In the second part of my article on Prof. Steve Keen and his Dataconsult Breakfast talk in Bangkok in late July, I look at his thoughts on private debt and its effect on economies.

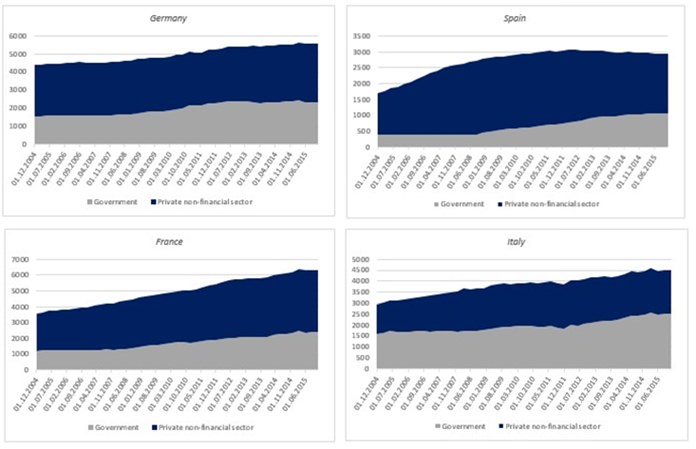

Having established that private debt is actually the real economic disease affecting us, the below chart reveals that it doesn’t take in-depth analysis or a PhD in economics to see that, while Eurozone countries are pushed by the ECB to reduce government debt, the real problem is in fact private debt (see chart 1).

It’s the private debt that counts

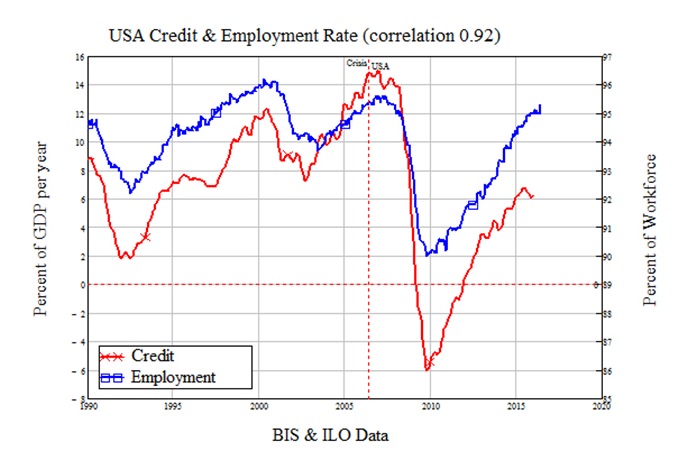

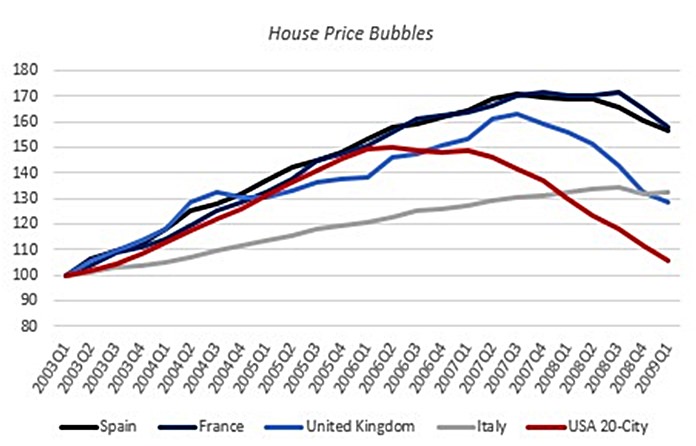

Private debt was the major contributory factor to the GFC1 – in no small way because of bubbles in house prices (see chart 2). As Prof. Steve Keen points out, when the private debt-to-GDP ratio is high, credit dominates other economic factors: a comparison of US credit and employment highlights this (see chart 3).

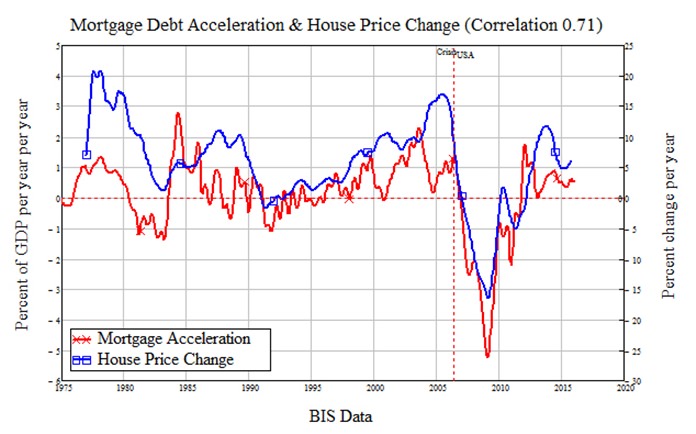

Also, Steve demonstrated in his talk how house price changes are driven by the acceleration in mortgage debt (see chart 4).

Possible solution

With this evidence in front of us, it would seem logical that governments and central banks of the most effected economies would do their upmost to reduce the amount of private debt, for example through a modern debt jubilee, as another IDEA Economics colleague, Michael Hudson, has demonstrated.2 This is something which Michael shows has happened regularly in the past.3 The overall effect of a modern jubilee would be to make economic conditions much more favourable for individuals and businesses alike (see graphic).

All this may seem like a highly costly way of rebooting the economy; yet the sums spent by central banks in an attempt at stimulation are so astronomical that they’re difficult to even contemplate. In its weekly editorial of 25th July, BOOM Finance & Economics puts the figures at US$3.5 trillion by the Fed on its QE policy, the ECB’s Expanded Asset Purchase Programme has cost US$1 trillion so far, the Bank of England has put down US$500 billion on its Asset Purchase Facility and the Bank of Japan’s stimulus package is at US$3.4 trillion so far. To give these numbers some kind of perspective, Croatia launched a programme to wipe out the debt of up to 60,000 of its poorest citizens at a cost of a maximum of just US$317,000.4

As the BOOM editorial rightly points out, all this stimulus is costing trillions, while – according to povety.com – some 7.6 million people in the world die from hunger every year.

Even if the central banks’ policies weren’t so expensive, they are completely misplaced. The general principle behind them is to kick-start economies by giving businesses and individuals easier access to debt – the very thing that put us in this mess in the first place. Meanwhile, austerity measures aim to reduce government debt; which means fewer public services, less spending on education, health and infrastructure – services which help improve people’s capacity to earn, thus increasing consumption, helping business, bringing more tax income and so on.

In fact, if governments actually bring in more money than they spend, it’s bad news for the economy. That’s because to achieve surplus, government taxes on the private sector exceed the subsidies paid to it by the government, so the private sector has to run a deficit with the government. But that means shrinking the private sector – the opposite of governments’ good economic management objective, unless the private sector somehow produces not only enough money to finance the government surplus, but also enough to allow the economy to grow at the same time.5 That’s some ask.

| The Effects of a Modern Jubilee1. Reduction in people’s debt levels;

2. Cash injection for non-debtors; 3. Alteration in the distribution of bank assets, with debt instruments declining and value and cash assets rising; 4. Fall in bank income, as debt is an income-earner for banks, whereas cash reserves are not; 5. Fall in income flows to asset-backed securities (ABSs) as a large part of the debt would be paid off; and 6. Individuals and corporations owning ABSs would have more cash to spend, instead of being reliant on income from ABSs. |

It’s taken a while but even the IMF has finally recognised this, urging G20 governments to increase their spending on infrastructure to boost growth.6 In its recent annual report, the central bankers’ central bank, the BIS, has also now admitted that there is an “urgent need to re-balance policy” and central banks’ “inability to get to grips with hugely damaging booms and busts” and the “debt fueled growth model.”7

That’s all very well but it’s now time – in fact it’s been time for about eight years – for central banks to stop mistreating the symptoms and deal with the actual disease. Steve’s analysis of BIS debt data shows that there are several countries which should be red-flagged for dangerously high levels of private debt: including Australia, Canada, Korea and Malaysia. If these countries, the US, the Eurozone and the UK don’t dramatically reduce private levels quickly, Steve believes another important financial crisis will hit them. If he’s right – as he was about 2008 – then China may not be in a position to soften the blow this time around.8

Footnotes:

1 http://www.ideaeconomics.org/blog/2015/1/13/steve-keens-2015-outlook

2 http://www.ideaeconomics.org/a-modern-jubilee/

3 http://michael-hudson.com/wp-content/uploads/2010/03/HudsonLostTradition.pdf

5 Steve Keen’s Economic Outlook 2015 IDEA Economics http://www.ideaeconomics.org/

7 BIS 86th Annual Report via http://boomfinanceandeconomics.com/

8 http://blogs.ft.com/the-exchange/2015/08/19/12621/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |