|

|

|

Paul Gambles,

Director MBMG

Investment Advisory |

|

|

Wall Street Crash:

Have we actually learnt anything?

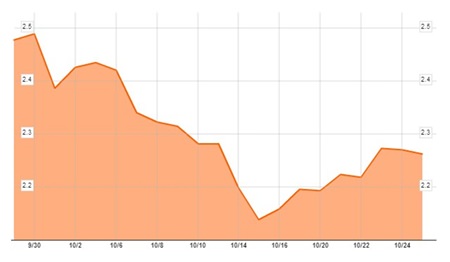

US Generic Government 10-Year Bond

Yield

(Sept 24-Oct 24, 2014)

Source: Bloomberg

We’ve just passed the 85th anniversary of Black Tuesday,

the pinnacle of the Wall Street Crash, when 16 million shares were traded in

one day. Have economists, central banks and governments learnt anything from

these events and the aftermath of the 2008 crisis? Economist Prof. Steve

Keen thinks not and is concerned about a long-term recession.

According to the US Secretary to the Treasury, “The high tide of prosperity

will continue.”1 Yet the German economy is showing signs of weakness, seeing

its hard-earned prosperity dwindle because of external economic

circumstances and obligations it wished it hadn’t signed up for. Meanwhile,

France is evaluating its role in a European Union and in Spain there is

discontent amongst academics and businessmen alike over government spending.

As Southeast Asian countries attempt to further modernize their economies,

there is deadly conflict in Jerusalem and Afghanistan.

The above is a selective summary of events in 1929; although it could easily

be used to describe the state of the world over the last five years. One of

the many consequences of Black Tuesday was the soaring in US private debt,

which in the years following the 1929 crash reached 130% of GDP. That

remained a record level until 2009, when it topped 175% of GDP.2

Prof. Steve Keen is head of the School of Economics, History and Politics at

Kingston University, London and a leading advocate of the school of thought

that debt, and changes in debt, determine outcomes in economies and markets.

He sees the level and growth of private debt as the root explanation for

both financial crises:

“A rising level of private debt compared to income ultimately gets to the

stage that it is such a burden that, first of all, credit-fuelled growth

stops growing because people don’t want to take on any more debt, and

secondly, the servicing costs of the debt can overwhelm the economy. That’s

what I saw back in 2005. That’s why I said a financial crisis was coming in

the very near future.”3

Keen observes that, since 2008, no enduring stability has been created;

instead there is another accident waiting to happen, probably in the next

1-4 years. That said, he thinks that this is likely to be just another

recession in a long-term cycle of going nowhere for the next couple of

decades.4

As a matter of fact, just two weeks ago the 10-year US Treasury Bond yield

dropped so quickly (see chart) that one bank’s representatives elected to

switch off its computers which automatically generated buy and sell quotes,

for fear of losses and being left with unwanted stock.5

Speaking on Bloomberg Surveillance,6 LPL Financials Fixed Income strategist

Anthony Valeri saw this as “Eye-catching to say the least”, and said that it

spoke to the illiquidity in the market. “We knew that corporate markets were

on the illiquid side,” he said, “but to see those types of moves in the

Treasury market, which we hadn’t seen an intra-day move like that since the

fall of 2008. […] It just shows that some of these moves can be exacerbated

to the up or the downside. In 2013 we saw it to the high side, and here in

2014 we saw it to the low side.”

According to Valeri, analysts are giving up on their forecasts, “3% annual

yield on 10-year bonds isn’t going to happen in 2014. They are lowering it

by consensus to around 2.5%.” Valeri says that yields will be probably be

within in the 2.0-2.3% range to the end of the year.

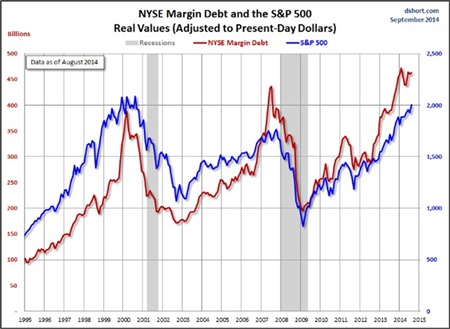

Marginal debt is at an all-time high (see chart) and last week, a drop in

the markets may once again have exposed some fragility: there were rumours

that at least one hedge fund was forced to liquidate.

All this comes while the Federal Open Market Committee7 carries on

regardless, in the mistaken belief that the Fed’s QE money-creation policy

is actually working.

Footnotes:

1 Andrew W. Mellon, Secretary of the Treasury, September 1929, as

quoted in John Kenneth Galbraith (1954), The Great Crash 1929, Mariner

Books; Reprint edition (September 10, 2009)

2 Crash, Boom, Pop! Economics and the Financial Crisis come to Comics, IDEA

Economics Press Release, October 23, 2014

3 idem

4 WTF - What the Future holds, MBMG Update, November 5, 2013

5 http://www.bloomberg.

com/news/2014-10-26/treasury-liquidity-squeeze-seen-in-dealer-who-shut-

off-machine.html

6 Bloomberg Surveillance, October 23, 2014

7 http://www.federalreserve .gov/newsevents/press/monetary/20140917a.htm

|

Please Note: While

every effort has been made to ensure that the information

contained herein is correct, MBMG Group cannot be held

responsible for any errors that may occur. The views of the

contributors may not necessarily reflect the house view of MBMG

Group. Views and opinions expressed herein may change with

market conditions and should not be used in isolation.

MBMG Group is an advisory firm that assists expatriates and

locals within the South East Asia Region with services ranging

from Investment Advisory, Personal Advisory, Tax Advisory,

Private Equity Services, Corporate Services, Insurance Services,

Accounting & Auditing Services, Legal Services, Estate Planning

and Property Solutions. For more information: Tel: +66 2665

2536; e-mail: [email protected]; Linkedin: MBMG Group;

Twitter: @MBMGIntl; Facebook: /MBMGGroup |

|

|

|

|

|

|

|

|

|

E-mail:

[email protected]

Pattaya Mail Publishing Co.Ltd.

62/284-286 Thepprasit Road, (Between Soi 6 & 8) Moo 12, Pattaya City T. Nongprue, A. Banglamung,

Chonburi 20150 Thailand

Tel.66-38 411 240-1, 413 240-1, Fax:66-38 427 596

Copyright ? 2004 Pattaya Mail. All rights reserved.

This material may not be published, broadcast, rewritten, or

redistributed.

|