It’s incredibly important to budget for your children, not only now but also for the future; after all the years pass quickly!

You may recall the American sitcom Married… with Children, in which, during the opening credits, the father character helplessly hands out money to all family members – including the dog. Anyone who is a parent has probably felt that this is the reality at some point. So it’s vital to set out a plan early on, not only for immediate expenses like food, clothing and toys but also for the potentially huge cost of education.

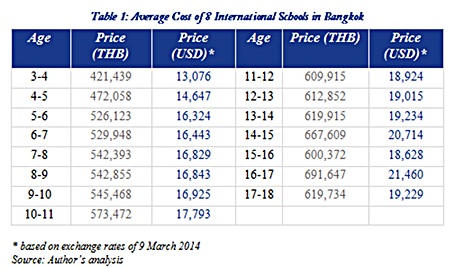

Table 1

Table 1

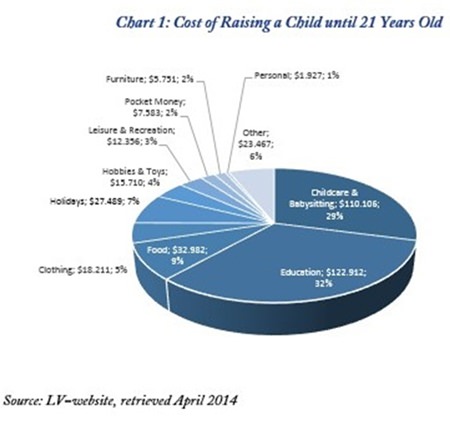

If you don’t want your child to go through the local public education system and you’re not on a company expat contract that covers schooling, fees could eat up a large part of your budget. Chart 1 is a British insurance company’s estimate of expenditure on a child in UK private education until his/her 21st birthday. To put that in an expat context, Table 1 shows the average price of tuition fees (thus not including enrolment fees) across eight international schools in Bangkok.

Table 2

Table 2

Even if you’re fortunate to have school paid for, today’s undergraduate course fees will make the eyes water. Table 2 provides some examples of fees for students with normal residence in the same country as the institution – non-resident fees are generally higher. Plus, don’t forget, there’s accommodation as well as living expenses to add. If that wasn’t enough, in many countries, prospective employers prefer entry-level candidates to have a Master’s degree as well.

Chart 1

Chart 1

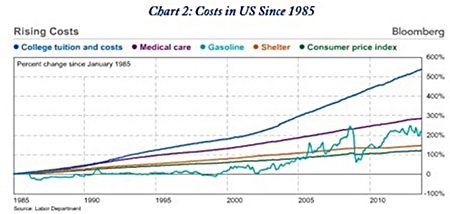

The overlying trend is for education costs to rise: US college (i.e. undergraduate) tuition costs have risen by 538% since 1985 – a Bloomberg chart (Chart 2) illustrates this.

Chart 2

Chart 2

In such difficult economic times there is of course not necessarily a guarantee of a well-paid job once our children leave education.

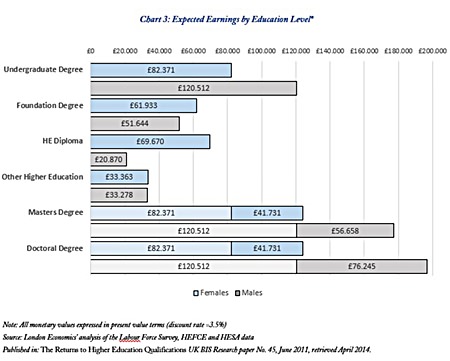

Added to this, a 2013 UK government study showed that a person’s earnings increase in line with every step up on the education ladder (Chart 3). Whilst there are plenty of millionaires without a degree, it does show that broadly speaking education does bring some return.

Chart 3

Chart 3

There are education funds which can help pay for your child’s learning. The key is to examine current education fees, use these figures to predict future fees and then calculate the required monthly contribution in order to meet the objective.

Ask an advisor: Like other types of financial planning, there are many funds on the market, so it’s important to find the one that best suits your needs, with a realistic level of contribution, risk and return. To ensure this is the case, ask an independent, impartial advisor who knows the products available on the market.

| MBMG Group Investment Advisory is a Thai SEC regulated investment advisory firm in Thailand that provides sound and impartial advice to assist private, corporate and institutional clients in all aspects of their financial life. For more information, please contact us at [email protected] or call 02 665 2534-9. Please Note: 1.While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation. 2. With investment comes risks. Please study all relevant information carefully before making any investment decision. 3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum. |