BANGKOK, Thailand – The Kasikorn Research Center said financial markets this week will focus on Thailand’s fourth-quarter 2025 GDP figures, progress in government formation, and foreign fund flows, while investors in the United States await key economic data including PCE inflation, PMI readings, and the minutes of the Federal Reserve’s latest meeting.

The research unit expects the Thai baht to trade within a range of 30.70–31.50 baht per US dollar this week. For the Thai stock market, key support levels are seen at 1,400 and 1,385 points, while resistance is expected at 1,445 and 1,460 points.

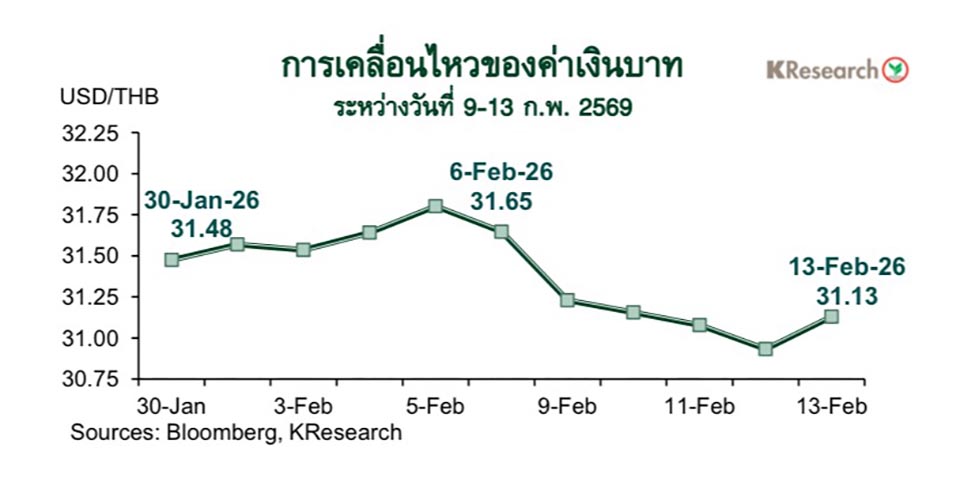

Earlier last week, the baht strengthened in line with rising global gold prices, which rebounded above US$5,000 per ounce, and was further supported by net foreign buying of Thai equities and bonds following the general election. Optimism over political stability and continuity in economic policy under a new government pushed the currency past the 31.00 level to 30.93 baht per dollar, its strongest level in two weeks.

However, the baht weakened toward the end of last week, tracking regional currencies amid a sell-off in risk assets and stronger-than-expected US labor market data. On Friday, February 13, the baht closed at 31.13 per dollar.

For this week (Feb 16–20), Kasikornbank said key factors influencing the baht include Thailand’s Q4/2025 GDP data, domestic political developments, capital flows, movements in Asian currencies, and global gold prices. US data to watch include PCE and core PCE inflation, preliminary PMI figures, industrial production, housing data, and the Fed meeting minutes from January 27–28.

Global markets are also monitoring Japan’s Q4/2025 GDP, UK inflation for January, and preliminary February PMI data for the euro zone, the UK, and the US.

Thai Stock Market Outlook

The Thai stock market rose for most of last week on strong foreign buying. The SET Index climbed above the 1,400-point level on the first trading day after the election, as investors anticipated the formation of a stable government following a decisive election outcome. Foreign and domestic institutional investors bought across all sectors, led by banking, technology, energy, and retail stocks.

The SET Index reached a one-year, two-month high of 1,443.97 points before easing slightly toward the end of the week, as domestic political factors were largely priced in and profit-taking emerged in selected large-cap stocks. Regional market weakness, following declines in US equities amid concerns over artificial intelligence-related risks, also weighed on sentiment.

On Friday, February 13, the SET Index closed at 1,430.41 points, up 5.64% from the previous week, with foreign investors posting net purchases of 31.51 billion baht.

For this week, Kasikorn Securities expects the SET Index to find support at 1,400 and 1,385 points, with resistance at 1,445 and 1,460 points. Key factors to watch include Thailand’s GDP data, developments in government formation, and foreign fund flows, alongside major US economic indicators such as housing starts, durable goods orders, personal income and spending, PCE inflation, PMI data, weekly jobless claims, and the Fed minutes. (TNA)