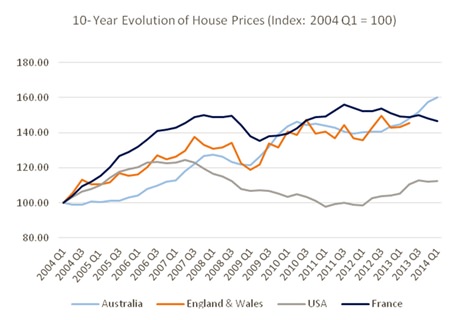

When it comes to investment, one obvious place to put money is in bricks and mortar. Despite the global financial crisis (GFC), house prices have continued to rise in some of the world’s largest economies. So much so that in mid-June the IMF warned of property bubbles in Australia, Belgium, Canada, New Zealand and to a lesser extent, France1. In fact, looking at figures from four major countries alone, there has been a sharp rise in housing markets in all but the struggling US.

Boomers: United Kingdom

Also in June, the Deputy Governor of the Bank of England, Sir Jon Cunliffe, raised concerns that there was a British tendency to buy houses as soon as people felt their income was increasing, or indeed felt there was a chance it would increase. This habit, he suggested, meant that supply could not keep up with demand. He was therefore worried that, as house prices surge, household debt could be set to rise yet again2.

Sources: Australian Bureau of Statistics, Land Registry, FHFA, INSEE.

Sources: Australian Bureau of Statistics, Land Registry, FHFA, INSEE.

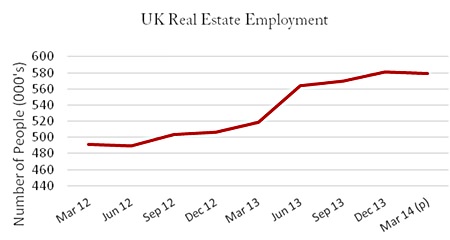

One tell-tale sign in the UK is the large increase in the number of people working in the real estate sector. Between Q1 and Q2 2013 alone, there was a 9.9% rise in the number of real estate workers3. This was not just a one-off either, nearly 100,000 more people now work in real estate than in March two years ago.

Source: Office for National Statistics.

Source: Office for National Statistics.

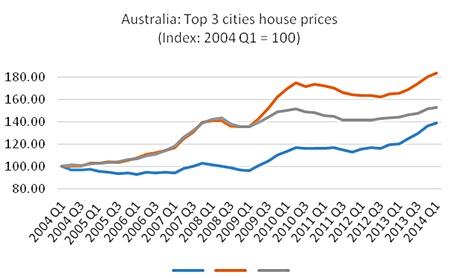

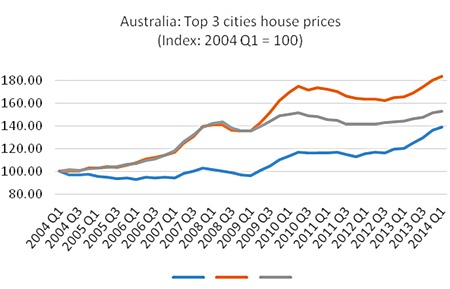

Whilst it’s true that, as reported by the UK press4, prices in London have increased significantly, the capital cannot take the entire blame for this trend. As the chart demonstrates, the two largest urban conglomerations outside London have also seen rises.

Boomers: Australia

Australia has been experiencing a house-price bubble for several years. Key economists, such as Steve Keen5, have long since been sounding the warning bells that a burst will come; and when it does it will be devastating. Over two years ago I suggested to CNBC that Australia’s huge credit bubble would at some point burst – possibly pricked by poor results in the Chinese economy, making the Australian dollar and perhaps the banks and property market drop in price6. That hasn’t happened yet, as Chinese economic results have so far stood up over the last couple of years, but Australia’s heavy reliance on the Asian giant means the Sword of Damocles still hangs above its markets.

Source: Land Registry.

Source: Land Registry.

Looking solely at the property market, since the dip in 2008, Sydney area prices have increased by over 40%. However, Brisbane and Melbourne continued augmenting without experiencing anything close to a dip: over the last ten years the former’s house prices have increased by almost 53%; the latter’s by a huge 84%.

To be continued…

Footnotes:

1 http://www.lesechos.fr/monde/europe/0203561280927-le-fmi-craint-une-bulle-immobiliere-en-france-1012176.php

2 http://www.telegraph.co.uk/finance/bank-of-england/10931956/Jon-Cunliffe-UK-property-obsession-threatens-to-push-up-household-debt-pile.html

3 http://www.ft.com/intl/cms/s/0/866e87c0-1af0-11e3-a605-00144feab7de.html#axzz36Nx2bapT

4 http://www.bloomberg.com/news/2014-07-15/u-k-house-prices-rise-as-london-surge-hits-record-ons-says.html

5 http://www.debtdeflation.com/blogs/2014/04/08/a-sudden-conversion-of-property-bubble-doubts/

6 http://www.cnbc.com/id/47290031#.

Source : ABS.

Source : ABS.

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |