At the Prachachat Business Forum 2024, under the theme “Navigating the Storm of Change,” Supachai Jiarawanon, CEO of CP Group, discussed the recent announcement by the Bank of Thailand (BOT) that permits the private sector to seek “branchless bank” licenses.

He said that CP Group, in collaboration with “TrueMoney,” is gearing up to embark on this venture. The CEO clarified that while a formal agreement with other private entities to establish a digital bank remains pending, CP Group is actively preparing for the licensing process.

The CP Group chief highlighted the shift among financial service providers towards embracing novel financial technologies.

Furthermore, he observed an increasing interest among banks and financial institutions in founding digital banks, aiming to enhance capital accessibility for underserved communities.

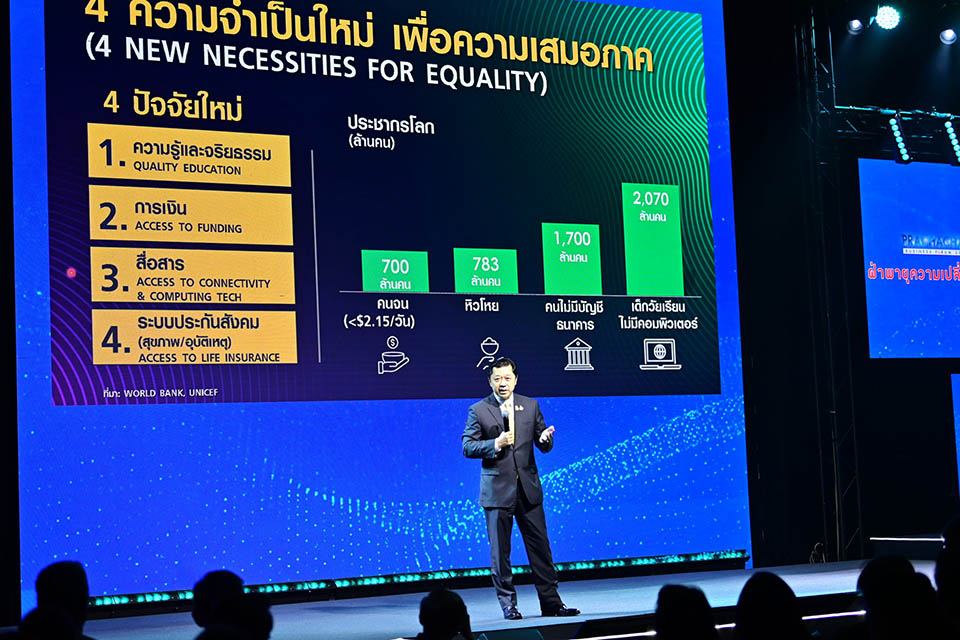

He pointed out the global challenge where approximately 1.7 billion individuals lack banking facilities, contrasting with Thailand’s progression towards an era of 5.0—a society driven by new technology advancements such as artificial intelligence.

As the marketplace evolves towards greater reliance on cloud data, applications, workforce, and digital innovation, it necessitates societal adaptation. (NNT)