|

Pattaya Property Show proves

a hit with developers & buyers

Pattaya City mayor Ittipol

Khunplome (right) attends the opening of the 3-day inaugural Pattaya

Property Show held at the Hilton Pattaya from Jan 9-11. For a full report on

the event, turn to page 6.

Exhibitors, visitors and organisers were all delighted

with the results of the 1st Pattaya Property Show which took place at the

Hilton Pattaya from January 9-12, 2014.

Over 2,000 visitors attended including buyers from over 23 countries,

tourists, expats and Thais. The event was also sold out with over 45

exhibitors.

Companies displaying their projects and services included huge national

developers Raimon Land PCL and Sansiri PCL, the largest local developers

such as the Nova Group, Universal Group and Blue Sky Group, other premium

developers including The Riviera Group, Kingdom Property, Onyx, Pattaya Posh

and Siam Royal View, as well as many smaller local real estate developers.

Agents and brokers were also well represented with some of the city’s

largest agents, A+ Properties, Ocean Residential, Compass Real Estate and

REBA, the Real Estate Broker Association, Eastern Seaboard all present.

Pattaya mayor Ittipol Khunplome

(center right) and Charlie Warner, CEO of Exact Trading Company (center

left), preside over the official opening of the 2014 Pattaya Property Show

at the Hilton Pattaya hotel, Friday, Jan. 9.

Charlie Warner, CEO of event organisers Exact Trading

Company, based in Pattaya, commented, “Our objective was to put Pattaya

property on the international map for real estate investors. Getting the

full support of the city administrators and by holding the event at a

prestige venue on the 17th floor of the Hilton resulted in the high quality

of visitors we wanted. It was serious people with a real interest that came

to the show.”

Mike Bridge of Exact Trading added, “We were very pleased with the results

of our first show in the city. It is always difficult to launch a new

exhibition, but because of Exact’s existing relationships with many of the

companies in this industry, we were able to generate what turned out to be a

very reputable show. A large number of contracts were confirmed during the

three and a half days, and I am sure there will be many more sales in the

next few weeks.”

The Riviera Group’s Marketing Manager Ubonjitr Thamchop said they had been

busy throughout the weekend: “The Hilton Pattaya’s ballroom definitely

fitted our profile of luxury, and we have already sold an apartment worth 12

million baht on the stand. We also have a fair number of excellent leads

which we feel confident we can close a few deals on shortly. I think this is

a very important step for the city to host a top level event to support the

property industry and maybe it should happen twice a year,” said Ubonjitr.

Over 45 exhibitors were present

during the 3 day event.

Meanwhile an Assistant Sales Manager at Kingdom Property

commented: “We were here promoting South Point and received lots of

enquiries, great feedback and we expect many of them to come to visit us at

our showroom.”

A+ Properties Director Steve Edwards stated, “We had a steady flow of buyers

onto our stand and it has exceeded our expectations. We saw Russians,

Germans, Thai and Korean visitors, and most were looking to buy to live in

the property. It has been great exposure for us too, being a relatively new

company.”

Daniel Arie General Manager at Decorum Furniture and Decoration added, “I

was surprised with the response. Many people who knew our shop but had never

visited us before came over to speak to us, and we even sold a large leather

sofa here from our stand.”

VIP Real Estate’s Jens Nielsen from Rayong said, “Although we were not

overcrowded, it did give us more time to talk to the visitors, who were

serious investors and in my opinion definitely keen to buy. Promoting Rayong

offered a different option from all the Pattaya real estate, which I believe

worked in our favour.”

David Thomas from Beach Properties was also in positive mood, ‘It has been a

pleasure to exhibit at a properly run international style show in Pattaya,

and definitely compares with exhibiting at any international event abroad.

We came here with only our luxury houses to promote as there are already

many condominiums on offer. Maybe next time we might introduce some condos

too.”

Philippe Leysen from Houbenvillas said, “Since we were from Koh Lanta, we

actually got a lot of positive feedback from visitors and I feel confident

that we have at least five serious investors from contacts made at this

event.”

The organisers are now considering running the event twice a year, possibly

in October and then again in February 2015.

Staff from The Riviera sales team

prepare to meet new customers.

Knowledgeable sales staff were

on hand at each booth to provide information on the various projects.

The best of Eastern Seaboard and

Thai real estate was on show at the expo.

The region’s leading developers

were all represented at the show.

Many new projects were showcased

to potential investors.

|

|

|

Hot high-season

for The Riviera

Winston & Sukanya Gale at The

Rivera, Wongamat.

Whilst Pattaya’s real estate market remains questionably

under the spotlight, The Riviera at Wongamat Beach seems to have ignored all

caution and stormed ahead.

Winston Gale, developer of The Riviera told Pattaya Mail, “This high-season

since December, we are pleased to state that we have sold over THB 800

million worth of units in the project, mostly to single buyers and not bulk

investors, and so are delighted at the response from both Thai and foreign

buyers alike.”

The Riviera was originally launched just 4 months ago and has since seen

sales of over THB 2.3 billion out of the expected THB 3.5 billion total

project value.

The luxury showroom located in Soi 16, Wongamat opened last November and

made an immediate impact on the local real estate market. It’s reported 50

million baht cost was, according to Winston, “designed to create a new level

of showroom vision for the consumer.”

A CBRE senior spokesperson said, “This extremely quick level of sales shows

that given a very well thought out product, a desirable location coupled

with heavy showroom investment by the developer, there are still many

investors and individuals that see Pattaya’s ongoing desirability.”

According to Winston at the time of interview, sales had reached a

staggering “70% since starting in October” and had also seen heavy numbers

of these sales generated by many local real estate agents.

The twin-tower development is anticipated to be a landmark project when it

completes in 2017. The Riviera follows the Thailand Property Award winning

The Palm, that is due for completion in 2015 and which Winston co-developed.

For more information on The Riviera, call the sales team on 092-269-1840

|

|

Construction commences at The Lofts Ekkamai

The Lofts Ekkamai units will

offer breathtaking views of Bangkok.

Leading property developer Raimon Land has awarded the

piling contract for its latest condominium project, The Lofts Ekkamai, to

Pylon PLC – one of the country’s most renowned piling contractors, with a

quality track record in major projects. The contract, which follows the

project’s EIA approval, represents the third collaboration between Raimon

Land and Pylon, building upon previous joint efforts at 185 Rajadamri and

Unixx South Pattaya. Piling work began on January 5, 2014 and is expected to

take 3 months.

Officially launched in June 2013, The Lofts Ekkamai has been attracting

potential buyers in search of a chic, trendy residential environment.

Located just 150 meters away from Ekkamai BTS station, the 28-storey tower

sits right inside one of Bangkok’s most fashionable and dynamic districts,

featuring some of the city’s best high-end dining, shopping and nightlife

venues.

“We always focus on location. It is a factor that can determine everything

about the project: style, architecture, target groups, or even the name,”

said Gerry Healy, Raimon Land Vice President – Development. “The Lofts

Ekkamai’s location and design fit exceptionally well together, offering a

stylish home right in the middle of the action in the vibrant city of

Bangkok. This project redefines what it means for Bangkokians to have a hip,

urban lifestyle, and this appeal has driven us to achieve an excellent

reception so far with 65% units sold since the launch.”

Gerry Healy, Raimon Land Vice

President – Development (right), stands with Pisun Sirisuksakulchai, Senior

Executive Vice President of Pylon following the awarding of the piling

contract for The Lofts Ekkamai condominium.

Pisun Sirisuksakulchai, Senior Executive Vice President

of Pylon, added, “We are very proud to be working with Raimon Land once

again. It is an honor for us to take part in the creation of one of

Bangkok’s up-and-coming urban landmarks.”

The Lofts Ekkamai is architecturally inspired by the famous lofts in iconic

urban neighborhoods like Manhattan’s Meatpacking District or Soho in London,

where world-famous artists, fashionistas and other culturally influential

figures managed to create wide-open living spaces that can spark expression

and creativity.

The project’s loft units, in particular at the last floor and penthouses,

fittingly feature a 5.9 meter ceiling height and breathtaking views of the

city. All units are equipped with floor-to-ceiling windows to further create

a sense of airiness, freedom and comfort for residents. In addition, The

Lofts Ekkamai offers its privileged residents exceptional facilities, such

as a podium top garden, a rooftop swimming pool, a sky lounge, gym and many

more amenities.

For further information, visit

www.raimonland.com.

|

|

Outward bound will be the trend among Asia’s property investors in 2014

In Hong Kong, many real

estate investors are shifting from core to non-core locations.

(Photo/Wikipedia Commons)

Asia’s accelerating economic growth and rising industrial

output and retail sales all point to a positive outlook for the region’s

property markets during the coming year, according to global real estate

services company Colliers International.

Colliers, in its International Asia Real Estate Forecast 2014, says it

expects tight supply and rising rentals in core city locations will

encourage office and retail tenants to relocate to less-expensive

decentralised areas.

“A striking feature in the market is likely to be a big increase in outbound

capital investment by Asian investors,” says Simon Lo, Executive Director of

Research & Advisory, Asia, at Colliers International. “They will be seeking

to exploit the big differences between the property cycles in Asia and the

US and Europe in order to achieve better yields and enjoy the strategic

benefits of diversification.”

Chinese investors are set to lead the way in this trend. They are likely to

spend at least twice as much on overseas property assets as last year. Their

favorite investment destinations will be gateway cities like London, New

York and Chicago. Taiwanese institutional investors will also be major

players, following the recent relaxation of regulations concerning overseas

investments by the authorities in those places. Meanwhile, Korea will be

following suit to see more relaxed policy on acquisition of overseas real

estate by Korean nationals.

In Hong Kong, a key trend of shifting from core to

non-core locations is expected. This applies not only to office occupiers,

which relocations to Kowloon East have seen, but also to retailers who

continue to shift their focus from high streets to sub-urban locations.

Lo explains, “The growth in the luxury segment of Hong Kong’s retail market

has decelerated, with the impact of China’s political reforms on

anti-extravagance rules that deter China tourists’ purchase of luxury goods.

Moreover, as the number of same-day visitor arrivals increases, the market

has observed a change of spending pattern towards mid-priced products and

daily necessities such as beauty and personal care products. These explain

the growing demand in locations out of the traditional high streets that are

mostly occupied by international brands and luxury retailers.”

Key highlights from Colliers Asia Real Estate Forecast 2014 for the region

include:

Modest office rental growth

Overall, Asia’s office leasing sector will remain steady, with rents

increasing by an average of around 3% across the region in 2014. However,

there will be some big variations. Jakarta and Manila are expected to remain

the hot spots. These two cities saw substantial increases in rents last

year, and the trend is set to continue with 13% and 9% growth in 2014. Its

recovery from a cyclical downturn and growing demand will probably fuel a

hefty 12% increase in Singapore too.

The performances of office markets in different regions of China will be

mixed. The region’s two key laggards are expected to be Hong Kong, due to

limited growth in demand, and India, where economic and political concerns

have dampened market sentiment.

Logistics fuels rise in industrial rents

Asia’s logistics real estate sector will definitely benefit from increasing

logistics throughput during 2014. The rents of industrial and logistics

premises will grow by an average of about 3%, as more small and medium-sized

companies outsource logistics operations to third-party logistics (3PL)

operators. Industrial and logistics rents in Manila are expected to remain

the fastest growing in Asia, although by a more-modest 21% this year.

Singapore is the only market that will likely experience a small decline in

industrial rents.

Retailers focus on decentralised locations

The retail sales in the Asia region are projected to grow by an average of

around 8%. Its vast retail market and spending power mean that China will

account for much of this, with added momentum from the government’s

relaxation of its one-child policy and proposals to facilitate the

relocation of people from the countryside to the cities. Vietnam and

Kazakhstan are also projected to see a major increase in retail sales.

Colliers forecasts retail rents will grow by an average of about 3% across

Asia in 2014, with retailers increasing their emphasis on decentralised

locations. While retail rents in Guangzhou, Hong Kong and Ho Chi Minh City,

Vietnam are expected to decline, those in Hanoi and Singapore are likely to

remain static. The increases in Asia’s other key retail markets will most

likely range by between less than 1% and 17% during the coming year. These

big variations will be due to differences between rents in core and

decentralised areas, as well as the locations of new supply.

Yield expansion to continue

In anticipation of an increase in the cost of funds, Asia’s real estate

yields are expected to continue its upward rise. Office yields in most Asian

cities are projected to edge up by a further 10 to 30 basis points (bps) in

2014. However, Shanghai, Guangzhou and Tokyo will be the exceptions where

yield compressions are foreseen for their office properties due to the

unique buyers profile and economic policies in the market.

The weak Japanese Yen will offer foreign investors a window of opportunity

to snap up high-quality office and industrial developments in Tokyo, where

office rents are expected to edge up in line with inflation and yields are

likely to be compressed by 10-15 bps in 2014. Since it is always difficult

to source top-calibre properties in Tokyo, Colliers believes investors will

seek out opportunities in other major Japanese cities, such as the Osaka and

Nagoya metropolitan areas.

In India, recent policy amendments to increase market transparency and plans

to establish REITs have set the scene for a turnaround in the property

market. However, this is not likely to occur until after the general

election in 1Q 2014. Further stabilisation of the Rupee would also increase

the confidence of real estate investors about returning to the market.

(Source: Colliers International)

|

|

CBRE Thailand receives double awards

Nithipat Tongpun (right),

Executive Director of CBRE Thailand, receives the World’s Best Property

Consultancy Marketing award during the International Property Awards held at

the Grosvenor House Hotel in London.

Property consultancy firm CBRE Thailand recently received

two prestigious awards including recognition as the World’s Best Property

Consultancy Marketing at the International Property Awards and a Silver

award for the Online Advertising and Marketing Category from the Summit

International Awards.

CBRE Thailand was announced the World’s Best Property Consultancy Marketing

for its work on Park Ventures, Bangkok’s award winning eco-complex, at the

International Property Awards sponsored by Virgin Atlantic and Yamaha. CBRE

Thailand competed against real estate professionals from 98 countries from

all over the world to receive this top recognition.

The finest architects, developers, interior designers, and real estate

agents from across the globe gathered at the Grosvenor House Hotel in London

in December 2013 to attend a gala dinner to celebrate the international

award winners.

CBRE Thailand won a Silver award

for the Online Advertising and Marketing category for its website

www.cbre.co.th from the Summit International Awards. The award is presented

to David Simister (center), Chairman of CBRE Thailand.

CBRE Thailand received a total of 10 awards including 1

award at the international level, 2 awards at the Asia Pacific level, and 7

awards at the national level in the Real Estate category covering

consultancy, agency, lettings and website. In 5 years of CBRE Thailand

competing in the International Property Awards, this marks up a total of 39

awards.

“We are proud of our continued success and the award of being in 2013 the

World’s Best Property Consultant Marketing. This is the second time we have

won the World’s Best International Commercial award. CBRE Thailand is proud

that our expertise and experience is recognised, not only by the Thai

property market, but also as being competitive with the world’s best. I

would also like to thank all CBRE Thailand staff for their hard work every

day to deliver leading real estate services to our clients, and this is a

testament to their efforts,” said David Simister, Chairman of CBRE Thailand.

CBRE colleagues in the Asia Pacific region also competed in the awards. CBRE

Philippines won the World’s Best Lettings Agency and World’s Best Property

Consultancy Website and CBRE Japan was awarded Best Property Consultancy in

Asia Pacific.

The International Property Awards is the world’s largest and most recognised

property awards with 98 countries participating last year and the value of

projects entered estimated to be around £100 billion. World’s Best awards

were given out for the most exceptional real estate agencies, lettings,

agencies and property consultancies, as well as the best industry websites

and marketing campaigns. Judging was carried out through a meticulous

process involving a panel of over 70 experts covering every aspect of the

property business.

|

|

AIA expands business platform to property development

AIA executives pose for a

photo on the roof of the AIA Capital Center in Bangkok during the building’s

topping out ceremony.

Insurance giant AIA Group is expanding its business

platform in Thailand by investing in property development. Over the next two

years, the group will be launching two large-scale office and retail

complexes in Bangkok’s prime areas. AIA’s first and biggest property

investment to date is the 6 billion baht environmentally friendly AIA

Capital Center, the only ‘Grade A’ office complex along Ratchadapisek Road,

which will complete and be ready to commercially launch by June 2014.

“Based on AIA’s experience in life insurance industry in Thailand for over

75 years, we have strong confidence in the country’s potential, especially

in its future economic growth and development,” revealed Anucha

Laokwansatit, General Manager and Chief Investment Officer of AIA Thailand.

“The 6 billion baht investment in the AIA Capital Center marks a significant

step in strengthening the foundation for our growth while ensuring a stable

future,” he explained.

A computer graphic shows the

completed 6 billion baht AIA Capital Center.

Standing on a spacious plot of land of nearly 10 rai, AIA

Capital Center is a 34 storey building offering 54,000 square meters of

‘Grade A’ office space, with each storey ranging between 1,700 and 1,800

square meters, and an additional 5,000 square meters of retail space. The

entire complex with a total construction area exceeding 100,000 square

meters will include banks, restaurants, cafés, a fitness center, and

convenience stores.

“Our Group decided to invest in this project because we see the solid

potential of this location which we believe will become Thailand’s next

business center for two crucial reasons, namely its location adjacent to the

new Stock Exchange of Thailand, which makes the environment resemble Wall

Street in the US, and its proximity to the underground mass transit system.

These factors strengthen our belief that this location will become a prime

financial area,” added Anucha.

Designed to conform to global environmental standards set by the world

renowned American environmental design institution, LEED (The Leadership in

Energy and Environmental Design), the project includes unique qualities that

makes it a green building, unlike other buildings along Ratchadapisek Road.

One of the most outstanding points of the AIA Capital Center is the height

and airiness of every space, from the stylish lobby with a 9 meter high

ceiling to 3 meter ceiling heights in its office spaces. The latter is the

highest ceiling found in any office space in Bangkok (commercial building

average ceiling heights range between 2.75 – 2.90 meters) and design

flexibility is created in offering column-free office spaces.

“AIA Capital Center features cutting-edge green design because AIA intends

to make this office complex visually outstanding, energy efficient and

environmentally friendly as much as possible,” Anucha emphasized.

“Our building design incorporates many types of green spaces that generate

positive health and emotional benefits to people working in the building and

living in the local community, so we welcome everyone to use our green areas

for recreational purposes and encourage the public to view our project as a

new urban park. With ample space, the building is also ideal for hosting

various public activities,” he added.

The AIA Capital Center is on schedule for completion and ready for tenants

to move in by early summer 2014.

|

|

Issara expands to Chiang Mai with new low–

rise condo in a contemporary northern design

Songkran Issara speaks exclusively to the Chiang Mai Mail about his company’s new project

By Peerasan Wongsri

Chiang Mai Mail General Manager Peerasan Wongsri recently met with Songkran

Issara of Chan Issara Development Public Co. Ltd. at the Issara showroom in

Chiang Mai as K. Songkran paid a flying visit to the city.

Songkran Issara of the Chan Issara Development

Public Co. Ltd.

K. Songkran is originally from Songkhla Province in the south, the son of

Chan and Malee Issara. Married to Sri Issara, he has three children; two

sons and a daughter. He was recently appointed as Managing Director for the

Chan Issara Wiphapol Co. Ltd, a subsidiary of Chan Issara Development Public

Co. Ltd.

Chan Issara Development Public Co. Ltd. have built housing projects in

Bangkok, Phuket and Cha-am - Hua Hin and their over 25 years of experience

has made them the leading real estate company in Thailand. Known for quality

construction and design, the company’s newest development in Chiang Mai,

labeled ‘The Issara Chiangmai’, will feature 570 units in 4 low-rise

buildings with a large central green area on 6.5 rai of land on the 2nd ring

road.

Here K. Songkran talks about the project and his company:

CMM: Where and how was “Chan Issara” established ?

The project will offer resort style living with

serviced units and 24-hour security for both regular visitors and full time

residents.

K. Songkran: The company was established in1987 and we initially began to

develop and facilitate real-estate in Bangkok. Gradually we expanded the

business to tourism destinations such as Phuket and Hua Hin before becoming

the leading real-estate company in Thailand. The company has since continued

its expansion and launched developments in other popular locations in

Thailand, like Chiang Mai.

CMM: How have resources been allocated for this project?

K. Songkran: For ‘The Issara Chiangmai’ we have allocated the project over

6.5 Rai of land, situated near the 2nd Ring Road, a short 5 minute drive

from Central Festival at San Dek intersection. The company will build condos

in a northern contemporary style under the concept ‘Special uniqueness

inspired by inherited cultural arts amidst the natural charms of Chiang

Mai’. Unique features of the project include a central green area, which

covers over half the property, a library, a jacuzzi, children’s swimming

pool, a gym, and a swimming pool next to Maenam Kao. Providing 24 hour

security and a spacious lobby, the condo offers a peaceful and secure

ambience.

Songkran Issara (right) chats with Chiang Mai

Mail’s General Manager Peerasan Wongsri about his company’s new development

in Chiang Mai.

‘The Issara Chiangmai’ will have a total of 4 seven storey buildings and

will offer 1 bedroom condos from 35-40 sqm starting from 1.89-3.28 million

baht and 2 bedroom condos from 70-77 sqm from 4.99-7.25 million baht.

Reservations will be available from May 2014 and the project is most likely

to be completed in 2016.

CMM: What was the objective of choosing Chiang Mai?

K. Songkran: There are many projects under construction for the Issara

Group, including locations in Bangkok, Phuket, Cha-am – Hua Hin and now

Chiang Mai. Personally, I prefer up-country projects, and to make them

resort style. I have had my eye on Chiang Mai for 15-20 years but back then

Chiang Mai was not ready in many aspects. Today the infrastructure is ready,

with an international airport and conference center, better schools and

attractons like the night safari. The roads have also been developed and

improved plus the launch of the ASEAN Economic Community in 2015 will make

Chiang Mai the northern hub. In addition, Chiang Mai has seen higher income

growth resulting in a higher purchasing power for local residents.

CMM: Is it true that the ‘Sri Panwa’ project by the Issara Group in Phuket

has earned a world class reputation and is attracting a large amount of

tourists in Phuket ?

K. Songkran: Yes, the Sri Panwa project in Phuket has developed a lot and

was originally constructed as a hotel with a resort atmosphere. Recently,

the Sri Panwa has received recognition as a world class attraction which

brings income to the people in the area as more visitors come. As for the

previous projects, we have enhanced the service for customers and are still

developing a new look to serve customers in Chiang Mai.

CMM: What are the main selling points of your new Chiang Mai project?

The Issara Chiangmai will have 570 units in 4

low-rise buildings with a large central green area on 6.5 rai of land on the

2nd ring road.

K. Songkran: We decided to make a project here because we believe the city

is ready for such a development. Real-estate developers in Chiang Mai are

known as developers with potential, including investing power and there is

high competition here. This requires that our project incorporates unique

features, from design to environment and landscaping, plus accessibility to

such places as Tesco Lotus, Central Festival, Meechoke Plaza and the

hospital. The development is also located next to the Kao river, which will

be integrated into the project and help offer the pleasurable ambiance of a

resort amid the convenience of city life.

The project will focus on after-services, we expect 40% of customers will be

locals, 30% from Bangkok and another 30% will be foreigners. For those who

do not live here regularly, the project will provide cleaning services

including looking after the unit after every visit and the project will

allow customers to rent according to their wishes. Unit bookings can be made

from May 2014 onwards.

For more information on the project call 095 885 5818-9 o go to

www.theissarachiangmai.com.

|

|

Real estate stands to suffer if economic woe continues

As Thailand’s economic growth softened throughout 2013

owing to the combination of lackluster export figures, rising household debt

and declining consumption and investment, long-standing political tensions

flared up late in the year, further dampening the economic outlook for the

end of the year into 2014.

While most economists expect the country’s GDP results in 2013 to show

growth of less than 4%, and are now revising 2014 forecasts downward,

Bangkok’s property market made it through the year relatively unscathed, yet

it is expected to feel the impact in 2014, according to real estate

specialists Jones Lang LaSalle.

Suphin Mechuchep.

Suphin Mechuchep, Managing Director of Jones Lang

LaSalle, said, “The Bangkok property market finished strong in 2013 despite

unfavourable conditions throughout much of the year. Demand across property

sectors was robust, as reflected by both steady growth in selling prices and

rents, as well as the successful introduction of new supply.”

In the condominium sector, most of the new projects launched were well

received by buyers, with those located near existing and under-construction

mass transit stations achieving the highest pre-sales rates. Average selling

prices continued to grow in 2013, though the growth rate was less than in

2012 due to stiff competition as a good amount of supply remains available

in the market.

Bangkok’s commercial property sectors performed well throughout 2013 as

limited supply and strong demand drove occupancy rates and rents to all time

highs in the office sector while the prime retail market is experiencing

near-record high occupancy and rent levels. Across Bangkok, office occupancy

has reached 90% while rents have been increasing for nine consecutive

quarters. In the prime retail market, occupancy is above 94% while rents

have been increasing for 13 consecutive quarters, due largely to limited

supply and strong demand from both local and international retailers.

“Strong fundamentals helped save the Bangkok property market in 2013. But at

this point, it remains hard to predict where the market is heading in 2014,”

continued Mrs. Mechuchep. “The major concern by most parties is the current

political turmoil. We have already seen property developers, owners,

investors and occupiers becoming more cautious, with some of them adopting a

wait-and-see approach. The fact that some property developers and owners

have become reluctant to invest in marketing and promotional campaigns

exemplifies this trend,” she said.

The Bangkok property market

finished strong in 2013. (Wikipedia commons)

“Though experience from previous bouts of political

unrest that Thailand has faced over the last decade suggests that short-term

impacts from individual incidents of unrest on the property market have been

limited, there has been longer-term uncertainty created by these events, as

is evidenced by the fact that growth in Thailand’s foreign direct investment

has not kept pace with its ASEAN neighbours in recent years,” the Jones Lang

LaSalle chief added.

“With all eyes on elections scheduled for February 2nd this year, the most

important factor in the outlook for 2014 is how quickly and smoothly the

current political situation is resolved,” she concluded.

|

|

Chic Republic opens Pattaya location

Home-furnishings retailer Chic Republic brought its

unique line of high-end furniture, lighting and decor products to the

Eastern Seaboard with the opening of a store in Pattaya.

The spacious and stylish “home fashion store” at 244/31 Moo. 11 Sukhumvit

Highway (opposite Big C South Pattaya) markets products under a “mix and

match” concept, letting decorators choose between modern and

Thai-traditional styles. Western-flavored choices include “Modern Chic,”

“Luxury Classic,” “Romantic Vintage,” “Elegant American” and “Beach &

Garden.”

Special features, such as the “Sleep Gallery,” offer some of the kingdom’s

largest selections of bedding. Special interior 3D program designing

services are also provided to give free home decoration ideas.

CEO Kijja Pattamattayasonthi said the word “chic” was not only easy to

pronounce, but set Chic Republic apart from other furniture retailers.

“We focus on exhibitions showing a mixture of a modern and traditional home

style atmospheres in our store,” Kijja said. “This includes all high-quality

products and our unique style of decorating homes. We also provide free

delivery service so that our customers will not have to go through trouble

to hire any trucks. Free installations are included as well as our expert

designers, which will be there to help make suggestions for our customers’

homes.”

He said the company works hard to determine what’s popular in the market as

well as come up with its own interesting ideas.

“We have also studied home-furnishing styles from all over the world,

including Italy, France, England and the United States, to combine with our

own traditional patterns,” Kijja said. “We focus on the need of our

customers, Thai or foreign, and what they want for their homes and what’s

suitable for their expectations to make them comfortable.”

Chic Republic, which operates two branches in Bangkok and one in Hua Hin, is

celebrating the opening of the Pattaya store with a sale offering discounts

up to 40 percent. For more information, see ChicRepublicThai.com.

(Veechan Souksi/PM)

|

|

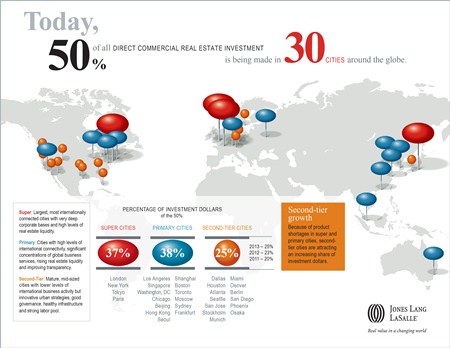

Real estate investment a major factor in city success

Top 30 cities for real estate investment worldwide demonstrate strength of “super cities” and growth of second-tier cities

As business and political leaders convened to discuss

global challenges at the World Economic Forum annual meeting in Davos,

Switzerland last month, there is slowly becoming a greater appreciation for

the importance of real estate in reshaping cities and, therefore, the

world’s commercial geography.

According to research by property services company Jones Lang LaSalle, with

real estate investment levels reaching a new high of an estimated ten

dollars chasing each dollar of prime assets, real estate is no longer

considered a consequence of city success, but is now actively employed to

drive it. A look at the 30 cities worldwide where 50 percent of the US$4.6

trillion in direct commercial real estate investments has been concentrated

over the past decade highlights real estate’s impact on the strength of

super and primary cities and the growth of second-tier cities.

According to Colin Dyer, CEO of Jones Lang LaSalle: “Investors are

allocating more capital to real estate today but focusing on a specific set

of cities globally. This has created an increase in demand for the limited

stock of prime properties in super cities, the world’s most attractive real

estate markets. As a result, investors are moving along the risk curve into

second-tier markets, which are becoming more conscious of how real estate

can make them more attractive to investors.

“The most successful markets share characteristics like transparency, good

governance, strong education systems and innovative city planning. The

‘push-pull’ effect is strengthening super cities and boosting investment

prospects for second-tier cities.”

Recent research from Jones Lang LaSalle identifies the connections between

cities of different sizes and rankings and how the investment market

responds to the underlying momentum that each is creating. These newly

revealed patterns and perspectives on performance bring more attention to

the need for cities to consider real estate as a core performance driver.

Cross border capital investment is boosting demand in the super cities such

as London, Paris and New York, supported by the continuing flood of Chinese,

Korean, Malaysian and Canadian money (amongst others) and helping

consolidate their attraction.

But with 50 percent of the US$4.6 trillion in direct commercial real estate

investments over the past decade having been concentrated in 30 cities

worldwide, there are signs of change. Investment patterns are shifting

partly due to the shortage of available product in the super and primary

cities and partly to the dynamism in second-tier cities.

Mid-size cities with innovative urban strategies, good governance and sound

education bases are gaining momentum by using well designed, accessible,

flexible real estate to attract and retain growth sectors such as tech,

healthcare and bio that will underpin future economic success.

While corporates remain focused on containing costs in their existing real

estate portfolios, they are migrating to second tier cities and expanding to

new geographies to meet business demands and to take advantage of skills and

new market opportunities. This is further encouraging real estate investors

up the risk curve as they chase corporates into new areas.

Super cities are the largest, most internationally connected cities with

very deep corporate bases and high levels of real estate liquidity. The four

super cities (London, Paris, New York and Tokyo) account for nearly

one-fifth of global direct commercial real estate investment activity.

Primary cities have high levels of international connectivity and

significant concentrations of global business services.

Second-tier cities are mature cities with lower levels of international

business activity than the other categories.

(Source: Jones Lang Lasalle)

|

|

|