BANGKOK, Thailand – Kasikorn Research Center has highlighted that investors should closely monitor foreign fund flows, Asian currencies, global gold prices, and corporate earnings for Q3/2025 this week. The Thai baht is expected to trade in a range of 32.10–32.80 per USD, while the SET index may see support at 1,285 and 1,260 points and resistance at 1,320 and 1,330 points.

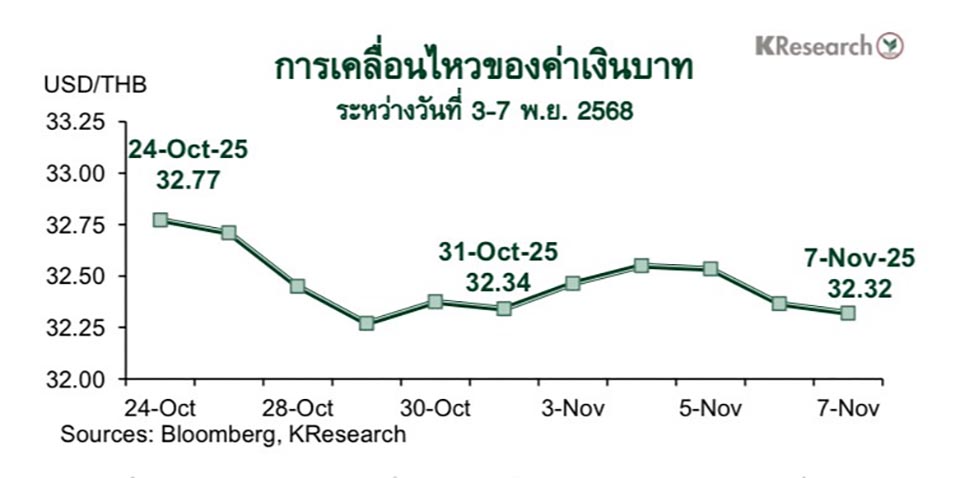

Last week, the baht traded within a narrow range before strengthening late in the week, following a rebound in global gold prices above $4,000 per ounce and capital inflows into Thai bonds. The currency closed at 32.32 per USD on Friday, 7 November, compared to 32.34 per USD previously. U.S. dollar momentum slowed mid-to-late week amid falling bond yields and economic uncertainty caused by the prolonged U.S. government shutdown and ongoing legal questions surrounding former President Donald Trump’s tariffs.

For 10–14 November, Kasikorn Bank projects the baht to remain within 32.10–32.80 per USD. Key factors to watch include foreign fund flows, Asian currency movements, and global gold prices. Other international developments include the U.S. government shutdown, Federal Reserve statements, Eurozone Q3 GDP data, and China’s October economic indicators, including new yuan loans, industrial production, and retail sales.

The Thai stock market was volatile last week, dipping below 1,300 points midweek amid institutional and brokerage selling, before recovering above 1,300 points, buoyed by strong Q3 earnings in the telecom sector. The SET index closed at 1,302.91 points, down 0.50% from the previous week, with late-week declines reflecting renewed U.S. tech bubble concerns and a lack of fresh market catalysts.

For this week, Kasikorn Securities projects Thai stock index support at 1,285 and 1,260 points, with resistance at 1,320 and 1,330 points. Analysts stress the importance of monitoring Fed comments, Q3 corporate earnings in Thailand, the U.S. shutdown, and foreign capital flows. Other international economic indicators include Japan’s October producer price index, Q3 GDP and September industrial output for the UK and Eurozone, and China’s October retail sales, industrial production, and fixed asset investment. (TNA)