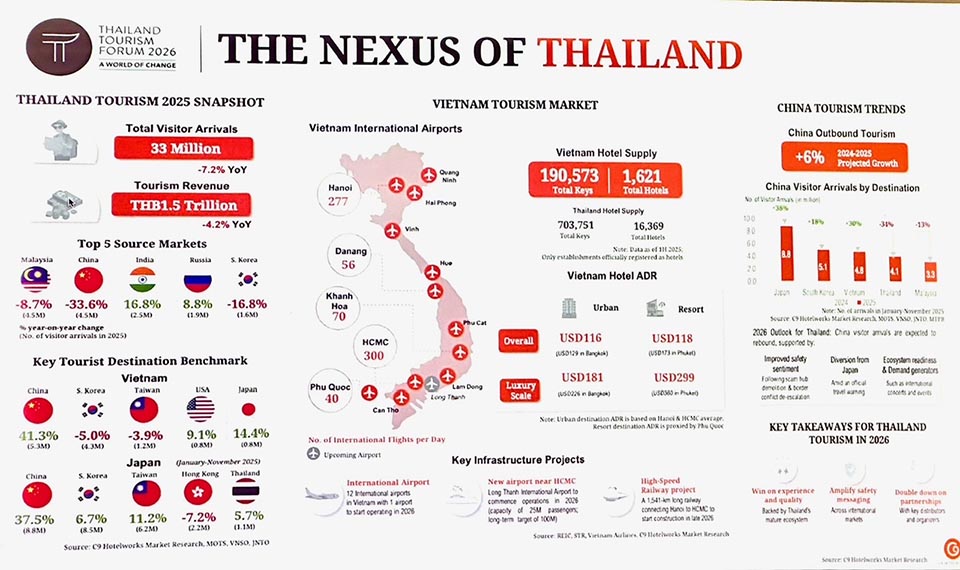

BANGKOK, Thailand – Thailand enters 2026 at a defining inflection point. Regional travel demand across Asia is rising strongly, yet Thailand’s relative performance is weakening as faster-moving competitors accelerate. The divergence is increasingly clear. While neighbouring destinations such as Vietnam and Japan are capturing growth and expanding market share, Thailand faces declining foreign arrivals and softer momentum from several core source markets. Leadership in Asian tourism no longer depends on scale alone. It now rests on infrastructure readiness, ecosystem coordination, safety perception and value competitiveness.

Speaking at the Thailand Tourism Forum (TTF) 2026, held before a sold-out audience of 1,300 delegates at Bangkok’s Athenee Hotel, Bill Barnett, Managing Director of C9 Hotelworks, highlighted a major shift in regional travel dynamics. “The most pronounced shift is unfolding in the China outbound market, once the cornerstone of Thailand’s tourism engine,” he said. Although Chinese outbound travel is projected to return close to pre-pandemic levels by 2025, Thailand’s share of that recovery has declined. Travellers are increasingly choosing destinations perceived as safer, better connected and more competitively priced, notably Vietnam. Safety standards, transport efficiency, seamless airport experiences, digital connectivity and perceived value for money have become decisive factors in destination choice.

Thailand’s challenge is not a lack of demand. Travel demand across Asia remains strong and continues to grow. The issue is relative competitiveness. For decades, Thailand benefited from strong brand familiarity, deep hospitality expertise and sheer tourism scale. Today, competitors are closing the gap and, in some areas, moving ahead through faster infrastructure development and clearer policy alignment.

Vietnam’s rise offers a particularly instructive example. The country has reshaped its tourism positioning through a coherent national strategy, combining lower pricing, aggressive expansion of airport capacity and rapid development of second- and third-tier destinations. Hotel average daily rates in Vietnam remain below those in Thailand across both urban and resort markets, reinforcing its appeal as a high-value alternative for cost-conscious travellers.

Connectivity lies at the centre of Vietnam’s advantage. The country now operates 12 international airports, with the new Long Thanh International Airport near Ho Chi Minh City scheduled to begin operations in 2026. Once completed, it will become one of Southeast Asia’s largest aviation gateways, easing congestion and enabling significant expansion in long-haul and regional connectivity. Importantly, Vietnam’s aviation strategy extends beyond a single mega hub, distributing tourism growth across multiple regions and accelerating development in secondary cities and coastal resort areas.

Thailand, by contrast, remains heavily concentrated around a limited number of gateways and mature destinations. Bangkok’s Suvarnabhumi Airport continues to face capacity and efficiency constraints, while progress on major aviation and rail projects has been slower than that of regional peers. Although expansion plans are underway, infrastructure readiness has emerged as a strategic differentiator rather than a background consideration.

Safety perception represents another critical challenge. Thailand’s tourism brand remains strong, but periodic high-profile incidents and uneven enforcement of safety standards have weakened confidence in certain markets. In the Chinese outbound sector particularly, safety narratives carry significant influence, and even isolated incidents can have disproportionate reputational impact in the age of social media. Competing destinations have invested heavily in visible safety upgrades and clearer communication, while Thailand’s response has often appeared fragmented.

Value competitiveness further complicates the landscape. Years of strong demand allowed hotel rates and associated travel costs to rise steadily in Thailand. In a more price-sensitive post-pandemic environment, however, relative value now matters more than absolute quality. Vietnam’s lower pricing, combined with improving service standards and expanding connectivity, presents a strong alternative, while Japan’s weak yen has made its major cities increasingly attractive to regional travellers seeking value.

These shifts underscore a difficult reality. Thailand’s traditional leadership model – built on volume, brand recognition and destination maturity – is no longer sufficient. Strategy, infrastructure and ecosystem readiness now define success.

Three priorities stand out for Thailand’s tourism agenda in 2026. First, a step change in strategic infrastructure investment is essential, particularly in aviation capacity, rail connectivity, urban mobility and digital tourism services. Second, safety standards must be consistently raised across destinations, supported by visible improvements and clear public communication. Third, second- and third-tier cities should be actively promoted through coordinated policy and budget planning to broaden market readiness and capture evolving global travel demand.

The China market remains central to Thailand’s future. Chinese outbound travel will continue to be one of the world’s largest drivers of tourism demand, but the era of automatic dominance for Thailand has ended. Regaining market share will require targeted airline partnerships, competitive pricing, safety assurance initiatives and product differentiation that moves beyond traditional beach tourism.

Thailand’s tourism future will not be shaped by visitor numbers alone. It will depend on how quickly the country adapts to a more competitive, value-conscious and infrastructure-driven regional landscape. The inflection point is now. Decisions made in 2026 will determine whether Thailand regains leadership momentum or continues to yield ground to faster, more agile competitors.

About the Author

Andrew J. Wood is a British-born travel writer, former hotelier and tourism consultant who has lived in Thailand since 1991. A graduate of Napier University in Edinburgh, he began his hospitality career in the early 1980s and brings more than four decades of experience across leading hotel groups in Asia and Europe, including Shangri-La, Minor International, Landmark Hotels and the Royal Cliff Group.

Andrew is a former Director of Skål International, Past President of Skål International Asia, Past President of Skål International Thailand and a two-time Past President of Skål International Bangkok. He is a regular contributor to international travel and hospitality publications, writing on tourism policy, sustainability, destination development and travel trends across the Asia-Pacific region.

His work reflects a lifelong passion for sustainable tourism, cross-cultural understanding and responsible destination growth, combining industry insight with on-the-ground experience across Thailand and Southeast Asia.