How to manage risk & return in turbulent times, part 2

| Date |

1 mo |

3 mo |

6 mo |

1 yr |

2 yr |

3 yr |

5 yr |

7 yr |

10 yr |

20 yr |

30 yr |

| 2/1/2012 |

0.05 |

0.06 |

0.09 |

0.13 |

0.23 |

0.31 |

0.72 |

1.27 |

1.87 |

2.65 |

3.01 |

Professor Bernanke’s academic

lack of interest

Even proponents of the policies that have taken the global

economy to the brink, such as Bernanke’s predecessor Alan Greenspan, admit that

these policies are a huge experiment, lacking any scientific grounding or

precedent.

Indebted western economies currently remain deeply mired in

the depths of Kondratieff’s winter despite the unconventional stimulatory

economic policy and smorgasbord of bailout packages. The three asset classes

which perform best during this winter phase are, as previously stated, gold,

bonds and cash. Gold has already risen from below USD250 per oz to a peak of

USD1901.35 per oz last year. It has the potential to climb rather higher than

that before the end of the winter period, but it also, in the longer term,

appears inevitably condemned to fall back below USD1000 per oz, meaning that

investors holding gold need to keep an eye firmly on the exit door. Bonds and

cash each face the horns of a vicious dilemma.

The Dilemma

Central bank policy has created a feedback loop where, in a

kind of Pavlovian nightmare, investors are, in the short term punished for

prudent, strategically appropriate asset allocations and rewarded for wild,

excessive and speculative behaviour. Sadly, unless you are prepared to take a

leap of faith based on blind belief in the power of central banks, this will

inevitably end in the failure of these government sponsored speculative

excesses. It is a difficult challenge for many portfolio managers, let alone

individual investors, to maintain the required focus, understanding and

discipline in the face of such manipulations. The best performing portfolio

managers ask two key questions -

* Which asset classes offer better risk/reward than cash?

* How to get the best cash returns?

US Bond and T-Bill rates dictate both global interest rates

and investment returns, but one month T-Bills now pay annualised interest of

just 0.05% and one year bonds just 0.13%, a negative real return once inflation

is factored in. The benchmark 10-year note has been gyrating around the 2% per

annum level for some time. To get a 3% annual return you have to buy long-dated

(30 years to maturity) treasuries with the added caveat of price volatility

between now and maturity, i.e. if interest rates increase by just 1% then the

capital value of 10-year notes would instantly fall by the best part of 10%. For

thirty year notes the price drop would be almost three times as bad. This

becomes even worse if interest rates increase more.

Flawed theory: Bonds and Bernanke’s blind man’s bluff

Bond prices have pretty well reached their apex with interest

rates on US Treasury Bills having fallen to almost zero. This is likely to

endure for as long as Bernanke & Co. continue to press ahead with flawed

stimulus policies.

Although negative real rates (interest rates minus inflation)

look as though they are here for some time and longer term rates (such as

30-year government bond rates) can fall, especially if manipulated by government

policies, interest rates look certain to move higher over time thus pushing down

the price of bonds. While this scenario may not be imminent - MBMG’s near term

expectation is for prices to continue to increase - it is all but inevitable,

and may be dramatic once it takes root, so investors need to know where the exit

door is located.

Given the heightened risks surrounding investing in gold or

bonds, cash emerges as the hardiest asset class in times of economic winter

despite the pressure that investors face to chase higher-yield/higher-risk

investments. This is the ultimate central bank manipulation and is generally

justified by reference to a range of economic theories including The Taylor Rule

which is a formula developed by Stanford economist John Taylor in 1993. It was

designed to provide central banks with guidance on setting interest rates in

response to changing economic conditions by systematically reducing uncertainty

and increasing the credibility of the central bank’s future actions through the

process of fostering predictable price stability and full employment.

One of the key elements of the theory is that any rise or

fall in inflation should at least be matched by relative increases or decreases

in base interest rates, thereby dampening growth with higher interest rates when

growth leads to inflation, or by stimulating economic activity (spending and

investment) by cutting rates in times of low growth. As it is not possible for

interest rates to drop below zero, an implied negative rate from Taylor’s Rule

would seem to justify “printing money” - the introduction of new money supply by

central banks, now universally known as Quantitative Easing (QE) - as means of

stimulating growth.

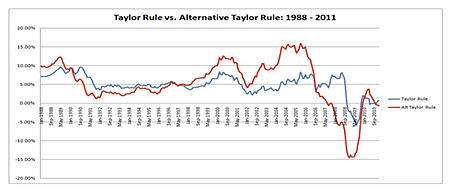

A problem arises, however, from the fact that in 1999, Taylor

wrote a further paper in which he discussed and tested a number of variants to

his original theory. It is these variants that have been cited by Bernanke when

defending his fiscal and monetary policies. This strongly contrasts with

Taylor’s position as he is now distancing himself from these departures to his

original theory due to their failure to stand up to historical experience and

investigation (see graph this page).

Specifically, the variants of Taylor’s Rule suggest very

different responses to the financial crisis. Whereas Taylor insists that his

original theory, which better stands up to historical evidence, suggests only

limited QE in the initial stages of a financial crisis, Bernanke is citing an

unproven or even discredited variant of the rule, which is based on forecasted

rather than actual inflation and a larger gap between actual and potential

economic growth. Bernanke’s monetarist postulate supports loose monetary policy

and massive levels of QE. - H. J. Huney, 2011

To be continued…

|

The above data and research was

compiled from sources believed to be reliable. However, neither MBMG

International Ltd nor its officers can accept any liability for any

errors or omissions in the above article nor bear any responsibility for

any losses achieved as a result of any actions taken or not taken as a

consequence of reading the above article. For more information please

contact Graham Macdonald on [email protected] |