Part Two shows how central banks are using the wrong tools in attempting to stimulate inflation.

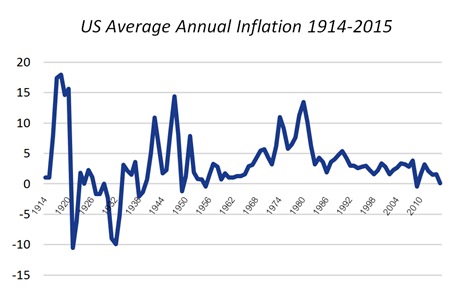

Despite relatively inexpensive lending rates, demand is extremely low in many countries; even the average US consumer price index in 2015 was just 0.1%.1 This isn’t yet a full blown deflationary period as dramatic as the 1930s (see chart 1). In fact high-debt, failed quantitative easing and low interest rates so far replicate more closely what has happened in Japan since 1990.2

As IDEA Economics Chief Economist Professor Steve Keen pointed out in his 2015 outlook, America is indeed turning Japanese.3

In any case, if we do go down the 1930s path, we can’t look at the Great Depression for solutions: the sudden spike in prices which occurred in the 1940s was due to ramped-up production and limited supply during World War II.

Some may argue that the Federal Reserve recognized this and changed policy when they raised their Fed base rate in December 2015. However, the US central bank had backed itself into a corner by hinting at a rate increase for almost a year. By the end of last year, failing to put the Fed rate up was confusing most of the markets4 and was arguably risking Fed Chair Janet Yellen’s credibility.

Chart 1 – Source: USinflationcalculator.com

Chart 1 – Source: USinflationcalculator.com

I say arguably because I don’t think that Mrs. Yellen or indeed many central bankers of G8 economies have any credibility left. This also has historic precedent. As Liaquat Ahmed explained so well in his book Lords of Finance,5 central bankers went from being credible figures in the early twentieth century to pariahs during the Great Depression. Paul Volcker possibly restored some respect for the Fed chair’s role in handling inflation in the 1980s but the prelude to the GFC and the reaction in its aftermath have exposed central bankers once more as undesirables.

Away from the Fed, the prevailing wind, from the European Central Bank in 2014, has been to actually make base rates negative. This has been copied by the Bank of Japan. Indications are that the Fed believe in negative rates too, but are worried about the consequences for Janet Yellen and her committee.

It seems to me that the heads of the major central banks are under so much pressure – Bank of Japan head Haruhiko Kuroda allegedly reports to Prime Minister Shinzo Abe almost daily6 – that they are prioritising their own immediate job security over the long-term transformation of the economy; a transformation which the GFC made blindingly obvious was necessary. In fact it’d be interesting to see how markets would react if one of the major central bankers were to be fired.

The Canaccord Genuity commentary suggests it is possible that the deflationary forces mentioned above will start to have less effect in the coming months.7 It states that as the impact in the decline of energy and commodities prices wears off, stability in oil prices would result in inflation and that only further decline in prices would prevent this. Furthermore, as unemployment is now going down in the US, UK and Germany, for example, wages will go up as employees’ bargaining positions get stronger; and, if salaries increase, so will consumption, also resulting in higher prices. Thus the vicious cycle will turn into a virtuous one.

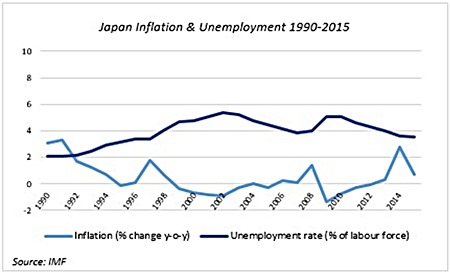

However, that isn’t necessarily true. Japan, for example, currently has low rates of inflation and unemployment (see chart 2).

Chart 2

Chart 2

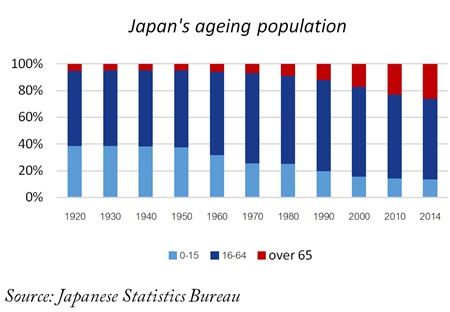

It has been doing a juggling act, continuing to try and balance government books, whilst paying interest on its debt. As there is an ageing population – only 60% of the population is between 16 and 64 years old and the birth rate is down (see chart 3) – it taxes the active population heavily to foot the bill. That makes disposable income very low and thus keeps demand (and consequently prices) depressed.

Chart 3 – Source: Japanese Statistics Bureau

Chart 3 – Source: Japanese Statistics Bureau

The reasons I don’t think inflation will rise in major economies right now are threefold: over-capacity, over-indebtedness and excessive asset prices.

China continues to produce steel at the same record rate – four times more than any country has ever produced – as it did before its construction industry started to slow down. As China has the world’s second largest economy and is a major exporter of steel, as well as other commodities, this over-capacity is a large contributory factor to depressed commodities and finished goods prices. If China persists in flooding the market to such an extent, I can’t see prices leveling out.

In addition to that there are asset prices. If the Federal Reserve’s quantitative easing (QE) programme did one thing, it was to inflate share prices – take a look at the S&P 500 over the last ten years and take a guess when QE began. Unsurprisingly, it was in December 2008 (see chart 4).

Chart 4

Chart 4

Finally we have the debt situation. Forget government borrowing, there are massive levels of private debt still around. This is a major issue because low inflation not only means less spare money to consume but it also makes it harder to pay off existing debts. Deflation and high debt tend to become mutually self-sustaining in a vicious circle.8

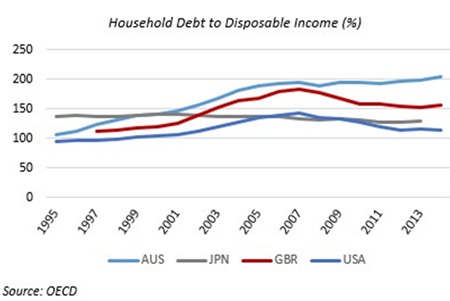

There has indeed been some localized deleveraging since the global financial crisis but if you look at Japan, the US, Australia, the UK (see chart 5), not to mention the catastrophe that will one day hit China9, it’s pretty clear that there are still vast amounts of old debt out there and even more new debt is being taken on.

Chart 5

Chart 5

With all this in mind, I can’t see inflation being a threat to the global economy in the foreseeable future. In fact, all the opposite, we need – within reason – a higher rate of inflation to make everyone’s lives a little easier, reduce debt and kick-start demand – but that seems to be little more than wishful thinking.

Footnotes:

1 St Louis Federal Reserve

2 http://www.ideaeconomics.org/blog/2015/1/13/steve-keens-2015-outlook

3 ibid

4 http://www.financialdirector.co.uk/financial-director/news/2432036/

macro-view-perverse-market-reaction-to-fed-rate-decision

5 Liaquat Ahamed, Lords of Finance, William Heinemann Ltd, 2009

6 http://uk.reuters.com/article/us-japan-economy-boj-insight-idUKKCN0WG04E

7 Six Investment Market Drivers for 2016, Canaccord Genuity, January 2016

8 http://www.ideaeconomics.org/blog/2015/1/13/steve-keens-2015-outlook

9 http://www.mbmg-investment.com/in-the-media/inthemedia/76

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |