PATTAYA, Thailand – Kasikorn Research Center (KResearch) reported that the Thai baht moved within a narrow range over the past week, while the Thai stock market rebounded from the previous week’s decline. The research unit expects the baht to trade between 31.00 and 31.70 per US dollar next week, with the SET Index facing support at 1,260 and 1,250 points and resistance at 1,285 and 1,300 points.

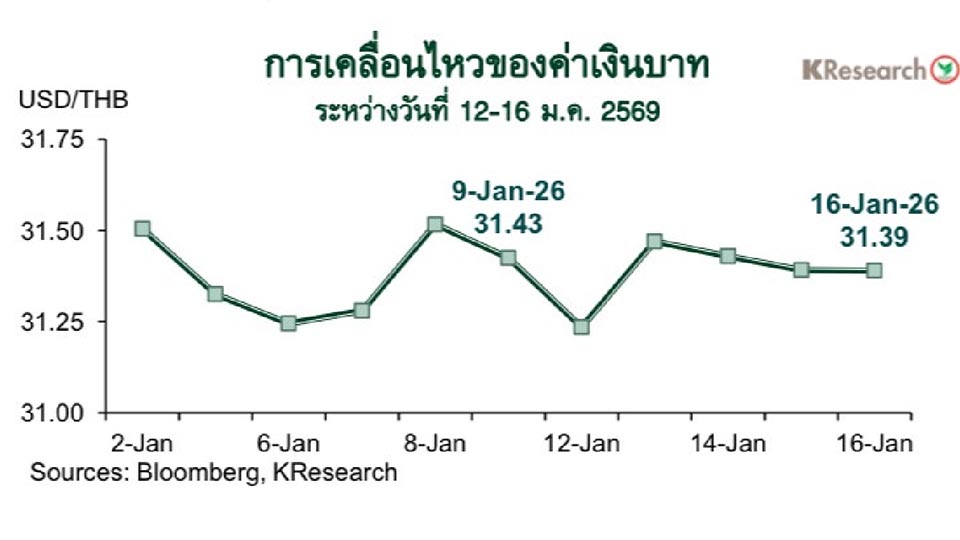

According to KResearch, during the period of Jan 12–16, the baht fluctuated within a tight range of 31.20–31.55 per dollar. The currency strengthened early in the week in line with a surge in global gold prices, which hit record highs, while the US dollar weakened amid concerns over the independence of the US Federal Reserve.

However, the baht later softened midweek as markets interpreted comments from the Bank of Thailand governor as dovish, reflecting expectations of potential interest rate cuts in Thailand this year. The baht’s movement was also in line with other Asian currencies. Selling pressure on the US dollar eased somewhat after reports that global central bank governors issued a joint statement supporting Federal Reserve Chair Jerome Powell.

The baht regained some strength toward the end of the week as the US dollar faced technical selling after USD/THB failed to break above the 31.50 level. The Japanese yen also rebounded slightly after Japanese authorities signaled possible intervention to curb excessive weakness.

On Friday, Jan 16, the baht closed at 31.39 per dollar, compared with 31.43 the previous Friday.

Foreign investors recorded net purchases of 7.58 billion baht in Thai equities during the week, while posting net inflows of 820.8 million baht into the bond market.

For the week of Jan 19–23, KResearch said markets will closely monitor foreign fund flows, movements in Asian currencies, and global gold prices. Key US economic data include GDP, PCE inflation, consumer confidence, PMI figures, and weekly jobless claims. Investors are also watching the Bank of Japan’s policy meeting, China’s loan prime rate decision, eurozone and UK inflation data, and China’s fourth-quarter GDP and December economic indicators.

Meanwhile, the SET Index fell early in the week amid a lack of fresh catalysts and selling pressure from domestic institutional investors, particularly in hospital stocks due to concerns over changes in health insurance policies. Profit-taking in retail and electronic component stocks also weighed on the market.

The index later recovered on foreign buying, led by energy stocks supported by higher global oil prices amid tensions involving Iran, as well as finance and banking shares ahead of fourth-quarter earnings announcements.

On Jan 16, the SET Index closed at 1,275.60 points, up 1.72% from the previous week. Average daily trading value stood at 40.15 billion baht, down 1.11% week-on-week. The mai Index fell 0.96% to 212.83 points.

Looking ahead, Kasikorn Securities expects the SET Index to find support at 1,260 and 1,250 points, with resistance at 1,285 and 1,300 points, while investors continue to track corporate earnings and foreign capital flows.