Today we have a special report from Scott Campbell – Managing Director and Chief Investment Officer of MitonOptimal.

Marc Faber, the famed editor of The Doom, Boom and Gloom Report to which we subscribe, was apparently moderating at an investment forum in Moscow recently where he asked his fellow panelists, “If tomorrow you were supposed to go to jail for 10 years and were allowed to make only one investment, which you would not be able to touch for this period, what would you choose?” Considering his panelists included Nouriel Roubini, Nassim Taleb, Hugh Hendry and Russell Napier, the answers were pretty enlightening.

In addition, this week on fullermoney.com a subscriber asked the question of what one should do when leaving a portfolio to a spouse upon death who has had no involvement or interest over the past 40 years.

These answers make for interesting reading.

The answers to Faber’s question were: a basket of western multi-national stocks which benefit from emerging markets (Roubini), land in Lebanon! (Taleb), large high-return emerging market stocks (PIMCO EM fund manager), basket of Asian currencies (Napier), tobacco stocks (Hendry) and gold (Faber himself).

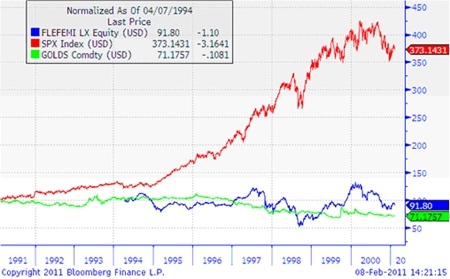

We devised the charts on this page from Bloomberg to look at the past 2 ten year periods and clearly picking the large under-performer of the previous period would have rewarded handsomely. Gold and EM equity massively underperformed in the 1990’s and Developed Equities (S&P500) in the 2000’s. We picked gold and EM over the past ten years but now we agree with Roubin that a basket of western multi-national high dividend stocks which will benefit from the emerging world boom would be the place to be after a dismal past ten years.

The next question is more behavioural and subjective. “I know my way around the investment world, but my wife has no interest. What happens upon my death? Should I leave her with a portfolio of unmanaged stocks, mutual funds or a money manager? All of these might be ok, but things change. The obvious similarity with the above debate is that what may have worked for the past 10 years may not work for the next 10. Also, as people get older their investment objectives change.” Two important points came out the discussion for me:

1. Succession planning to minimize tax implications is important but ensuring that all family members sit down and understand the actual investment portfolio and how it is to be managed is more important.

2. 30 years ago, income objectives were easily met by building a portfolio of long dated western government bonds as runaway inflation peaked.

Today, those same investments are a massive avoid at the end of a long bull market as deflation has worked its way through the system and the reflation season begins again.

An income yield portfolio must incorporate commercial property and high yield equities (which are more volatile) but will provide a growing income yield in the face inflation over the next 30 years. This time period could be important if American congressman Ron Paul is to believed, “We have so much unemployment, it is so undercounted. The free market economists report that there is probably 22% of unemployment. They [the Fed] pumped in $4 trillion, they should have added a lot of jobs, but how much did it cost us, and that of course is the price inflation that will come. We are moving into another 30 year period where we are going to see a reversal of interest rates, and we are going to see a crashing of the bonds like we saw 30 years ago and it’s going to last a long, long time. The Fed deserves the blame for the inflation, and for the unemployment.”

Looking forward is vital. Jesse Livermore was one of the most outstandingly successful traders of the early 20th Century, immortalised in Edwin Lefèvre’s “Reminiscences of a Stock Operator”. On the few occasions when he lost money, it was invariably because he chose to override his own rules. He said many insightful things about the psychology of successful investing, but perhaps his most pertinent observation was the following: “After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It always was my sitting. The big money is made by the sittin’ and the waitin’, not the thinking.” He did not plan things differently when he decided to end his life, “I seem to remember that Jesse Livermore, despite being an extremely active trader, chose to put together a portfolio of high yielding rail and utility shares for his wife before his suicide. I guess he knew that he would be trading less actively in future.” Fullermoney.com

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]