2013 was a year in which the bubbles ran amok in developed markets, especially American equity markets, but in which gold, fixed interest, some emerging equity markets and many emerging currencies had a much more difficult time. It was also a year in which the disconnect that many observers, myself included, perceive between the direction of asset prices in developed economies and the performance of underlying economies widened significantly.

What will happen in 2014? It could well be what David Stockman calls The Great Deformation: where the economy is beyond the point of return, filled with the politics of crony capitalism and the ideologies of fiscal stimulus, monetary central planning and financial bailouts. Yet, before declaring a doomsday scenario immediately, here is a summary of what economic conditions are like in early 2014 and what may take place during the rest of the year.

Global economy

The combination of demographics and unfunded liabilities is a definite concern lingering around the corner. It can already be seen in Japan, where economist Rich Marin estimates there will eventually be one worker for every three retirees1. This appears to be a premonition of what will happen in the US.

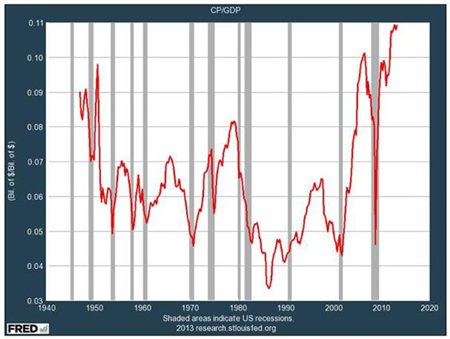

Chart 1: US Corporate Profit Margins

Source: Federal Reserve Bank of St. Louis economic Research

Source: Federal Reserve Bank of St. Louis economic Research

Like Japan, covering the US population’s entitlement to benefits will come at a hefty price: economist Laurence Kotlikoff and renowned journalist Scott Burns2 have estimated the bill to be USD 205 trillion. There doesn’t seem to be a plan as to how that will be funded as yet. Taking an average annual salary in the US to be USD 50,000, even if 100,000 workers gave their entire salary to the state, it would take 40 years to pay off these liabilities!

Many economic commentators have pointed out that the post-2008 economic recovery has favoured the few to date. As David Collum put it in his review of 2013: 1% “the economy is doing very well”, 99%: “We’re very happy for you.”3 If we can agree that an economy where only 1% of the population thrives is unhealthy for the economy as a whole, as well as a threat to social stability, then it is a grave concern that this unbalanced distribution of wealth exposes nation states as failing.

Companies

If we place the spotlight on corporations, it seems that the big global players are doing well. As the chart 1 shows, profits have jumped since the dark days of 2008-2010 and are at record highs.

Corporate profits represent 11% of US GDP and are 70% above their historical average – thus 70% above the average means regression. This implies that the only way is down and a possible 30-40% drop in equity prices is on the cards. (See chart 1)

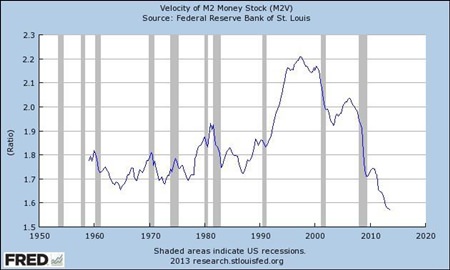

As Collum points out4, the companies which form the Dow 30 collectively have USD 500 billion more debt than cash. It seems that they are borrowing money while it’s cheap to do so and holding on to it for future use – capital expenditure is near zero, meaning companies are cutting back on innovation and/or investment in employees. The Fed hesitated before tapering its QE programme because it felt that US employment statistics were not showing signs of recovery. (See chart 2)

Chart 2, Source: Federal Reserve Bank of St. Louis economic Research

In spite of the Fed’s and other central banks’ QE policies, inflation has remained relatively low. This is because the velocity of money has been falling sharply since 2010 (see chart 2), a continuation of a broader trend dating back to the mid-1990s. The ever increasing stock of money is now simply serving as an added break to the circulation of money – the ‘cure’ is making the disease even worse. There is also a concern that the accumulated cheap credit currently available will also sow the seeds of future inflation, although that concern does seem some way off yet.

Next week: Part 2 – Unemployment & Household Income

Footnotes:

1. Richard A. Marin, Global Pension Crisis: Unfunded Liabilities and How We Can Fill the Gap, Wiley Finance, 2013

2. The Clash of Generations: Saving Ourselves, Our Kids, and Our Economy, The MIT Press, 2012

3. 2013 Year in Review, David Collum, http://www.peakprosperity.com/blog/84101/2013-year-in-review

4. idem

| MBMG Group Investment Advisory is a Thai SEC regulated investment advisory firm in Thailand that provides sound and impartial advice to assist private, corporate and institutional clients in all aspects of their financial life. For more information, please contact us at [email protected] or call 02 665 2534-9. Please Note: 1.While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation. 2. With investment comes risks. Please study all relevant information carefully before making any investment decision. 3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum. |