A few weeks back I appeared as guest host on CNBC’s Squawk Box, where I mentioned the Bank of England’s (BoE) admissions about monetarist policies. The presenters’ reactions were a mixture of incredulity and confusion.

Astoundingly, the BoE’s comments were not picked up on by the global financial or mainstream media; yet I find them highly significant.

BoE article

Earlier this year, the BoE published an article in its Quarterly Bulletin1 written by researchers in its Monetary Analysis Directorate. What was so striking was the statement in the introduction that a “common misconception is that the central bank determines the quantity of loans and deposits in the economy by controlling the quantity of central bank money – the so-called ‘money multiplier’ approach.”

Since 2009, in an attempt to kick-start the economy after the Global Financial Crisis, the Bank of England, the US Federal Reserve and a number of other central banks have persisted with a policy of printing vast quantities of new money, so-called Quantitative Easing (QE).

The concept behind this forms the basis of monetarist theory: the central bank creates currency for banks to invest. This encourages banks to create more money by lending to businesses and individuals at competitive interest rates. In turn, businesses use the money to expand their commercial activity and individuals can spend more on what they want, be it for buying houses, cars, clothes, etc.

Economist Prof. Hyman Minsky (1919-1996) disagreed with this assumption. Minsky believed that people and businesses are not encouraged to borrow money purely because it’s cheaper than usual to do so. They also need a feeling of confidence in the economy, job security and other factors before they embark on borrowing.

Therefore, the BoE article is an admission that Minsky was right. Dr. Andrea Terzi, Professor of Economics at Franklin University Switzerland, recently made this point as well.2 When looking back at a 1980 video series and book entitled Free to Choose by Milton and Rose Friedman, Dr. Terzi said:

“Milton Friedman explains the money multiplier in a fixed-rate monetary system (the gold standard) and argues that the same principle holds in the contemporary U.S. banking system. Friedman concludes that the Great Depression was caused by the U.S. Fed doing a very poor job, forcing the money multiplier to work its way downwards and effectively destroying the money supply. A former graduate student at MIT who had studied Friedman’s view of the Great Depression – named Ben Bernanke – has seemingly dealt with the 2007-2008 crisis with one idea in mind: prevent the money supply contraction that caused the Great Depression. This was the theoretical foundation of Helicopter Ben’s QEs.”

Dr. Terzi believes the recent economic crises have “dealt a deadly blow to what was until recently considered the state-of-the-art of monetary policy.”

A mistaken belief

Back in June 2011, CNBC’s wonderfully inquiring Karen Tso asked me, when I was criticizing Fed policy, how could I be so negative about Ben Bernanke, an academic expert on The Great Depression. My concern was that he was so totally convinced of neo-classical monetarist theories that demanded a great leap of faith that, to me, wasn’t justified.3

The BoE article is in stark contrast to the monetarist view and Dr. Terzi suggests that the central bank now considers the multiplier a mistaken belief. In fact it is apparent that the only notable effect the Money Multiplier Approach is having is to raise share values. For example, on 21st February 2014 the FTSE 100 climbed to its highest point (6,838 points) since the dotcom bubble nadir of December 1999. In mid-May of this year, the index came close again at 6727. Yet in late February 2014, per capita income in the UK was still lower than its level in 2007.4

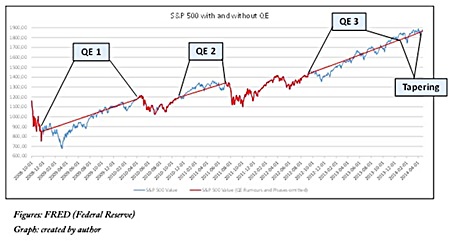

In the US, the S&P 500 continues to rise, especially in periods of QE (see chart). The index hit its highest ever value, 1,569 in late March 2013 – the previous record was set in 2007. As with the UK, US per capita income had not yet recovered to its 2007 level. By February 2014, the S&P 500 had risen by around 20%; yet per capita income was struggling to reach a 2% increase.5 At the end of April of this year, the S&P was almost at 1,884.

Dr. Terzi also suggests that many professionals in the banking and finance industry will find the new view much closer to their operational experience. “The few economists who have long rejected the ‘state-of-the-art’ in their models, and refused to teach it in their classrooms, will feel vindicated,” he adds.

Next week: Endogenous money

Footnotes:

1 M. McLeay, A. Radia & R. Thomas, Money Creation in the Modern Economy, Bank of England Quarterly Bulletin, Q1 2014, http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf retrieved 30 April 2014.

2 https://www.creditwritedowns.com/2014/03/money-matters-old-lady-fails-get.html

3 See http://video.cnbc.com/gallery/?video=1971155393

4 http://www.theguardian.com/commentisfree/2014/feb/24/recovery-bubble-crash-uk-us-investors

5 ibid

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |