If you spent any time in the UK in the 1980’s, you may be familiar with the national railway operator’s telling slogan, “We’re getting there”. How quickly was a detail the accompanying advertising campaign failed to divulge. Fast-forward thirty years and the slogan seems equally as apt to describe Thailand’s economic performance.

Current performance

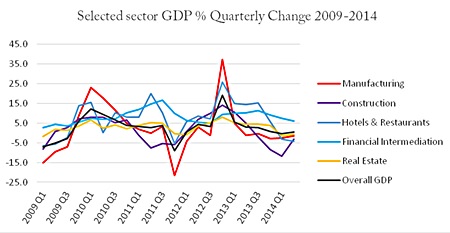

The Thai government’s National Economic and Social Development Board (NESB) recently released reports for Q2 of 2014 and full year forecasts.1 They showed that in Q2, Thai GDP grew by 0.4% year-on-year. This is an improvement after its Q1 contraction of 0.9% but it means that in the first half of 2014 overall the economy contracted by 0.1% year-on-year.

A breakdown of these year-on-year figures shows that the agriculture sector grew by 2.2% and non-agricultural sectors by 0.2%. The slight rise in non-agricultural came from an improvement in utilities (from -3.1 in Q1 to 3.4% in Q2); transport and communications (Q1 3.4% , Q2 2.6%) and wholesale-retail trade (Q1 -0.4, Q2 0.3). There were continued rises, albeit at decreasing rates, in financial intermediation (7.4% rise in Q1, followed by 6.1% in Q2); and education (Q1 7.3%, Q2 2.6%).

Unsurprisingly, given the political situation, these increases were checked by a decline in the tourism and restaurant sector (-4.2% in Q2 meaning a 7.3% decline in the first half of 2014). Worryingly, the manufacturing industry also suffered a continued decrease of 1.6% in Q2 following a horrible 2.7% decrease in Q1, meaning a -4.3% for H1 2014.

Overall, the small expansion that did occur was largely through government expenditure, private consumption and exports; whereas private investment declined. This was really to be expected as previous commentaries such as the Bank of Thailand’s Q1 Report had highlighted the headwinds of:

(i) Softer global export markets

(ii) Reduced domestic consumption constrained by the dramatic increase in private debt from 2010-13

(iii) The uncertainty created by the political deadlock in the second half of 2013 and the first half of 2014.

Future Outlook

The government body suggested that in 2014 as a whole, the Thai economy was likely to grow at a slower rate than previously projected. It put this down to the political disturbances in the first five months of the year, the slow recovery of the export sector and the continual decline in car production and sales.

So, although the economy contracted in the first half of the year as expected, the NESB still expects growth, thanks to improved confidence and “the return of government administration and budget disbursement to normal.”

That said, headwinds remain which are expected to continue to inhibit economic growth:

(i) the constraints on export expansion due to slower than expected recovery of the global economy and the decline in terms of trade (i.e. export prices);

(ii) the delay in tourism recovery and the damage to Thailand’s image at a time of heightened competition among the global tourism market, which have combined to reduce the number of tourist arrivals;

(iii) the constraints on investment growth due to the low capacity utilisation and the slow progress in investment promotion approval in the first half of 2014; and

(iv) continued declining car production because of the inflated sales base in the previous years.

This analysis certainly rings true with what was discussed by Adrian Dunn of The Brooker Group and MBMG co-founder Paul Gambles at the BCCT-MBMG Insights event in June (see the MBMG Update entitled Coup d’État or Coup de Grâce from June 2014). At this event, Mr Dunn also suggested that the new government would attempt to speed up approval of infrastructure projects and foreign investment.

All-in-all, the NESB forecasts that the Thai economy will grow by 1.5-2% in 2014. The export sector is expected to expand by 2% and private consumption by 0.8 %. It still expects total investment to decline by 2%. It also predicts that headline inflation will be at between 1.9-2.4% and the current account in surplus of 2.6% of GDP.

As with any economic picture, some aspects are decidedly mixed but there are already aspects of the new government’s policy that are being well received at home, if not internationally:

(i) A healthy approach to structural reform – tourism may be temporarily affected but some of the ‘cleaning-up’ activities proposed by new administration2 should, in the long run, help improve the image of the country in the eyes of foreign tourists in a way that makes it more transparent and sustainable.

(ii) Attempts at wealth redistribution – proposed inheritance and wealth tax programmes3 will actually make a difference in terms of tackling the constraints of the Middle Income Trap; improved income distribution and wealth distribution will help to spread the private debt burden more affordably, stimulate consumption and boost GDP in the long run; although this may take a while.

(iii) Plans to encourage greater domestic consumption4 are designed in the long term to help reduce export dependence. Thailand should continue to fire up its export engines but with a focus on the development of more value-added sectors especially services; there are some areas where Thailand is able to add value rather than just act as a source of cheap labour and materials. Salaries in Thailand (excluding in the agricultural sector) have risen by 80% in the last ten years5 but there are no indications that productivity has outstripped this in recent years. This is essential for Thailand’s economic development. Again this is a long-term change which the military government says it is implementing.

(iv) As the new government has centred policy on anti-corruption measures,6 inefficiency should hopefully be consigned to the past. This would give Thailand the opportunity to move towards an efficient, market-based economy that owes no allegiances to rentiers.

The challenge for the new government, therefore, is the sheer scale of the structural problems that they are aiming to tackle and the inevitable resistance that they’ll meet along the way. Their greatest asset is the goodwill that currently underpins their overwhelming popularity7.

With western governments imposing soft sanctions on the Thai people, I wonder if any of them can point to an 88.5% approval rating? It could be argued that the opprobrium of American, British and European governments has far more to do with how they see their vested interests being threatened, rather than with any genuine concerns for Thailand. Maybe the biggest challenges to serious structural reform in Thailand are to be found in London and Washington DC.

Footnotes:

1 http://eng.nesdb.go.th/Default.aspx?tabid=481

2 http://www.nationmultimedia.com/webmobile/politics/Expectations-high-that-reforms-under-NCPO-will-end-30240650.html

3 http://englishnews.thaipbs.or.th/inheritance-tax-bill-ncpos-scrutiny/

4 http://www.bot.or.th/Thai/MonetaryPolicy/Documents/MPC_Minutes_52014.pdf

5 Source: Labour Force Survey, National Statistics Office

6 http://www.bangkokpost.com/opinion/opinion/417625/public-must-own-anti-corruption-drive

7 http://blogs.wsj.com/searealtime/2014/06/23/thai-junta-scores-high-approval-rating-despite-concerns/?mod=WSJ_SEA_Blog

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |