So you’re thinking of putting some money into an investment plan? Why?

No, seriously, why?

That’s a key question which, with the plethora of information available to us today, is often forgotten. It’s all too easy to check the internet, download the app, watch the 24-hour business TV channels and become engrossed in Wall Street’s 1ฝ-point rise between 2pm and 2.15pm today; but does it all really matter?

The point is that, in my experience, investment isn’t really just about out-performing the markets. Clients tend to have specific reasons to invest their money – whether they’re aware of it or not.

That’s why, before even writing a proposal, I ask clients specific questions about their goals and priorities. I find this approach has several advantages.

Firstly, it gives me an idea of the level of risk clients are comfortable with. Some people are looking to make a relatively high return on a small portion of the money they have in the bank; whilst others wish to use a large portion of their savings to retire comfortably.

This goal-oriented approach also gives both the clients and I a clearer picture of what they actually wish to achieve. It could be to have enough money to fund a child’s education or to put to work an amount of money which is lying dormant in a low-interest bank account.

With that picture accurately painted, we can get to work looking at the type of investments which are best suited to an investor’s aims. As much as analysts, forecasters or the shoe-shiner on the street corner may like to generalise about good and bad investments, it really depends on the objective. Knowing this enables me to make recommendations to maximise chances of achieving the required value. After all, there’s no point in looking at high-risk short-term gain if it’s for a retirement fund you wish to cash out in 10 years’ time.

Another advantage is that it helps investors avoid making rash – and possibly disastrous – decisions. That’s because if you have the bigger picture in mind, you don’t necessarily react to the extreme situations which can crop. For example, imagine people who, back in July 2007, invested in a portfolio of funds based purely on the S&P 500. Without a clear plan in mind, they may have been tempted to sell up as the market crashed in late 2008 (see chart 1). They may have been lucky enough to have made that decision early; yet they could have easily waited a bit longer – anticipating a further drop – and actually sold when the market bottomed out. At the most extreme points, that would have translated into a 55% loss in portfolio value.

However, had those people established that their investment was a 10-year plan, they would have been more likely to stick to that and not sell near the bottom. If they had followed this path, by May 2016 – with two months to go before the ten years were up – the value of their investment would have been 33% up on their purchase price.

The opposite can also happen: whereby investors put money into a certain fund or asset class which thereafter increases in value at a strong rate. Without a clear goal, it may be tempting for the investors to keep their money in the fund, as it appears to be constantly increasing in value, only to persist as the price starts to fall.

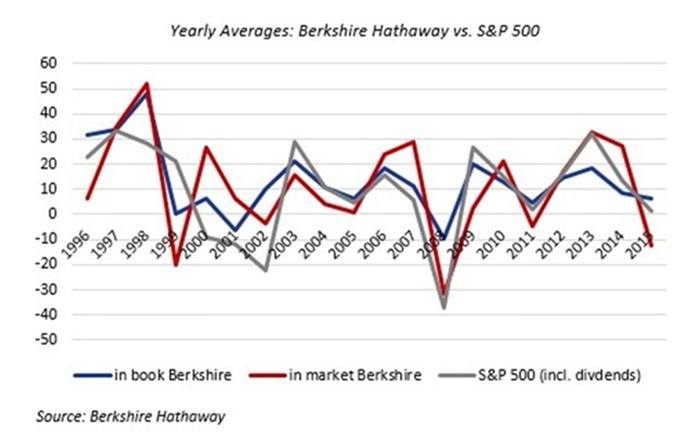

For example, you may have seen books,1 articles2 or even CNBC’s dedicated blog, allowing you to follow every move of – and presumably invest as successfully as – Warren Buffet, the Oracle of Omaha3 and CEO of Berkshire Hathaway. Thanks to some wise investments, the company made a while ago, there have been some exceptional returns over the years – particularly in the 1960s and 1970s.4 But that doesn’t necessarily mean that it should be used as a sort of high-interest savings account. In the last twenty years, it has had moments of outperforming the S&P 500; but, crucially, has also had many periods of significantly under-performing the index (see chart 2).

Another example is gold, which has historically acted as an investment of refuge in uncertain times.5 Investing in the metal in May 2006 would have cost just under US$ 1,205 an ounce (see chart 3); the price rose swiftly soon after and remained there for three years, so it may have been tempting to hold onto the investment indefinitely. If investors had done that, by April 2016 their investment would have gone up a paltry 3%, thus proving that sticking to an old favourite does not necessarily bring a great deal of reward.

With all that in mind, the only real secret to successful investing is to have clear goals listed in terms of priority. It’s at that point when it’s time to look at how to achieve those goals.

Consequently, my idea is to help people focus on their objectives and explain how they may achieve them with complete independence and objectivity. That’s because – rather than taking commissions from fund management companies – I charge an advisory fee directly to the client. Furthermore, this ensures high-quality, competitive and cost-effective advice – after all, the better the job I do, the higher the chance of getting an ongoing fee.

Footnotes:

1 http://www.forbes.com/pictures/efgd45gek/invest-like-warren-buffett/

2 http://www.telegraph.co.uk/investing/isas/copycat-investing-how-to-invest-like-warren-buffett-and-other-gu/

3 http://www.forbes.com/ebooks/warren-buffett-59-billion-philanthropist/

4 Berkshire Hathaway

5 http://www.mbmg-investment.com/in-the-media/inthemedia/55

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |