William Littlewoods of Artemis has been very aggressive recently on his shorting of the Aussie Dollar (AUD). This is because he reckons the Australian housing market is about to take a downward turn. As Joanne Baynham of MitonOptimal says, he also believes that “If China were to sneeze, Australia could very easily catch the flu.”

If Littlewoods had made the call early in the year then he would have suffered as the AUD went up to almost AUD1.10 to the Greenback. However, it has now weakened quite a lot over the last few weeks and Gavekal actually states, “There is more pain to come and the currency is very vulnerable.”

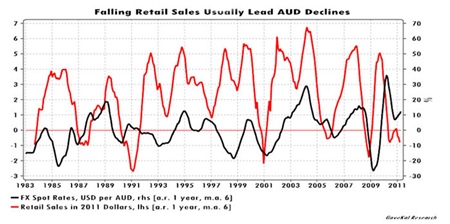

This research is based on the fact the private sector, but not including the mining and finance sectors, has not been doing too well recently and that the economy is not doing as well as people think. This can be seen by the fact the retail sales for this year have now turned negative and house sales are flat for 2011.

Another reason for the Aussie Dollar being so strong for the first few months of the year is that the Central Bank has been very aggressive on rates. However, one of the largest mortgage insurers, QBE, believes that if the Central Bank did raise rates by 0.5% then 20% of house owners would not be able to repay what they owe on their property. If this is true then it will be difficult for the Central Bank to put up rates in the near future as it would increase the pressure on property prices and worsen an already bad situation with debt servicing levels higher than that of the USA during the sub-prime era.

To go back to Joanne Baynham, “If currencies chase ever rising yields, this argument is less in favour of Australia than it used to be. Bottom line: For those who have been long Ozzie dollars for the last year, banking the 25% gains against the dollar might be a prudent investment.”

It will also not help the Aussie cause that Moody’s, on 18th May, cut the credit ratings of Australia’s big four banks. The reason stated was that they rely far too much on overseas debt markets. This followed on from the negative ratings watch in February. This downgrade now means that Moody’s have reached the same conclusions as Fitch and Standard & Poor.

In the world of FIAT there are always accidents waiting to happen and whilst the AUD may not be the most obvious it is there ready to be taken down. In the near future all eyes are on the USD, GBP and EUR. However, these are all in for a volatile ride but if the AUD is valued against gold or a stable currency like the Singapore Dollar (SGD) then it will be in for a rough ride as will the values of Australian property and the banking sector.

The only thing that may delay this is if the Central Bank raises rates again. Even if this happens, it is only delaying the inevitable. Get out of AUD now and take gold as a currency bet and SGD, Thai Baht, Malaysian Ringgit and Indonesian Rupiah as a currency hedge – unless there is evidence of a flight to USD in the short term.

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]