After all the promises of several governments to “save, invest and export”1 and the enactment of laws to reduce deficits, it seems that all this hard talk of austerity is turning out to be a load of hogwash.

In June of this year, economists at the IMF – the world enforcer of austerity – published an article questioning its own approach, stating:

Austerity policies not only generate substantial welfare costs due to supply-side channels, they also hurt demand—and thus worsen employment and unemployment.2

A month later, the UK’s incoming Chancellor of the Exchequer, Philip Hammond, indicated a scaling back of predecessor George Osborne’s book-balancing programme.3 Then, consistent with two years of the Italian government speaking out against austerity, its economic development minister, Carlo Calenda, spoke in August of how it was “fighting to change” the 2017 reduction target of 1.8%, set by the European Commission.4

It seems that, in Europe at least, cracks are beginning to form in the grand plan to reduce government debts. And about time too!

Frankly, austerity, fiscal responsibility, balancing the books, however you want to label it, has been one of the great disasters of post-GFC policy. And that’s saying something, when you consider that it shares its infamy with quantitative easing and negative interest rates.

The whole idea behind austerity comes from the governments’ apparently sudden realisation that they were cranking up massive public deficits through borrowing. This particularly came to the fore when, in some cases, public money was used to stop the banking system from collapsing under the weight of its own bad loans.5

So it makes sense that governments offset these massive costs by tightening their belts to the point that they bring in more money than they spend, right? Wrong.

A government’s balance sheet is in no way the same as that of a company or an individual’s credit card bill. The belief that it is similar betrays a total misunderstanding of what money is and where it comes from. Governments create money by borrowing from banks, so bank notes are in fact a collection of IOUs. If you’ve ever looked at an English bank note, for example, you may have noticed the Governor of the Bank of England’s signature and a promise to pay the bearer the sum of the note.

So, if there were no national debt, governments wouldn’t have to borrow from banks. The banks would then have to create all the money themselves through private loans. The problem is that there simply aren’t enough private borrowers for the banks to do business in that way.

Even if we disregard that reality, if you try to cut national debt you’re actually reducing demand in the economy, which then reduces national output because firms cannot sell enough. Three countries whose governments have recently run a surplus – Chile, Denmark and Sweden – have seen a reduction in GDP and an increase in unemployment during periods of belt-tightening (see chart 1).

This reduction in GDP highlights the nonsense that has been circulating the corridors of the European Commission, the ECB and the IMF over the past seven years. Their focus is on reducing public debt, seemingly irrespective of the cost to a country’s social and physical infrastructure; yet they use the percentage of public debt to GDP as the main measure.6 That’s the economic equivalent of jumping at shadows; because both debt levels and GDP figures are moving variables. So if, as in the cases of Chile, Denmark and Sweden, the government is able to bring in more money than it spends and GDP shrinks, the debt-to-GDP ratio will not improve – and may even worsen.

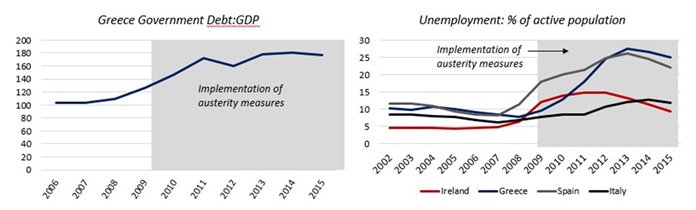

In fact, economist Ha-Joon Chang recently pointed out that in the now infamous case of Greece, the result of 5 years of austerity is merely more public debt as a proportion of national output than before (see chart 2).7 So what we’re looking at is a situation whereby, not only is the policy of austerity flawed, but so is the way of measuring success – or, more the point, the lack thereof.

If we take our minds away from the mind-set of central banks and the IMF for a while and instead apply some basic logic, it seems a fairly straightforward statement to suggest that governments receive their income from taxes, such as corporate and personal income taxes, sales and property taxes.

It’s also not particularly controversial to say that – as has happened in Greece – if a government raises corporate and personal income taxes and cuts the minimum wage (by 22%),8 pensions and public sector salaries,9 as well as increasing sales tax up to 24%,10 businesses and families have less money to spend. Not only that, unemployment tends to increase as companies either can no longer afford to or feel nervous about committing themselves to employ – as has happened in the worst-hit Eurozone countries (see chart 2).

Consequently, investment and consumption drop and the economy shrinks. That in turn brings in less corporate and personal income and sales tax revenue to the government. Hey presto, that’s where Europe is now.

The solution to this is not so complex either. In a nutshell, governments need to put money back into the hands of the people. There are several ways to do this. My IDEA Economics <http://www.ideaeconomics.org/> colleague Michael Hudson talks of society’s rich history of debt jubilees,11 used to wipe the slate clean and recharge the economy. As he says, “Debts that can’t be repaid, won’t be repaid,” so a cancellation removes the shackles.

There’s also the possibility of actually increasing government expenditure on important services such as health, education, digital and physical infrastructure. This would provide a long-term economic climate where the private sector is able to invest and spend and thus bring in more tax revenue for the government to reinvest. Of course that depends on the public sector using the money on its people, rather than wars.

In the meantime, we can apply pressure through reasoned argument until the penny/cent/yen eventually drops and the vicious circle is turned into a virtuous one. My fear, though, is that this will be ignored and it will take another huge economic crisis to trigger such a rethink.

Footnotes:

1 Then UK Chancellor of the Exchequer George Osborne’s 2010 Budget Speech, http://www.telegraph.co.uk/finance/budget/7846849/Budget-2010-Full-text-of-George-Osbornes-statement.html

2 Jonathan D. Ostry, Prakash Loungani & Davide Furceri, Neoliberalism: Oversold? Finance & Development, IMF, June 2016

3 http://www.ft.com/cms/s/0/db1b6304-492a-11e6-b387-64ab0a67014c.html

5 https://www.theguardian.com/business/2008/dec/28/markets-credit-crunch-banking-2008

6 http://ec.europa.eu/economy_finance/publications/eeip/ip018_en.htm & https://www.imf.org/external/pubs/ft/scr/2016/cr16130.pdf

8 http://www.nytimes.com/2010/07/09/business/global/09drachma.html?_r=1

9 http://www.reuters.com/article/us-greece-idUSTRE81R1KR20120228

10 http://www.dw.com/en/greece-braces-for-new-austerity-induced-pension-cuts/a-19241953

11 http://michael-hudson.com/wp-content/uploads/2010/03/HudsonLostTradition.pdf

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |