Firstly before we even start this debate, it is only fair to

take a step back and explain what the Fed model is and what it attempts to do.

In simple terms it is a model that compares the valuations of 10 year bonds to

equities by comparing their respective yields. It argues that when earnings

yields are above bond yields, shares are cheap relative to bonds and vice versa.

Interestingly enough this model has not actually been endorsed by the Fed, but

was penned by Ed Yardeni who came up with the concept when working at Prudential

Securities (Some of our readers might remember Ed Yardeni as the analyst who

rose to fame over concerns about Y2K, but I digress.)

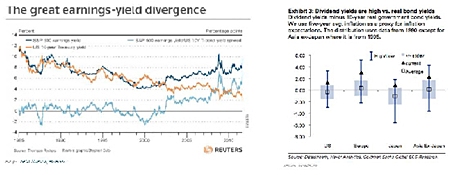

In the graphs on this page, one can see that earnings yields

are currently way above bond yields and, in fact, if the earnings yields are

subtracted from bond yields, the difference sits at over 7%, the highest it has

been in over 25 years. Based on this information, surely one should throw

caution to the wind and buy equities and sell bonds?

However, as the FT has recently argued, the problem with the

Fed model is that it does not always work (proving once again that there really

are no holy grails in markets). If history is any guide, the Fed model would

have indicated that shares were a lot more attractive at the start of the 1970s

equities bear market than at the start of the bull market that began in 1982. In

addition, earnings yields are a notional concept and tell one nothing about real

cash flow, whereas bond yields are a true account of cash flow yield, for bond

investors have no choice but to pay.

The same cannot be said for the dividend yield, which for the

most part is a good indicator of actual cash paid by companies and in this

respect, equities are indeed offering a better alternative to bonds. The graph

indicates the difference between the dividend yield and the 10 year real bond

yields (adjusting for inflation) and in every region, shares are offering value

on this measure. Naturally one is assuming that dividends will grow, unlike

coupons which are fixed, hence the reason for comparing dividends to real bond

yields. As an example, the Euro Stoxx 50 yields 5.32 percent - more than double

German Bunds. But, before you mortgage the house, take note of the fact that

this has been the case in Japan since 08 and it has not helped the hapless

Japanese investors.

Bottom line: Dividend yields on stocks are attractive and

help justify buying stocks in absolute terms, if one believes earnings forecasts

(a topic for another weekly view). But to just compare bond yields to equity

yields is not reason enough to buy shares. All it might be telling us is that

bonds are expensive, not necessarily that shares are a screaming buy.

|

The above data and research was compiled from sources

believed to be reliable. However, neither MBMG International Ltd nor its

officers can accept any liability for any errors or omissions in the above

article nor bear any responsibility for any losses achieved as a result of any

actions taken or not taken as a consequence of reading the above article. For

more information please contact Graham Macdonald on

[email protected]

|