Chinese insurance funds have more than US$14 billion available for overseas real estate investment, with high transparency markets, including the UK, US, Canada, Singapore and Australia, as well as Asian markets with similar cultural backgrounds such as Thailand, Hong Kong, Singapore and Malaysia, expected to be among the key targets, according to the latest research from global property advisor CBRE.

Given the present scarcity of investable prime properties in first-tier Chinese cities and the short-term risk from the oversupply in second- and third-tier Chinese cities, prime high-end office properties in core international cities are expected to be highly sought after, especially considering the attractive yields they can produce in today’s low interest rate environment.

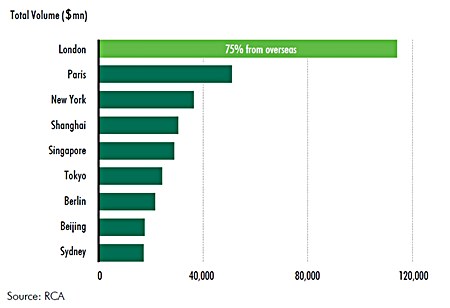

Top Cross-Border Investment Destinations (2007-2013 Q1).

Top Cross-Border Investment Destinations (2007-2013 Q1).

Chinese institutional investors are still relative newcomers to cross-border real estate investment strategies, compared to pension funds, insurance funds and sovereign wealth funds from other regions. However, in recent years Chinese institutional investors have started to increase their investment in overseas real estate markets; a trend that has been driven by several factors, including limited investment channels in China, abundant liquidity, local currency (RMB) appreciation, and the relatively lower valuation of overseas assets in the years following the 2008 financial crisis.

In 2012, the total assets of China’s national insurance institutions stood at US$1.2 trillion. New regulations permit these institutions to invest up to 15% of their assets in “non-self-use” real estate. By this measure, there is in excess of $180 billion currently available for real estate investment. Based on patterns of insurance fund allocations witnessed in developed countries in recent years (with most insurance funds typically allocating up to 6% of their assets to direct property investment) and assuming an 80:20 split between domestic and overseas market, it is estimated that Chinese insurers could invest up to US$14.4 billion in overseas real estate.

Although the number of investable properties in developing regions has increased sharply in recent years, those of high enough quality are still limited in Asia Pacific when compared with North America and Europe. For this reason, Chinese institutional investors are expected to focus on premier office investment opportunities in gateway cities, which are capable of generating stable Return on Investment (ROI) in the short term, such as the premier offices in international gateway cities.

Markets marked by high transparency, including the UK, US, Canada, and Australia, as well as Asian markets that are adjacent to the Chinese mainland with similar cultural backgrounds, such as Thailand, Hong Kong, Singapore and Malaysia, will likely be the major destinations for Chinese real estate investors in the future.

Marc Giuffrida, Executive Director, CBRE’s Global Capital Markets, commented, “Chinese insurance institutions are already well established in domestic markets, but following a series of government policy changes, they will look to target overseas commercial real estate markets. The insurance industry, in particular, is thriving; buoyed by ever-increasing funds they will target gateway cities around the world such as London, New York, Toronto, Singapore and Sydney in increasingly large amounts. The low liquidity, value-added potential and stable cash flow of prime office and retail assets offers a perfect match for these investors.

“Compared with developed countries, the allocation by Chinese insurance companies to overseas real estate investment is still relatively low, even with a modest increase in allocations given the capital base the flows could be quite substantial. Using the Malaysian and Korean outbound investing experience as a guide, big industry leaders will lead the way, but once they demonstrate success the rest of the industry is expected to follow.”

Real estate investing is relatively new for these investors, with Chinese insurance funds only permitted to invest in real estate beginning in 2009 when changes to government policy were made. Further regulation changes now permit insurance companies to invest a maximum of 15% of their total assets as of the end of the last quarter in ‘non-self-use’ real estate.

The new regulations are well measured to encourage sustainable investing through the cycle. For example, investing is limited to “mature retail and office properties with stable income, located at the central areas of the major cities in 25 developed markets,” including the US, UK, Hong Kong, and Australia. This also includes listed real estate investment trust funds (REITs) in these 25 countries or regions. The investment total is limited to a maximum of 15% of the insurance institution’s total assets at the end of its previous fiscal year.

“There has been significant Chinese private and corporate investment in development sites in both Cambodia and Laos, but to date only limited investment in Thailand. Chinese direct property investment in Thailand has been through joint ventures with Thai partners due to the restrictions on foreign ownership,” commented David Simister, Chairman of CBRE Thailand.

Frank Chen, Head of Research – China, CBRE, commented, “Most of the Chinese investors with sufficient capital are now facing limited domestic investment channels. Factor in the escalating purchasing power enabled by the continuous appreciation of the RMB and now is the ideal time for Chinese capital to enter the overseas market – not only institutional investors targeting stable income flow with moderate long-term risk, but also individuals who are looking for opportunities to preserve and create wealth as well as to immigrate or gain a better education for their children. In addition, companies that are initiating new growth points, seeking more diversified investment channels and expecting to learn from the best international practices are also looking further afield.”