From last week: In contrast to Greece’s total lack of control over economic policy, the Chinese government thinks it’s in complete charge. The government has gone all-out to limit the effects of the crash, cutting interest rates, halting scheduled IPOs, threatening to arrest short sellers and allowing speculators to use their houses as collateral for marginal loans. Whether this constitutes assistance or interference is a matter of debate. Word is that the government will keep throwing ever more kitchen sinks at the problem until the markets behave more the way it wants them to. However, what Beijing doesn’t seem to realise is that even with all that power to control markets, it is merely papering over the cracks. The fundamental problem that many governments – not only China – are failing to recognise is that private debt is so elevated as to pose an impediment to sustainable growth.

ASEAN currency impact

Against this backdrop, a positive resolution to either or both of the Greek and Chinese issues would be expected to boost pro-cyclical ‘risk-on’ currencies like the Baht, Rupiah, Peso or Ringgit.

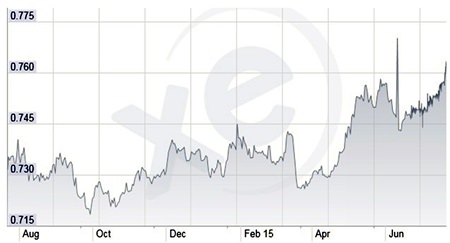

THB:MYR

Chart 1 Source: XE.com

Chart 1 Source: XE.com

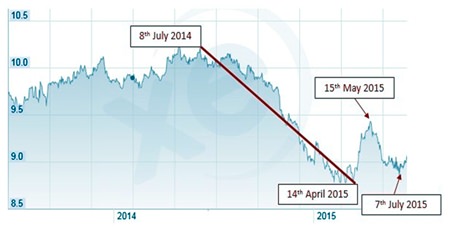

The Thai Baht has suffered disproportionately to most neighbours over varying terms – falling by 14% against the Malay currency from this time last year to April 2015 (see chart 1); although it bounced strongly off those lows, before giving back most but not all of that bounce. It’s also had a rough few weeks against the likes of the Peso as well (see chart 2).

THB:PHP

Chart 2 Source: XE.com

Chart 2 Source: XE.com

In Malaysia, specific local factors, such as the recent financial scandal1 are more likely to generate relative direction versus the Baht; but with Peso and Rupiah it seems that markets are paying greater heed to Thailand’s weaker growth outlook.

This is a very short-term perspective – greater current account challenges remain for both the archipelago nations than for Thailand.

Whilst I remain concerned about Thai growth, I can see much better fundamentals here and I think these will have a medium to long-term effect that is more significant than the short-term growth forecast differentials. This is particularly because I feel all three countries may miss their revised official growth targets to the downside, a problem that would have a greater impact on countries where growth is a key determinant in currency valuation.

James Sullivan of Coram remains a believer in the longer term ASEAN growth story and sees ASEAN assets as offering less distorted medium term valuations than in developed economies that are more divorced from fundamental realities:2

The vast majority, if not all major stock markets, have been huge beneficiaries of loose monetary policy. Without QE led policy, I have little doubt markets would still be far below their previous peaks.

Three primary reasons have made equities the least worst asset class:

1) Currency debasement has supported corporate earnings

2) Cheap liquidity has been in abundance

3) Negative real rates

…QE has been wide reaching, and reached parts of the market that other policy measures couldn’t reach. However, when one observes some of the extremities, there are clear laggards. The Emerging Markets have been left behind, and drilling down, few more so than the Association of South East Asian Nations – the ASEAN region…

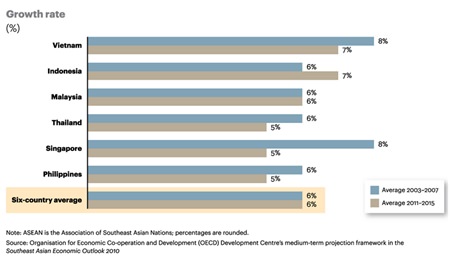

Chart 3 Source: Coram Asset Management

Chart 3 Source: Coram Asset Management

The FTSE ASEAN index is up 12% over 5 years, compared to the MSCI World Index and the S&P which are up 87% and 118% respectively (see chart 3):

Sullivan goes on to summarise the medium term attractions of ASEAN:

The unification of the 10 member states, higher growth rates, a younger population, modest debt to GDP ratios and ‘undervalued’ currencies all add up to a quite enticing investment opportunity. Not without risk and potential volatility, but with a medium term outlook, it appears to offer something rather exciting. Certainly something different from the rather saturated safe(r) haven developed markets… (See chart 4)

Chart 4

Chart 4

From a UK perspective the relative attractions are apparent, especially as Sullivan shares my views that the UK economy and currency are on very thin ice because of the extreme levels of private debt, the ever more fragile housing bubble and the record current account deficit:

When we then consider the UK current account deficit is the greatest since records began, surely as part of a multi asset portfolio we should be diversifying our currency exposure also?

…It isn’t without risk – both equity and currency risk is apparent – but when we consider Sterling is a multiyear high (5 plus years) against the Singapore Dollar, the Malaysian Ringgit, the Indonesia Rupiah and strong against the Baht and Peso, the currencies themselves offer something different… However, the consequence of a $9 trillion carry trade unwind… remains the most unpalatable risk.

Sullivan is particularly drawn to my own main proxy for Thai Baht base portfolios, the Singapore Dollar, noting that even by such unscientific metrics as The Economist’s Big Mac Index3 (fast becoming the only part of that increasingly political polemic that’s worth reading regularly), SGD is 23% undervalued as the following Bloomberg PPP data also highlights (see chart 5).

Chart 5 Source: Coram Asset Management

Chart 5 Source: Coram Asset Management

All this means that, because of exchange rates, there may come an opportunity to buy reasonably-priced Thai assets at an effective discount. That said, I’ve long felt that the Baht could fall below 36 to the US Dollar in any relatively major global (or China-generated) crisis and below 39 to USD 1 in an extreme case.

Thus, notwithstanding that the Euro has the life expectancy of a pre-Thanksgiving turkey, that Sterling appears to be overvalued against just about anything, that China is likely to weigh around the necks of ASEAN and indeed Asian currencies like a dead albatross and that Baht looks like good medium to long term value relative to Peso, Ringgit & Rupiah, whether there is an attractive general opportunity in Thai assets right now really depends far more on events in Athens and Shanghai than in Bangkok. However, conditions still appear to be favourable to more value-driven, opportunistic, absolute return style managers, although in Thailand, as indeed elsewhere, they remain a very small minority.

Footnotes:

1 http://www.forbes.com/sites/riskmap/2015/07/21/

a-scandal-in-malaysia-spurs-credibility-crisis/

2 All markets are equal, but some markets are more equal than others – Client note by James Sullivan of Coram Asset Management

3 http://www.economist.com/content/big-mac-index

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |