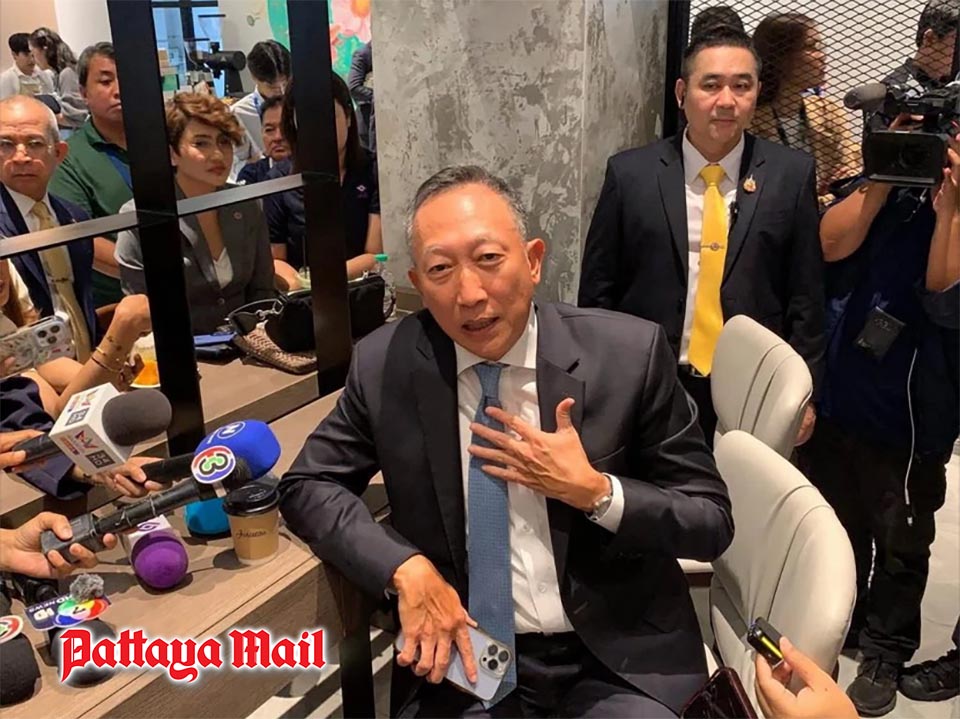

BANGKOK, Thailand – Former Krungthai Bank President and incoming Deputy Finance Minister Vorapak Tanyawong has voiced concern that hot money inflows may pressure the Thai baht to strengthen further, following the U.S. Federal Reserve’s 0.25% interest rate cut.

In a Facebook post, Vorapak said the Fed’s move was “as expected,” citing clear signs of a cooling U.S. labor market. August nonfarm payrolls added just 22,000 jobs, while historical revisions showed a reduction of 911,000 jobs since 2024. Futures markets anticipate two more rate cuts before year-end.

Fed Chair Jerome Powell explained the decision as a “risk management cut,” prioritizing labor market risks over inflation, despite CPI edging up from 2.7% to 2.9% and core PCE remaining at 2.6%, above the 2% target.

Vorapak noted political dynamics within the Fed board, mentioning Stephen Miran, a Trump ally and architect of the “Mar-a-Lago Accord,” who pushed for a sharper 0.5% cut. Ultimately, 11 out of 12 members voted for the smaller move.

Markets reacted with volatility: the S&P 500 closed down 0.1%, while the U.S. dollar rose 0.3%. Investors view the Fed as shifting into risk-management mode, focusing on structural risks rather than monthly data.

Implications for Thailand:

-Narrower interest rate differentials between Thailand and the U.S. could draw more foreign capital into Thai bonds and equities.

-The baht is likely to strengthen further from capital inflows.

-Continued Fed cuts while U.S. inflation stays above 2% could trigger dollar volatility, making the baht swing sharply in both directions depending on global risk sentiment.

-The Bank of Thailand faces the challenge of using smoothing operations to prevent excessive baht strength that could hurt exporters and the tourism industry.

Vorapak concluded that while the Fed’s cut was “as scheduled,” Thailand must remain alert to hot money inflows that may arrive faster than expected and push the baht beyond equilibrium. (TNA)