The Pattaya City Expats Club (PCEC) received advice on how to avoid financial problems when you are an expat residing in Thailand from Lee Stevens at their Sunday, June 16, meeting. Lee is with Business Class Asia’s Bangkok office. His topic ‘How to avoid insurance, taxation and financial problems in Thailand’ primarily focused on some of the financial complications that are often caused as we travel and settle in countries not our own; encouraging the audience to consider how best to control and safeguard their assets.

Lee has been in the financial industry for nearly 30 years, having worked in the United Kingdom for Midland Bank and then HSBC for ten years. In 2001, Lee moved to Hong Kong where he advised international expats, including senior lawyers, bankers and fund managers on how to best take advantage of the opportunities available to people working overseas; helping his clients with investing into stock markets and UK property, formulating their wills and putting trust structures into place. Lee has been in Bangkok since the end of 2015. His expertise is in wills and trusts and how they help to avoid financial problems when living abroad.

He mentioned UK tax issues and stressed the importance of understanding the difference between being domiciled or resident in the country where you are located as there are important differences on how your estate will be treated for tax purposes. Especially when making moves to secure your assets, or your wishes for the future. To clarify this point, he noted that residency is where you live, whereas domicile is usually where you were born, but if you are from the UK, you can take steps to change your domicile to where you also reside, an important consideration if you want to avoid some inheritance tax issues.

He said it is fair to say most of the audience either live or work overseas long term. Many may have travelled from one foreign country to another. In each they usually build assets, company benefits, pension schemes, life cover and so on in addition to buying property, opening bank accounts or starting families. When they move on, they often build another new set of assets.

ften these are – by definition – in more than one jurisdiction. This will complicate matters when an individual begins to organise his/her affairs. Especially important after the death of the individual, when it’s important to know your wishes are carried out and the taxman isn’t walking away with a big chunk of the inheritance you bequeath to family or others.

Lee’s basic advice is to make a list of all assets and create a will in each jurisdiction. One can then decide on all relevant points to be included in their will, such as appointing guardians for any minor children, deciding on funeral arrangements, organ donations and so on. This is vital he said if you wish your family and beneficiaries to have no delays in receiving their distribution of your assets; thereby easing financial burdens on remaining family or dependents.

In the normal course of things, a grant of probate will need to be given by the court in each jurisdiction before assets are distributed. This can take three to six months or longer. If there are separate wills, then each can be probated in the respective country simultaneously. But, if there is only one will, then it will be a consecutive process for probate which will take much longer. If no will exists, then intestacy rules apply and can often take years. There may also be death taxes to finalise, depending on the individual’s domicile and residency. Bearing in mind the taxman has the reputation for scooping up whatever they can, often by whatever means.

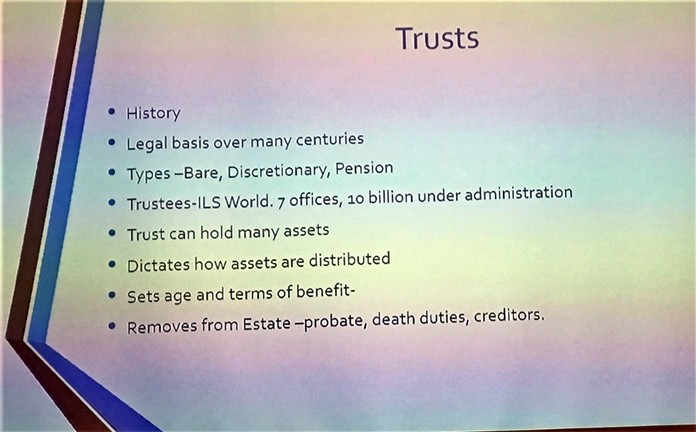

The simplest way through many of these complications and to give peace of mind, may be through setting up a Trust instrument. A Trust will can be funded with assets and provide a quicker source of money for dependents as it removes assets from the estate and can pay the proceeds outside of probate. It also usually removes the funds from death duties and creditors, plus have income tax benefits if the beneficial owner draws an income. It can be held as a Discretionary Trust or a Pension Trust and explained the differences. The Pension Trust being the most often held and normally providing the most benefits.

Having a Trust is not the only way to safeguard things after your death but depending on your circumstances may be the best.

Lee then answered many questions from the audience. To view a video of Member Ren Lexander’s interview of Lee Stevens, visit https://www.youtube.com/watch?v=32pr9oQkxUg.

After the presentations, MC Roy Albiston updated everyone on upcoming events which was followed by the Open Forum where the audience can ask questions or make comments about expat living in Thailand especially Pattaya. For more information about the PCEC, visit their website at www.pcec.club.

|

|

|