Unemployment

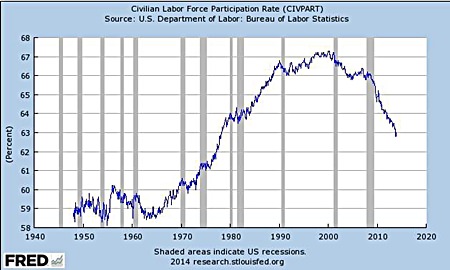

Since the global financial crisis (GFC), the number of employed in the US has reduced dramatically (see Chart 1). What this graph shows – and mere unemployment rates do not – is the trend in the number of people actually working. Considering that one percentage point on the graph represents 2 million workers, the number of people who have departed or been dissuaded from the workforce is significant.

GRAPH 1

Chart 1 Source: Federal Reserve Bank of St. Louis economic Research

Chart 1 Source: Federal Reserve Bank of St. Louis economic Research

The trend is similar to the US pre-1980, during the times of oil crises and stagflation. However, the world is a different place today: back then, there weren’t as many women in the workforce, and men mainly worked full-time and earned enough to support a family. Thus, there were far fewer people on the job market. The US census of 2011 measured 100 million people in the US to be receiving welfare in Q2 of that year.

The US’s Bureau of Labor Statistics (BLS) may report that there is a growth in employment, yet close analysis of this reveals certain holes.

To begin with, apparently computer issues in counting unemployment numbers in California over a period of five months have meant that official figures are well below the reality.1

They also show that 77% of new jobs created in 2013 were part-time positions2, which in the US do not carry the social protection of a full-time job. It is estimated that less than half of American adults have a full-time job3 and that, while labour force participation is actually on the up amongst the over-55’s, it is still on the slide amongst 24-54-year-olds (see chart 2) – all this just as the baby-boom generation is approaching the age of 70. The concern here is that this impairs that major engine of economic activity, consumer spending.

GRAPH 2

Chart 2 Source: Federal Reserve Bank of St. Louis economic Research

Chart 2 Source: Federal Reserve Bank of St. Louis economic Research

A smaller workface also reduces business spending in many ways, hence the record levels of corporate profitability. One positive spin on these numbers is that increased asset prices have allowed many baby boomers to retire having achieved adequate wealth goals to do so – if true, this is also a huge concern in that the assets that have appreciated the most are those with significant risk, such as equities, which now look expensive and vulnerable to a major correction – the virtuous circle of higher asset prices generating wealth and facilitation retirement could very easily unravel if retirees are dependent on high dividend stocks and corporate or high-yield bonds for their retirement income. Not only could this income vanish or at least diminish in a moment, this would create a self-fulfilling cycle of ongoing selling that could have devastating effects on assets such as US equities and fixed income. The wealth created by the stimuli of the last few years could easily disappear just as quickly as it was conjured into being.

Household Income

The last US census, conducted in 2011, revealed that median household income had fallen in four consecutive years. In 2012, just over 67% of wage earners had net compensation less or equal to the mean average4, which was just under USD 42,500. Taking inflation into account, these figures are similar to those of 20005, although in 2012, 53% of earners made less than USD 30,000, a slightly higher percentage than those earning the equivalent twelve years previously.

However, if we compare salaries between 2012 and 1968, the difference is revealing. Back in the year of the Prague Spring, the minimum wage in the US stood at USD 1.60/hour. According to the BLS inflation calculator, the 2013 equivalent would be USD 11.08. That translates into an annual salary (allowing for a two-week annual holiday) of USD 22,160. Given that 40% of the working population earned less than USD 20,000 in 2012 we can see that real salaries have decreased extensively. Furthermore, according to the US Department of Agriculture, over 47 million people are currently supplementing their income with food stamps6 – only 17 million people required food stamps in 20007.

In spite of all the money being printed by the Federal Reserve, the vast majority of Americans will be no better off in 2014. Commentators suggest that the newly-printed wealth has become trapped in the financial sector, where speculators buy cheap US Treasury debt and mortgage-backed securities8.

Whilst it may not be new that people working on Wall Street are able to enrich themselves through market conditions, it is significant that when economies are struggling, speculation appears to be winning out over innovation and entrepreneurship.

Next week: Part 3 – Housing and Mortgages & Debt.

Footnotes:

1 http://www.zerohedge.com/news/2013-10-17/idiotic-initial-claims-rise-above-made-california-numbers-continue-trickling

2 http://www.zerohedge.com/news/2013-08-02/obamacare-full-frontal-953000-jobs-created-2013-77-or-731000-are-part-time

3 http://www.breitbart.com/Big-Government/2013/07/05/only-47-americans-have-full-time-job

4 US Social Security http://www.ssa.gov/cgi-bin/netcomp.cgi?year=2012

5 US Social Security http://www.ssa.gov/cgi-bin/netcomp.cgi?year=2000

6 http://www.fns.usda.gov/pd/34snapmonthly.htm

7 http://www.fns.usda.gov/pd/snapsummary.htm

8 http://www.nytimes.com/2013/03/31/opinion/sunday/sundown-in-america.html?pagewanted=all&_r=0

| MBMG Group Investment Advisory is a Thai SEC regulated investment advisory firm in Thailand that provides sound and impartial advice to assist private, corporate and institutional clients in all aspects of their financial life. For more information, please contact us at [email protected] or call 02 665 2534-9. Please Note: 1.While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation. 2. With investment comes risks. Please study all relevant information carefully before making any investment decision. 3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum. |