Most stock investors are pursuing capital gains, the profits they will realize by selling their investment above the buying price.

But as no stock in the world is completely shielded from risks, internal or external, that could influence share prices and potential capital gains regardless of the stock’s actual fundamentals, many investors balance their portfolios with dividend stocks. At least when they don’t want to sell stocks at a loss, good dividend stocks can provide a sizeable amount that could alleviate their need for cash.

As a cushion against unexpected events like the COVID-19 or the Russia-Ukraine war, Thai stock investors should consider dividend strategy, particularly amid market volatility.

The Thai listed companies managed to bounce back rapidly from the COVID-19 hit. The Stock Exchange of Thailand (SET)’s data showed that the combined net profits of listed companies in 2021 made a new high, at above USD 31.25 billion (THB 1 trillion).

The growth momentum continued in 2022 despite a spike in energy and food prices following the Russia-Ukraine war and lingering impacts from the pandemic, given their resilience to the COVID-19 effects and thanks to Thailand’s reopening. In the first nine months of the year, the combined net profits were USD 23.41 billion (THB 811 billion), up 3 percent from the same period a year earlier.

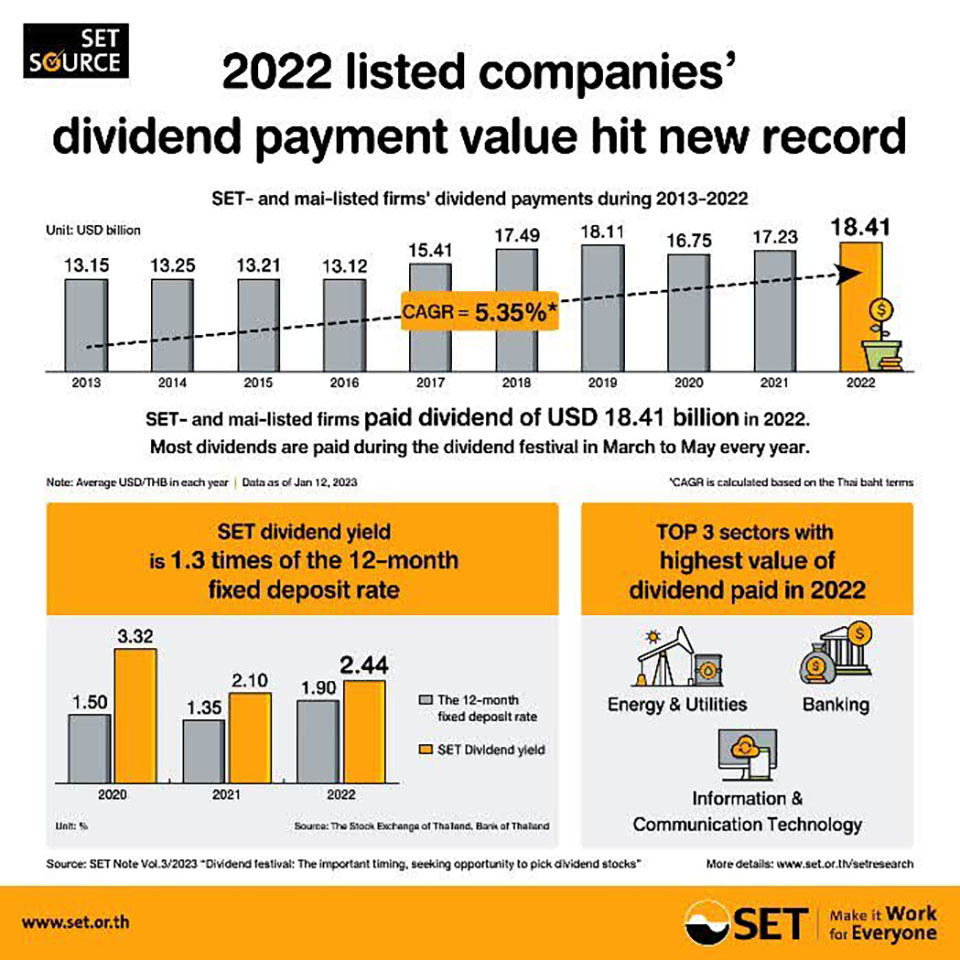

Their shareholders reaped a total of USD 18.41 billion (THB 645.62 billion) in combined dividends, payable in 2022. That sum was another new high in the Thai stock market’s history.

Energy & Utilities, Banking, and Information & Communication Technology were the three sectors that paid the highest amounts of dividends.

In the past 10 years (2013-2022), aggregate dividends reached USD 156.13 billion (THB 5.12 trillion). And the busiest dividend payment season was from March through May. In 2022, 564 Thai listed companies made a total 846 dividend payments and 62.6 percent were paid during March and May. Notably, 52.1 percent took place in May alone.

The SET’s research showed that dividend yields have stayed about 1.3 times above commercial banks’ average 12-month fixed rate during 2018-2022. In 2022, the dividend yield of stocks listed on the main bourse was 2.44 percent. That was comparatively higher than the average 12-month fixed rate of 0.20-1.90 percent, even after Thailand’s policy rate was hiked three times since the COVID-19 outbreak.

Significantly, dividend yield of Thai companies listed on Consumer Products industry group was attractive at 10.11 percent at the end of 2022, followed by that of Industrials, Resources and Property & Construction industry groups at 3.89 percent, 3.20 percent and 2.66 percent, respectively, according to the research.

Based on brighter outlook for the Thai economy in 2023, it’s not unusual to expect a better performance of listed companies for the whole year. And it won’t be unusual either if we are expecting these companies to be as generous as in the past years when it comes to dividend payments. (NNT)