The UK’s Vote to leave has caused a lot of turmoil in the markets… but it’ll improve the global economy in the long run.

It’s a strange life being an expat. You still feel a strong attachment to where you grew up, yet it’s no longer the place you call home. This can lead to confusing and conflicting feelings about your origins. One of the many advantages, though, is that it gives you a completely different sense of perspective, especially on the place you once lived, because you’re looking from the outside, yet you know it very well.

The UK’s referendum on EU membership is a good example. While everyone on the inside is getting into heated debate – especially on social media – from the outside, the events are confirmation of what a dreadful state the UK has been in for some time. The political classes have acted with a level of selfishness that is unprecedented – which in their case is already a stratospheric bar to clear; while the media continues to pump misleading information and downright lies merely to conform to pre-set conclusions.

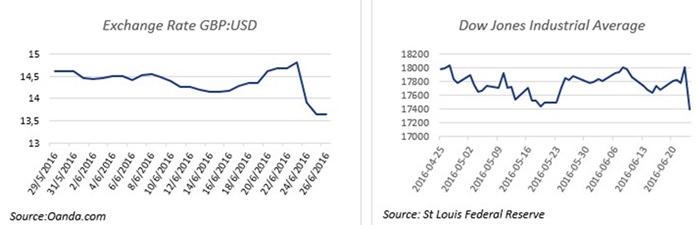

The effects of this vote go far beyond a few fly-by-night politicians and newspaper editors – and it could well turn out to lay the seeds for a brighter economic future. The immediate response was the kind of carnage that we had been rather lonely in predicting would accompany an exit vote – both in terms of the markets and the resignation of PM David Cameron. The response of capital markets to the initial vote and subsequently to the reaction of policy makers such as Bank of England1 Governor Mark Carney was, however, all too predictable. What has happened until today has played out pretty much exactly as we’d forecasted. The key question is, as Barbara Dixon once asked, ‘so what happens now?’

As I mentioned in January, 2016 is the most unpredictable year I’ve experienced in my whole career.2 That’s why I’ve been advocating to cover all bases in case of a big event. Those who did will not necessarily have lost in the last days – a market neutral approach to equity components would have seen a roughly break-even return during the worst days of post-referendum market hysteria and assets like gold and treasuries rallied strongly. So covering bases has worked so far and it remains our approach even though the whole process of the UK leaving the EU could last at least two years and there’s a strong popular movement from the losing side to overthrow the referendum result. Consequently, it’s worth taking a measured view, rather than making panic decisions. So it could well be worth focusing on the opportunities that the short term market disruption has uncovered in order to make a return from them over the longer term. Sterling seems very slightly oversold at this stage whereas US Treasuries have shot up so far that we have been advocating profit taking, even though we’ve only been positive on Treasuries and flagging them as a buy again in the last couple of months.

In the long run, though, I see the referendum result as a step – albeit a tiny one – towards global normalisation. It’s something that can kick-start the move towards a far stronger global economy than we have today.

We can already see the domino effect begin with the collapse of the UK government. Ahead there is the significant possibility of the implosion of the United Kingdom, the gradual break-up of the European Union, followed by the Minsky Moment3 that will lead to the greatest economic re-adjustment that will occur in our lifetimes.

So whilst certain politicians and sympathisers with the far right may now be celebrating the UK’s independence, the reality is that these events will ultimately, represent good news not just for the whole of the UK, but also for Europe and for the totally interdependent global economy. That counts for all participants, even Germany and China – the places that will suffer the most in the medium term.

The reason for this is that we have seen the stacking up of unprecedented levels of private debt in practically every major economy.4 Then, when the bubble burst eight years ago, governments and central banks (especially the ECB and PBoC) have consistently used the wrong tools. Instead of alleviating the situation, they have exacerbated it with an inconsistent mélange of austerity, quantitative easing and zero/negative interest rates.5 They may be forgiven for mishandling these major economic events at the outset; but they have infuriatingly refused to recognise failure to look at an alternative approach, such as that proposed by my colleagues at IDEA Economics.6

From an expat point-of-view, the result means uncertainty over changes in the way they are taxed, domicile issues and the possibility that British expats living in Europe may see their UK pensions frozen, the way they are in certain other non-EU countries. Right now, the best course of action is to stay informed of events and be in a position ready to react.

Nearly all of the experts offering up their views to the world’s media have echoed the view that the Leave vote will have a massive impact, primarily on the UK, and lasting for years to come.

There will be case-specific ‘victims’ such as retired British expats who rely on pensions that are paid to them in pounds sterling.7 Alternatively, residents of Gibraltar worried that because Spain has long claimed the British overseas territory for itself, it could seek to use it as a bargaining chip in return for its signature on treaties between the newly exited UK and the EU, for which unanimous votes are needed.8

The Spanish government called for joint sovereignty over Gibraltar9 after the UK’s vote to leave the EU and the acting foreign minister José Manuel García-Margallo was quoted as saying that “The Spanish flag on the Rock is much closer than before.” As is the case with his British colleagues, this could all be bluster though. Spain’s general election in December was inconclusive and the re-run, which took place three days after the UK referendum, could well result in a new foreign minister of a different political persuasion.10

The key point to emerge from the vote is that the EU faces an existential crisis which would put an end to the policies that have disadvantaged peripheral members of the EU at the expense of core members – a core that has become increasingly defined as Germany alone since the financial crisis of 2008. In return for a larger share of a shrinking pie, Germany has been increasingly forced to underwrite the financial obligations of the EU and it is in Frankfurt where the Buck or rather Euro stops when it dies. Spain will gain far more from exiting the Euro and the EU than from reclaiming the overhanging rock where Nelson’s body was taken ashore over 2 centuries ago.

The referendum wasn’t the only incredible event that week, though. The BIS – the central bank for central bankers – made an extraordinary declaration on financial stability. It’s worth a look in the Editorial Section of BOOM Finance & Economics.

Whatever happens going forward, sit back and stay informed. It’s going to be a bumpy ride.

Footnotes:

1 http://www.bankofengland.co.uk/publications/Pages/news/2016/056.aspx

2 http://www.mbmg-investment.com/in-the-media/inthemedia/77

3 http://www.investopedia.com/terms/m/minskymoment.asp

4 See my IDEA colleague Steve Keen’s 2015 Economic Outlook http://www.ideaeconomics.org/

5 idem

6 http://www.ideaeconomics.org/

7 http://www.bbc.com/news/business-36606847

8 Article 50 TEU

9 http://www.bbc.com/news/world-europe-36618796

10 http://elpais.com/elpais/2016/06/24/inenglish/1466781108_739015.html

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |