PATTAYA, Thailand – Just about everyone agrees Pattaya is changing fast, but there’s no consensus about how. To many YouTubers and their cell phones, it’s all about gogo clubs changing hands for exorbitant sums or the shock of finding a real transvestite pub in the heart of Soi Pothole. Facebook still hosts umpteen chats about where to find the best breakfast or whether mushy peas should be present on a genuine plate of fish and chips. It’s obvious that many retirees still live in a comfort bubble: yes, Pattaya has gotten more expensive with awful traffic, but it’s really the same underneath.

But others warn us that the writing is on the wall. In a series of real-time articles, lengthy expat Tom Tuohy has explained Pattaya’s (and Thailand’s) vanishing past. It’s no longer the simplistic paradise of bar girls, cash under the table and visa loopholes. The government is now pushing for serious visa reform, digital IDs, blockchain financial tracking and even cryptocurrency. The post-war Bubble retirees – 30, 20 or even 10 years ago – had just assumed that retirees were the key to Sin City’s future. Time for a rethink.

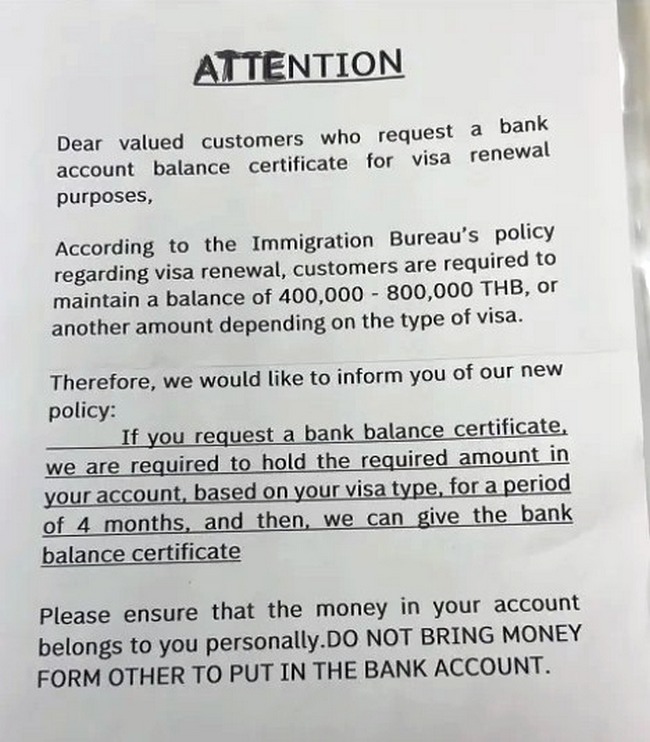

Pattaya has taken some particularly hard knocks. Banks here have been hostile towards tourists trying to open bank accounts. There was even a 24-hours rumor that retirees and others with annual extensions of stay would receive only a two years driving licence instead of the customary five. Retirees relying on visa companies to boost bank accounts for a longstay renewal have been warned this year that the ploy isn’t going to work in future. Digital photos and biometrics are now invading state bureaucracies and the banking sector. Paying for favors under the table won’t work like in the past.

And now even Pattaya is slowly moving towards a cash-free status. Local DHL courier services and some Starbucks locations have actually banned physical cash payments. Many street traders now have their QR code prominently displayed on their food carts. Meanwhile online banks, neobanks, digital wallets and peer-to-peer apps such as PayPal and Venmo are fulfilling many financial needs and bypassing traditional banking barriers.

Benjamin Hart, an American attorney and Thai citizen, in his insightful and frank videos has suggested that some of the blame lies with the current Thai government which seems to take too much notice of the World Economic Forum, a clique of elitist Euro socialists and totalitarians putting forth a global agenda of wealth distribution imposed by technology. His cited examples include proposed negative income tax, complex banking rules and increasing data-collection surveillance of the general public, including foreigners. Hart hopes that if the current Thai government falls in parliament, a more sensible administration will take over.

What has changed Pattaya is mass tourism, slick marketing (including booking apps and digital itineraries) and gentrification leading to the collapse of communities and the advent of the concrete jungle so familiar today. Whether retirees fit into the new scenario depends on a host of factors, not least their ability to accept new technologies which remove their privacy and, of course, their financial and wealth clout. Thailand makes no secret of its preference for rich foreigners. Columnist Bernard Trink (I Don’t Give A Hoot) wrote 20 years ago in Bangkok Post that the best summing up of Pattaya was the title of the musical hit Hey Big Spender. Perhaps Sin City hasn’t changed that much after all.