Whether you’re an entrepreneur, potential entrepreneur or someone who merely reads the business pages of the newspaper, you will probably have heard of crowdfunding.

Types of Crowdfunding

That’s because crowdfunding platforms, such as Kickstarter and GoFundMe, have helped individuals and small companies raise money to get their creative ideas or whizzbang technology to market. Two famous examples are actor/director Zach Braff’s campaign to partially fund his film Wish I was here, which set him up with USD 3 million in capital; and Pebble Technology Corporation, whose venture into the smartwatch market raised USD 10 million.1

Source: Bank of Thailand

Source: Bank of Thailand

However, this form of raising money is much more present in the global finance scene than just a couple of examples and it has evolved rapidly since musician-fundraiser ArtistShare first came to prominence in 2003.2 Perhaps one reason for its rapid rise is the fact that the platforms may be powered by modern technology but the concept has been around for centuries – the construction of the Statue of Liberty was funded in a similar way, with contributors receiving rewards including having their names printed in Joseph Pulitzer’s New York World newspaper.3

Start-ups of course need an initial investment to establish themselves; buy equipment; get that first service delivered or first batch of products; and build up brand awareness. It can take a long time to receive acceptance for a bank loan, if you get one at all given issues of collateral and high interest rates.4 Failing that, it can often prove difficult to access angel investors or venture capital funds if you’re new to the game. Thus a reward-based crowdfunding scheme may suit best as no real return is expected.

Source: Bank of Thailand

Source: Bank of Thailand

Equity-based crowdfunding gives investors and venture capitalists the opportunity to invest whilst spreading the risk with others. This model can be used for start-ups deemed as having the highest potential, as well as established SMEs needing capital to expand their business. This method not only gives the investor potential reward if the business is successful but also some say in the way forward.

If a company is at the stage where a traditional-style loan suits best, then there is debt crowdfunding. This covers different kinds of lending, including small bonds, invoice financing and peer-to-peer lending.

Peer-to-peer lending is where, rather than receiving rewards or a stake in the company, lenders receive interest paid on a loan. However, those lenders are not financial institutions, such as banks.5

Application to Thailand

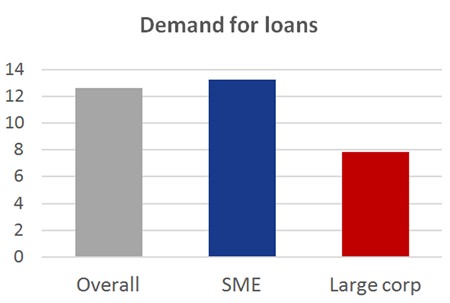

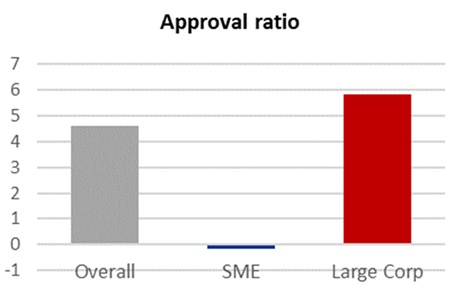

Crowdfunding is not just for tech start-ups in Silicon Valley. It can also be an ideal way for entrepreneurs in Thailand to get access to capital. The reality here is that whilst small and medium-sized businesses make up the majority of loan requests to banks, hardly any of them are successful. (See charts)

In fact, even though bank loans to SMEs increased by 67% between 2007 and 2013, 61.4% of those 2013 loans were short-term loans.6

The Asian Development Bank estimates that the SME credit gap in Asia is at least THB 41.4 trillion (USD 400 bn); and Thailand’s at THB 425 bn (USD 11.8 bn), with over 28% of all formal SME’s financed internally.7

These figures demonstrate a definite need for an alternative way to find investment. With a 100% year-on-year growth rate in Thailand for capital raised since 2012,8 crowdfunding appears to be filling that gap.

Acknowledging this, Thailand’s Capital Market Supervisory Board set out new regulations regarding selling securities over the internet in May 2015, designed to facilitate crowdfunding.9

The marketplace in Thailand may be embryonic but it is flourishing. There are already several platforms on the market. Equity crowdfunding platforms include Dreamaker and Sinwattana; and for debt crowdfunding there’s Satangdee, Sinwattana again and Beehive.

Getting it done

Now that crowdfunding is making headway in Thailand, it may seem easy to put your project out there and ask for investment. However, that would be an over-simplification of the whole process.

The old adage you only get one chance to make a first impression still applies, so you have to get the presentation of your idea spot on. Also, you need to know which type of crowdfunding best suits your business: are you willing to give up a share of the business? Do you have any attractive rewards to give? Do you prefer a loan-type arrangement? Finally, it’s vital to ensure that the offer is compliant with the new regulations and the policies of the crowdfunding platform.

That’s why it’s worth entrepreneurs consulting an independent expert who can guide them through the steps.

Footnotes:

1 http://www.businessweekme.com/Bloomberg/newsmid/190/

newsid/917/The-Rise-of-Crowdfunding-in-the-Middle-East#cnttop

2 www.artistshare.com

3 http://www.libertyellisfoundation.org/statue-history

4 http://www.dreamakerequity.com/

5 http://www.investopedia.com/terms/p/peer-to-peer-lending.asp

6 OECD, Financing SMEs and Entrepreneurs 2015

7 ADB Working Paper Series on Regional Economic Integration

8 Dreamaker AIS

9 TorChor. 7/2558, TorChor. 8/2558 & KorChor. 3/2558

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |