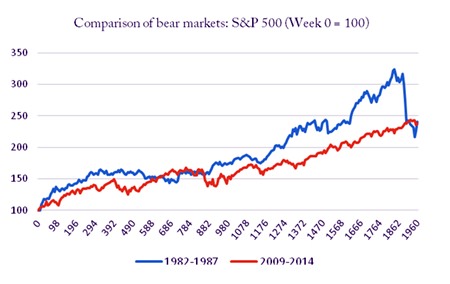

If we are to believe certain analysts, the US is in the midst of a stock market boom, which began on 3rd September 2009.1

Should that be the case, will it result in a bust, as in the past? This question was first asked by analysts back in April, as the current S&P 500 upturn passed the longevity of the 1982-1987 surge. Four months on, there is still no sign of a massive drop in share values (see graph 1).

Graph 1 – Figures: FRED (Federal Reserve)

Graph 1 – Figures: FRED (Federal Reserve)

So why should we worry? Well, the issue is that current stock prices are baseless: they have been fuelled by the Federal Reserve’s policy of quantitative easing (QE) – printing new money to give to banks so that they lend out to businesses and individuals, thus stimulating the economy. This hasn’t worked and other key economic indicators in no way reflect share prices.

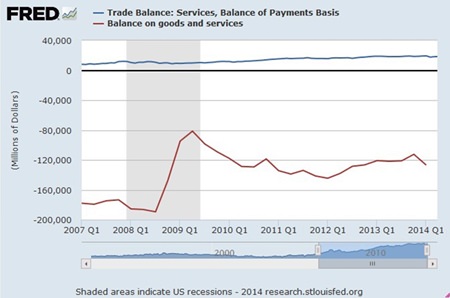

Graph 2 – Source: FRED Federal Reserve Bank of St Louis.

Graph 2 – Source: FRED Federal Reserve Bank of St Louis.

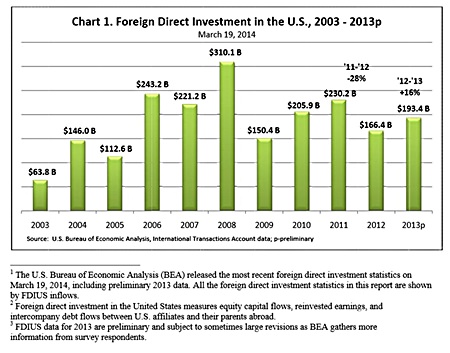

If the central idea behind QE is to increase access to capital, so that businesses can get back on their feet and make America an attractive place to do business again. A look at the stuttering trade figures and FDI trends show that this is not the reality (see graph 2 & 3).

Graph 3

Graph 3

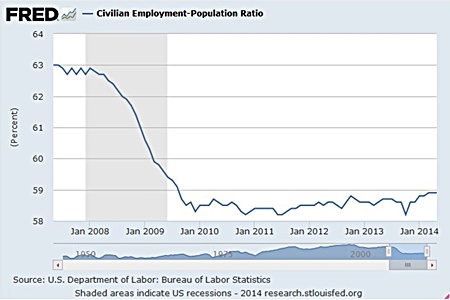

Also, a few months back the Fed announced that by the end of 2014, unemployment would fall to 6% – its goal for recovery is in the mid-5% range2. A look at the actual figures for employment in proportion to population shows a less optimistic picture (see graph 4).

Graph 4 – Source: FRED Federal Reserve Bank of St Louis.

Graph 4 – Source: FRED Federal Reserve Bank of St Louis.

Lending

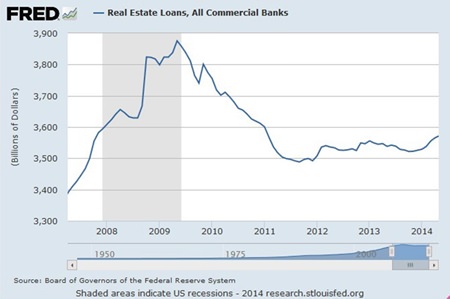

Given that the banks were supposed to be handed freshly created money to loan out to the population, the figures for home loans show little movement since they bottomed out in 2011 (see graph 5).

Graph 5 – Source: FRED Federal Reserve Bank of St Louis.

Graph 5 – Source: FRED Federal Reserve Bank of St Louis.

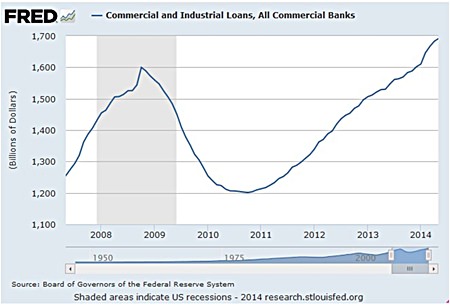

If you follow the Fed’s logic that having more debt is a sign of recovery, commercial loan figures could be seen as more encouraging. Yet, despite the trillions of dollars pumped into the QE programme since 2010, loan levels only got back to peak 2008 levels at the turn of this year (see graph 6).

Graph 6 – Source: FRED Federal Reserve Bank of St Louis.

Graph 6 – Source: FRED Federal Reserve Bank of St Louis.

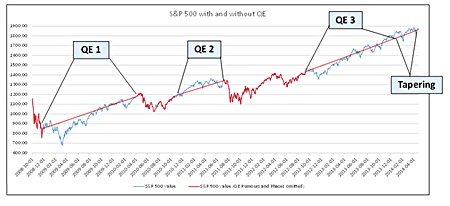

If all the above is not proof enough of the artificial rate of stock prices, the largest rises in the S&P 500 since autumn 2008 have occurred during periods of QE (see graph 7).

Graph 7 – Figures: FRED (Federal Reserve) (Graph: created by author)

Graph 7 – Figures: FRED (Federal Reserve) (Graph: created by author)

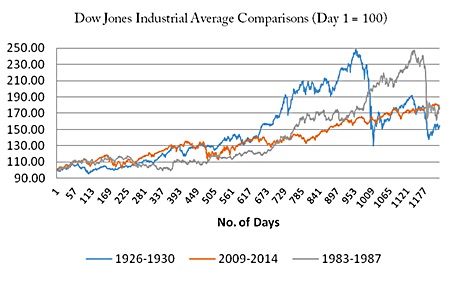

Of course, when analysts begin to warn of a stock market bubbles bursting, it reminds us of the Wall Street Crash of 1929, as well as the only slightly-less dramatic version in 1987. Looking at those two events, it is clear how quickly the bubble can burst (see graph 8).

Graph 8 – Samuel H. Williamson, ‘Daily Closing Value of the Dow Jones Average, 1885 to Present,’ Measuring Worth, 2012.

Graph 8 – Samuel H. Williamson, ‘Daily Closing Value of the Dow Jones Average, 1885 to Present,’ Measuring Worth, 2012.

Investment strategist Jim Paulsen made the comparison in April between the current situation and those events of 25th August 1987, when after five years of rising, prices took a dramatic nosedive. Although he doesn’t expect as large a drop as the 20% fall in one day in 1987, he does think that when the market falls there will be a 10% correction “sometime in the next few months”.3

Over in the UK, similar alarm bells are being rung, given the high levels of both public and private debt, yet rising stock prices: the FT All-Share index has gone up 40% over the last 5 years (see graph 9). The increase has been so consistent, amongst seemingly fearless buying, that the Bank of England’s Deputy Governor Charles Bean says: “the lack of volatility is eerily reminiscent of the run up to the financial crisis in 2007-2008.”4

Whilst it’s an easy option to remain permanently pessimistic, it is also extremely difficult to predict when the bubble will burst. However, if prices continue to go up, purely on speculative buys rather than a firm economic basis, we could well be heading for a significant drop.

FT All-Share Index last 5 years

Graph 9 – Source: Bloomberg

Graph 9 – Source: Bloomberg

Footnotes:

1 http://blogs.marketwatch .com/thetell/2014/04/02/now-theres-a-1987-chart-to-get-worried-about/

2 http://www.cnbc.com/id/101525990

3 http://blogs.marketwatch .com/thetell/2014/04/02/now-theres-a-1987-chart-to-get-worried-about/3

4 http://blogs.telegraph .co.uk/finance/ambroseevans-pritchard/100027346/global-watchdogs-rattled-by-lack -of-fear-in-the-markets/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |