This week and next we have part 2 in a special report

from Tim Price, Director of Investment with PFP Wealth Management.

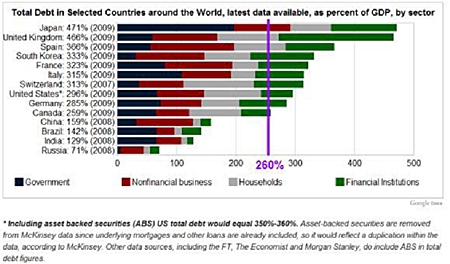

Investment conclusion #2: while it doesn’t make sense to hold

the debt of bankrupt countries (see graph 1 for some of the more visible

culprits), it makes sense to own bonds issued by the most creditworthy

sovereigns. Particularly if Soc Gen’s Albert Edwards is onto something with his

deflationary “Ice Age” prognostications. The Edwards thesis, in brief, is that

in a cooling global economy, equities de-rate in isolation and versus government

bonds, which re-rate in absolute terms.

Graph 1

These charts come via Chris Martenson and his excellent blog.

A recent post, the self-explanatorily titled “Death By Debt”, makes the

damning point that we are all trapped in an expanding credit system that has run

into its terminal phase. We are used to living in a financial environment in

which credit has grown exponentially. Global debt has been growing in a “nearly

perfect” exponential fashion throughout the 1970s, the 1980s, the 1990s and the

2000s.

“In order for the 2010 decade to mirror, match, or in any way

resemble the prior four decades, credit market debt will need to double again,

from $52 trillion to $104 trillion.”

Needless to say, this is not going to happen, although there

would appear to be politicians, presidents, intransigent single currency blocs

and bankers out there who believe it might.

“It explains why Bernanke’s $2 trillion has not created a

spectacular party in anything other than a few select areas (banking, corporate

profits) which were positioned to directly benefit from the money. It explains

why things don’t feel right, or the same, and why people are still feeling

queasy about the state of the economy. It explains the massive disconnects

between government pensions and promises, all developed and doled out during the

prior four decades, cannot be met by current budget realities.

“Our entire system of money, and by extension our sense of

entitlement and expectations of future growth, were formed during, and are

utterly dependent on, exponential credit growth.

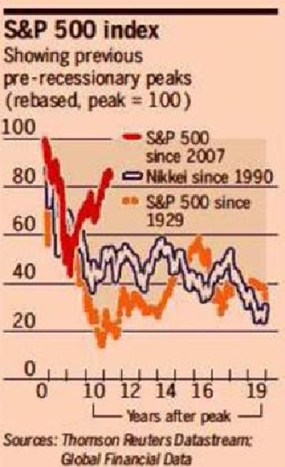

Graph 2

“What will happen when credit cannot grow exponentially?

.Debts cannot be serviced, the weaker and more highly leveraged participants get

clobbered first (Lehman, Greece, Las Vegas housing, etc.) and the dominoes

topple from the outside in towards the centre. Money is dumped in, but traction

is weak. What begins as a temporary programme of providing liquidity becomes a

permanent programme of printing money needed in order for the system to merely

function.”

Note that Martenson uses the word “function” as opposed to,

say, “thrive”. This is because the system has gone beyond the point of no

return.

Fed chairman Bernanke during his June 7th address at the

International Monetary Conference in Atlanta made no explicit mention of

introducing QE3. He did concede that monetary policy rates would be kept at

exceptionally low levels for an extended period, but we already knew that. Like

a consistently spoilt child, the equity market didn’t like what it heard and

went into a sulk. But there is merit in looking beyond the short term to see the

longer term trend. The Financial Times published graph 2 in its weekend

edition last month.

Its impact may not be immediately clear, so let us try and

spell it out like crystal. After two previous historic busts, the S&P 500 (1929

to 1948) and the Nikkei 225 (1990 to, well, today) spent the subsequent two

decades losing up to 80% of their value. In other words, after a colossal boom

and a once-in-a-generation collapse, equity markets can and will disappoint all

those taught to believe in stocks for the long run.

The last several years (the bounce in the red line for the

S&P 500) would seem to diverge from the historic path implied by the other two

graphs. Perhaps the recovery of the last two years was a false one, bought by

the trillions of stimulus poured into the market by a desperate Fed? Time, as

always, will tell.

But if the comparison is a fair one, and we think it is, it

is also time to reflect on what a sensible allocation to equities should be in

the context of a balanced portfolio positioned primarily for capital

preservation. The good news (if any) from the chart is that there is time for

this reflection before deciding just how much, and how fast, to get out of

Dodge.

|

The above data and research was compiled from sources

believed to be reliable. However, neither MBMG International Ltd nor its

officers can accept any liability for any errors or omissions in the

above article nor bear any responsibility for any losses achieved as a

result of any actions taken or not taken as a consequence of reading the

above article. For more information please contact Graham Macdonald on

[email protected] |