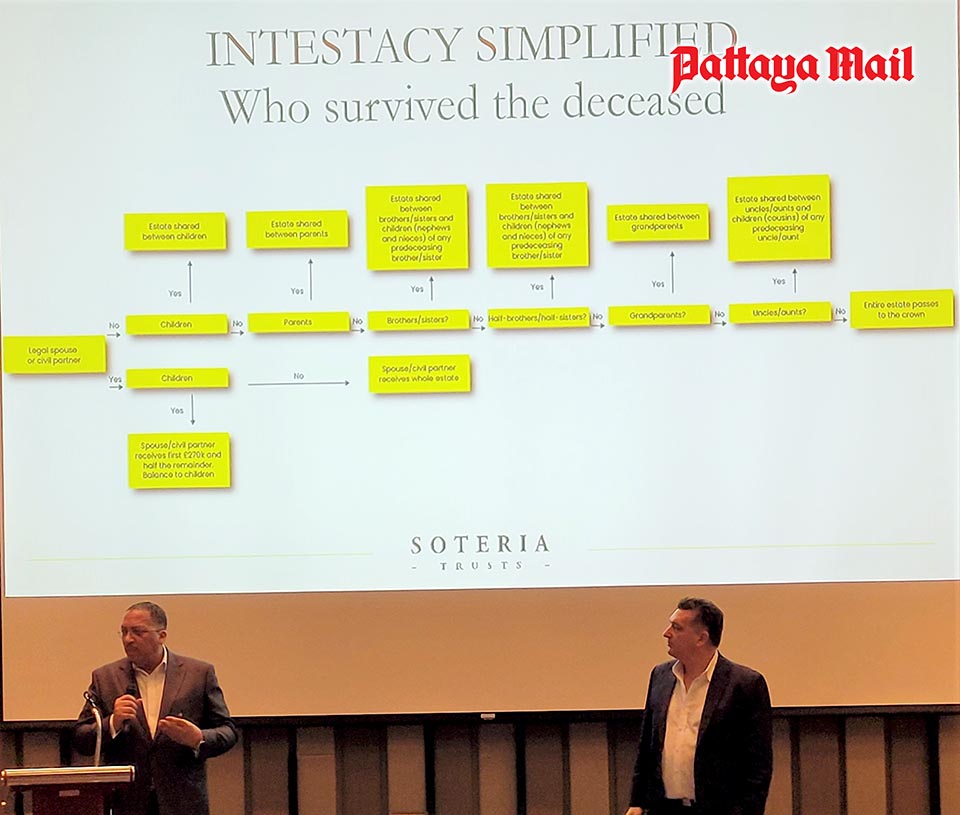

They gave an overview of estate planning; what it is and why planning is important. This was followed with information on Wills; why one should have one and what happens if you die without. Primarily, one should have a will to ensure that their assets go to those they want and without a will, Thailand, like many other countries, has a statutory provision setting for who gets one’s assets if they die intestate.

They noted the following as being costly will writing mistakes and how to avoid them: leaving out assets, being too specific when describing assets, not properly catering for stepchildren or elderly dependents, not preparing for what will happen if your beneficiaries die before you, using an invalid witness/witnesses, selecting inappropriate executors, failing to update the Will after major life events, and changing a Will after it has been signed and witnessed.

After answering many questions from the audience, Lee mentioned certain tax incentives available to UK citizens. Ken then mentioned some tax issues that US Expats should be aware of including the Foreign Account Tax Compliance Act and how its reporting requirements on foreign financial institutions has made it often very difficult for US Expats to even open a Thai bank account.

MC Ren Lexander than mentioned some upcoming events before calling on George Wilson to conduct the Open Forum portion of the meeting where the audience comment and ask questions about Expat living in Thailand. To learn more about the PCEC, visit their website at: https://pcec.club. To view Lee and Ken’s presentation, visit the PCEC YouTube Channel at: https://www.youtube.com/watch?v=jKphNA3XZ8Y.