Investors in Thai stocks have done extremely well over the past 18 months, with the local SET index almost doubling from the levels of late 2011.

While clearly a positive outcome for investors, such strong performance raises questions of whether current market levels are sustainable, with media attention focusing on whether speculation is taking too much of a role in driving the market (particularly in less liquid smaller stocks).

The long-term picture remains bright…

Relative to some of the issues plaguing economies in the west, Thailand (like a number of emerging markets) is relatively well placed. Not only are debt levels lower than the US or Europe, but a younger population means the country does not share the burden of a rising support relative to a declining workforce.

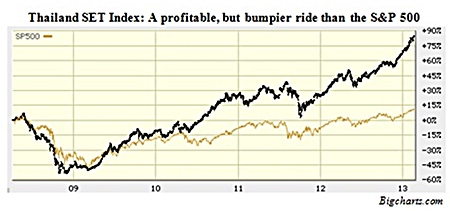

Chart 1

Chart 1

Economic growth also continues to show a strong recovery from the disruptive impact of the 2011 floods, while Thailand’s strategic location at the geographic centre of the AEC puts it in a strong position to capitalize on growth in intra-regional trade, along with the future development of Myanmar and China.

…but global challenges cloud the near-term outlook

This paints an encouraging picture for the longer term, but today’s globalised financial markets mean that there is no escaping the rest of the world’s issues. As Chart 1 shows, the SET’s stellar run in part reflects its greater sensitivity to world market growth – initially falling more than the S&P 500 in 2008-2009, and delivering its share of interim upsets over the past 1-2 years whenever US markets developed jitters.

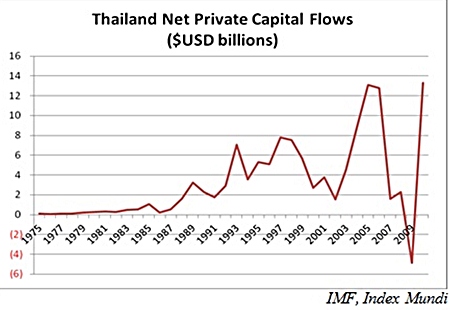

Chart 2

Chart 2

International capital flows are a big driver of this relationship, with foreign inflows recovering strongly after briefly turning negative in 2009. As the size and direction of such inflows are heavily reliant on global risk appetite, it is clear that a re-emergence of concern relating to Europe, China or some other overseas risk factor could well have an amplified effect on local shares.

Some domestic factors also point to caution. While debt levels are relatively low, consumer debt has been rising and, therefore, the level of non-performing loans bears close watching. The government’s economic stimulus plans pose similar issues in the public sector, and while likely to support growth over the next few years, could lead to unintended consequences depending on the effectiveness of their implementation.

Finally, political issues as ever remain a potential source of instability, along with an interesting sideshow tug of war between the government and the Bank of Thailand, with the BoT’s reluctance to cut the policy interest rate drawing criticism in the face of a high Baht and stimulatory government fiscal policies.

Strategy depends on timeframe and risk tolerance

Given the global and local situation at the moment, the best approach from hereon depends on an investor’s own circumstances and attitude to risk. For risk averse investors or those with short time horizons, we believe the SET contains too much inherent volatility and downside risk, and such investors would be best served by averaging into the market after a 15-20% fall. But for longer-term investors who have more time and risk tolerance to ride out interim volatility, we expect that positive long-term fundamentals will drive strong long-run returns, and see the SET rising from 1,500 now to between 5,000 and 10,000 by the year 2025 – i.e., gaining 10%-15% per annum. In particular, investors paying the top rates of Thai income tax have the ability to take advantage of up to a 35% tax rebate, effectively reducing the cost of the SET index to around 1000 – well below our target entry level of 1200, making the long-run value proposition much more attractive. While investors looking for a more strategic approach to the Thai market should consider multi-asset class, multi-manager funds such as Somdul, which offers the flexibility of including both income generating and equity investments based in the Thai market.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |