All eyes on Europe

Politicians and European central bankers, driven by a desperate desire to preserve the status of the impossibly flawed single currency have followed a similar course of action to Ben Bernanke. – Tyler Durden, 2011

A fickle twist of rate

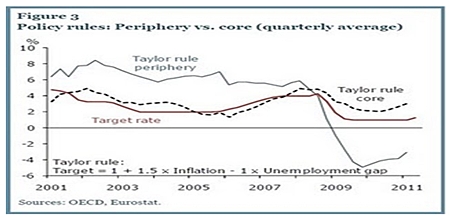

Despite pledging their allegiance, central bankers globally have discarded Taylor’s rule book, based on his study of economic precedents. In doing so, they have turned global capital markets and the global economy into a terrifying laboratory test experiment.

Unless you are convinced that today’s central bankers wield hitherto undiscovered powers that can change the essential nature of economic activity then it is important to realize that these policies will only serve to amplify the extent of the current deflationary cycle, boosting the gold and fixed-interest boom, exaggerating the subsequent bust and increasing the outperformance of miserly cash rates compared to the severe losses expected from risk assets such as equities, commodities and property.

Expert Witnesses

This Time Is Different: Eight Centuries of Financial Folly, (Kenneth Rogoff and Carman Reinhart) makes a very clear and convincing argument as to why central bankers are engaged in pure folly. It concludes that the experiment will fail and that this time is no different, in which case, the long term cycles, the four Kondratieff Seasons, will continue their relentless transitions. This means that investors need to avoid risk assets until the economic Winter ends and ushers in a new, more hopeful Spring, at which point they need to be ready to unload their gold and fixed-interest holdings and hold high levels of cash and cash equivalents.

Investors’ dilemma

Those who depend on the interest from their investments to fund their lifestyle may be unable to resist being forced further up the risk spectrum than is really advisable for them. In order to meet the short term need for yield, they may take on risks that permanently impair their capital base while other investors seek what they hope will be secure capital appreciation from gold bullion – an asset class which is destined to collapse at some point in the future.

Savings: Safe Havens or Net Loss

Not only has the zero interest rate environment increased the demand for secure, liquid deposit and investment vehicles thereby driving down yields to the point where the end result, once inflation has been taken into account, is a net loss but also, in recent months, the market has once again witnessed negative notional interest rates. This is where, at the moments of greatest fear, short term government bonds returned, thirty or ninety days later, less than the amount actually invested, without even taking into account the effect of inflation on the real value. Some large American banks have actually quoted negative short-term interest rates in an attempt to deter depositors.

Forgotten risk/reward

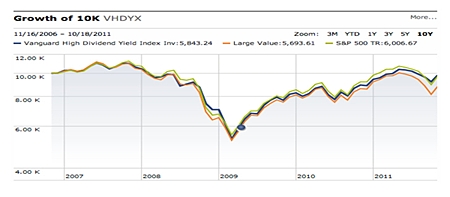

The lack of secure, liquid returns has prompted some investors to explore high-yield stocks. The Vanguard High Dividend Yield Index fell by more than one-half from 11,011 in 2008 to 5,303 in 2009. This currently pays an annual yield of 3.2%, which appears totally inadequate compensation for the risks involved.

Other investors have chosen to chase the yield on corporate bonds – forgetting that in 2008-9 these assets also faced losses as bad as the 50% hit for dividend stocks.

Return of capital – no gain, no pain

Many investors find it difficult to accept the premise that making nothing at all is better than the risk of losing 10% of the value of their investment every time rates are hiked. However, in an environment where investors and depositors are worried about the manifold risks of double dips, currency collapses, political gridlocks and social unrest, Main Street is showing an increasing willingness to simply accept the return of their capital – even without allowing for the extent to which inflation takes its toll – as opposed to a return on their capital.

FX – Risk or Opportunity

Volatility in foreign exchange rates, another significant challenge that today’s investors must face, increased significantly from the beginning of August 2011 to January 2012 (see the Bloomberg chart on this page). The major currencies continue to hold an ‘ugly contest’ and take turns in claiming the prize of being the least desirable currency to invest in.

The idea of locking your wealth into any long term currency position seems too risky for the time being, especially as the current pitiful yields and deposit rates do not offer sufficient compensation to warrant taking such risks. The Greenback remains our current flavour of the month, looking set to embark on a volatile, but generally upward trend for the near term. Medium to long term forecasts are much more uncertain.

One should remember, especially in the short term, that currency relationships are never straightforward or linear. The US dollar, in particular, may benefit as a safe haven currency during the more volatile times. In a crisis, do not be surprised to see the Baht weaken below 35 Baht to the US Dollar, only to ultimately strengthen beyond 25 Baht to the US Dollar.

Bloomberg

Bloomberg

Clearly this gives opportunities for active currency management to produce gains over time. MBMG Group’s chosen portfolio manager, Martin Gray of Miton, recently discussed this matter on Squawk Box. Martin has held substantial cash holdings but has put this cash to work by enhancing meagre cash rates with impressive currency attribution.

To be continued…

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |