|

Family Money: Currencies

are not Stocks

By Leslie

Wright

It seems that many investors think of currencies as if

they were stocks, and despite my having touched on this topic before, many

otherwise shrewd investors seem utterly confused on this issue.

Any particular currency simply reflects the value of

assets held in that currency.

For instance, if you’re holding cash (whether in a

bank account or greasy bits of paper) those are simply assets valued in a

local currency, which you may translate on your portfolio tracking system

into your base currency - the currency you think in.

Your base currency may be a different currency from

that in which you hold most of your investments or spend most of your

money - and then currency movements become important. (Perhaps this is why

many Pattaya residents so avidly follow the exchange rate of the baht

against whatever currency their overseas bank accounts or investment

holdings are denominated in.)

Similarly if you are a direct investor and hold shares

in one or several markets. You have to track not only the share movements,

but also the exchange rates of the various currencies they’re traded in.

If the share price rises by 5% but the currency in

which the shares are traded drops by 5% against your base currency, your

potential profits are wiped out.

Many investors think it’s just the same using a

collective investment instrument such as a mutual fund or unit trust.

To a certain extent it is - if their unit trust is

investing only in the home market of the denominated currency. (E.g., a

Sterling-denominated UK Stock market or Gilt fund or a Dollar-denominated

US Stock market or Bond fund.)

But since the term “denomination” confuses some

investors, let’s define what this term really means.

When you invest capital into some form of collective

investment - a mutual fund or unit trust for example - its current price

will be in quoted in one currency or another. This is known as the

fund’s ‘denomination’: for instance, US Dollars.

It could just as well have been denominated in

Sterling, or Deutschmarks, or Euros, or Yen, or Dongs (the Vietnamese

currency in case you didn’t know), or even Ogles (the much-vaunted

newly-floated currency of Oglingland which I am reliably informed is one

of the newly-independent Central European States and not to be confused

with Pattayaland, although the activities in both seem somewhat similar:

turning old men’s dreams into reality. But I digress.)

The fund’s price in, say, US Dollars represents the

aggregate value of its individual components divided by the number of

units currently held by investors. If the fund in point is an equity fund,

those components will be shares in a multiplicity of publicly traded

companies.

If all those shares are in US-based firms, then their

value will not be affected by any fluctuation in international exchange

rates. (Unless of course the firm is a multinational, when its

international holdings have to be converted into US-Dollar value to

establish the true worth of the company in US Dollar terms.)

However, if the fund is a globally-diversified fund,

its component stocks may well be spread all over the world, and hence will

themselves be bought, sold, and valued in a multiplicity of international

currencies.

Thus, to make things simple and enable unit-holders in

that fund to know at a glance what their units are worth, the value - and

hence the price - of the fund is quoted in just one currency. This seems

and indeed is somewhat arbitrary.

Arbitrary pricing?

If you stop to think about it, that fund could equally

well have been priced in US Dollars or Ogles, because the real value - the

value of its component stock-holdings - remains the same no matter what

currency the fund is priced or valued in.

The denomination of any particular fund is therefore

only for convenience of evaluation and reflects the worth of that fund in

just that one currency.

If you are a dollar-orientated investor (that is, you

generally think in terms of US Dollars), and all your portfolio’s

holdings are denominated in US Dollars, it’s easy for you to work out

what your real net worth is.

Similarly, if you’re a Sterling-orientated investor,

it’s equally easy if all your portfolio’s holdings are denominated in

Pounds Sterling.

But if you’re a Sterling-orientated investor (or a

Dollar-orientated investor or an Ogle-orientated investor) holding some

fund units denominated in Sterling, some in Dollars, some in Deutschemarks

and some in Euros, it becomes slightly - but only slightly - more

complicated.

You simply find out what the prevailing exchange rate

is between those various currencies and your base currency - the one you

tend to think in - and divide the price in the other currencies by the

exchange rate to your base currency to determine your net asset value

(NAV) in your base currency. Simple as shelling peas, and most investors

will be familiar with this exercise so far.

Betting on currency gains

But now things tend to move off the path of simple

logic and into the realm of foreign exchange (or ‘forex’) speculation.

For instance, some investors think that because the

Euro is currently weak against the Dollar, if they buy into a

Euro-denominated fund (rather than a similar one denominated in Dollars)

when the Euro gains in value against the Dollar (as they expect will

happen, although when this may come to pass is anyone’s guess), they

will make a windfall capital gain by reason of the higher exchange rate.

Smart, aren’t they?

No! Theirs is a totally fallacious argument, resulting

from a fundamental misunderstanding.

So let me explain how it really works.

The single country scenario

To illustrate the mechanics in its simplest form, you

might for instance be investing your Pounds Sterling into a

Dollar-denominated Thailand Stock market fund, which as can easily be

surmised from its name, is holding a basket of shares bought on the SET in

Thai Baht.

In this scenario the movement of the Dollar against the

Thai Baht is cancelled out, and the significant currencies (as far as you

are concerned) are just Sterling and Baht.

If the SET goes up (or rather, the fund’s component

shares do) and the exchange rate remains the same, you make a profit in

both Sterling and/or Baht.

Similarly, if the fund’s price remains the same but

the Thai Baht strengthens against Sterling you still make a profit in

Sterling terms - although not in Baht should you then remit your Sterling

‘gains’ over here: again, the currency movement has been cancelled

out.

Thus if you were investing Sterling or Dollars or Ogles

or whatever into a Thailand fund and then remitting the proceeds back into

Thailand, the currency movements have all been cancelled out in local

terms, and the amount of Baht you receive would approximate to the

movement of the local investment.

But this is a unique situation.

The multi-currency scenario

Things become rather more complex (and hence more

difficult to grasp) when you invest capital accumulated in one currency

into an institutional fund denominated (i.e., priced) in a second

currency, which itself is dealing in bonds or equities in a country which

uses a third currency, and you need to draw down an income from that

investment to cover local expenditure in yet a fourth currency - say, Thai

Baht.

If you had similarly invested Pounds Sterling into a

Dollar-denominated Japanese equity fund, and planned to remit the proceeds

of selling your units over to Thailand, you’d have to consider not only

the price movement of the fund (which would inherently reflect both the

rise or fall of the underlying Japanese equities and movement of the Yen

against the Dollar), but also the relative strength of $/? and ?/Baht.

What you thought was a profit may in fact be a loss

masked by relative currency movements.

In our example, if the fund’s component stocks move

sideways (i.e., the Nikkei neither rises nor falls), and the denominated

currency of the fund (US Dollars) doesn’t move against the trading

currency (Yen), you only stand to make a profit in your base currency

(Sterling) if that currency depreciates against either the fund’s

denominated currency (US$) or the single-country fund’s local trading

currency - in this case Yen.

(To make it simple to understand, your units are worth

the same in Dollars as last week, but Sterling has dropped in the

meantime, so your Dollar-denominated units are now worth more Sterling.

It’s as simple as that.)

On the other hand, if the Nikkei rose by 2% and the Yen

concurrently weakened against the Dollar by 2%, the price in US Dollars of

the fund’s units would remain almost the same - despite the underlying

assets having increased in local value terms.

Then, if Sterling and the Dollar had moved parallel to

each other, when you convert the units’ value back to Sterling, your

holdings in Sterling would also appear to have remained the same as before

the rise of the Nikkei.

But if Sterling had weakened against the Dollar by the

same amount as the Yen had (2%), then your sideways movement in Dollars

would translate into a 2% rise in your Sterling value - because Sterling

has moved parallel to the Yen, and thus reflects the movement of the

underlying assets, not the denominated currency of the fund.

The Dollar pricing dog-leg has been effectively

cancelled out. And this scenario equally applies to the Euro, as I’ll

explain shortly.

Gains from the weak Euro?

Many people imagine that it’s a very complex exercise

if your chosen fund invests throughout a region such as Asia, Europe, or

even globally, where a multiplicity of currencies may be involved.

How many currencies would you need to watch then?

In fact, the answer is really the same as for the

rather simpler Japanese Equity fund (i.e., a single-country fund) in the

example above.

The movements of individual component stocks and the

movements of the various currencies involved will be reflected in the

overall price movement of the fund in question, expressed in a single

currency.

For instance, a Euro-denominated European stock market

fund will in fact be holding a basket of shares in various countries of

Europe, all bought on the local bourses in the local currency.

For simplicity, the aggregate value of those shares is

translated into Euros (which remember is still an artificial currency),

and the price of units in the fund calculated accordingly in Euros.

If our Sterling-orientated investor bought those units

originally with Sterling, and Sterling had moved parallel with the Euro,

his value in Sterling would directly reflect the movements of the

underlying assets in their local currency terms.

However, if the various European stock markets were to

remain stagnant (i.e., the various local share prices hadn’t changed),

but the Euro appreciated against the Dollar and Sterling (which have

remained relatively stable against each other for some time), the unit

price of the fund in Euros is likely to drop, not rise.

(This is because the price simply reflects the

underlying value of the component stockholdings, which remember have not

changed in local currency terms, but are now worth less ‘expensive’

Euros than before the currency appreciation.)

Converting that price into Sterling one then finds (to

many investors’ surprise) that the Sterling value is virtually the same

as before the currency movement, and the currency movement has effectively

disappeared!

One must remember that a currency simply reflects a

value of assets held in that currency, and is not a stock - and should not

be regarded as if it were. Unless of course you have joined the highly

speculative and risky game of currency speculation known as forex trading

- which is another subject for another day...

(to be continued next week)

Leslie Wright is Managing Director of Westminster

Portfolio Services (Thailand) Ltd., a firm of independent financial

advisors providing advice to expatriate residents of the Eastern Seaboard

on personal financial planning and international investments. If you have

any comments or queries on this article, or about other topics concerning

investment matters, contact Leslie directly by fax on (038) 232522 or

e-mail [email protected].

Further details and back articles can be accessed on his firm’s website

on www.westminsterthailand.com.

Editor’s note: Leslie sometimes receives e-mails to which he is

unable to respond due to the sender’s automatic return address being

incorrect. If you have sent him an e-mail to which you have not received a

reply, this may be why. To ensure his prompt response to your enquiry,

please include your complete return e-mail address, or a contact phone/fax

number.

The Computer Doctor

by Richard Bunch

From Michael Breeze: I have

purchased a new notebook from Hong Kong. It contains a modem card made by

Compact Flash Technology CFT56K MDC Modem (SIL-22/Sec on Banister).

Connection to CS Internet is extremely slow by comparison with my desktop,

as is connection to web sites once connected (I can compare connection

times almost instantly so the problem appears to be with my modem and not

with the ISP). I have double checked configuration settings and am at a

loss to know what the problem is. I conclude either the modem is defective

or CS Internet doesn’t like my kind of modem. How can I fix this

problem? Many thanks for any help you can give.

Computer Doctor replies: I am assuming that the

modem you are referring to is a PMCIA one (credit card size). If as you

say you can connect, but the speed is very slow, I feel it is unlikely the

modem card itself is at fault, although this could not be totally ruled

out. Although you say that you have already checked the configuration it

is far more likely that this is the cause of the problem. Did you just

check the modem settings? Or did you go deeper? Often conflicts occur with

other devices, which prevent it from functioning correctly, if at all.

There are really too many options and possibilities to go into in this

column, so I suggest that you have the problem investigated by a competent

technician.

From: Peter (London, UK): I read your column and

indeed the Pattaya Mail every week and have been a past and recent

frequent visitor to Pattaya. I have a very simple question, which I’m

hopeful you can advise me on. Is there any software that can be purchased

which when used can translate instantly any emails sent or received from

Thai to English and vice-versa? Thank you in anticipation

Computer Doctor replies: A simple question, eh?

This is a vast subject and I have to say one that I have not had much

contact with lately. One package I do know which may fit your requirements

is Simply Translating Deluxe from L&H software. However, I think maybe

the best solution is to throw the question open to the Pattaya Mail

readers, so if any readers have first hand experience of any of these

programs, please let me know your experiences via the contact details

below and I can pass these on to Peter.

Send your questions or comments to the Pattaya Mail at

370/7-8 Pattaya Second Road, Pattaya City, 20260 or Fax to 038 427 596 or

E-mail to [email protected]

Richard Bunch is Managing Director of Action Computer Technologies Co.,

Ltd. Providing professional services which includes website design,

website promotion (cloaking), turnkey e-commerce solutions, website

hosting, domain name registration, computer and peripheral sales service

and repairs, networks (LAN & WAN) and IT consulting. Please telephone

038 716 816, e-mail [email protected] or see our website www.act.co.th

Successfully Yours: Gerrit

J de Nys

by Mirin MacCarthy

Gerrit J de Nys is the Chief Executive of the Unithai

Group, the Thailand arm of the IMC Pan Asia Alliance Group, a large regional

organization with primary business interests in shipping, distribution,

logistics, engineering and infrastructure. Gerrit J de Nys is the Chief Executive of the Unithai

Group, the Thailand arm of the IMC Pan Asia Alliance Group, a large regional

organization with primary business interests in shipping, distribution,

logistics, engineering and infrastructure.

A youthful looking man in his mid-fifties, he seems young

to be the driving force of such a diverse corporation. Gerrit does not agree,

as he sees himself as a builder of businesses.

Twinkling eyed, sharp humoured and handsome, his educated

accent does not give away his background. His parents emigrated from Holland

to Australia for a new life when he was twelve. His childhood must have then

been tough, having to start a new life? Gerrit laughs then says frankly,

“No! It was tough on my father at age 48 with eight kids to begin again.”

He dismisses the influence of having to adjust to a new

land and a new people might have had on him as a teenager and suddenly you

understand he was born a survivor. Gerrit laughed again and said, “Kids are

buggers, they tease like hell. We were so desperate to assimilate, arriving

not speaking the language but by the end of the first year I was top of my

class in English. That might tell you a bit about me.”

Gerrit now speaks and writes six languages, Dutch, Hebrew,

“Because of my time in Israel although I am not Jewish, French although I am

rusty, English, Thai passably, a bit of Cantonese and if you think Thai is

difficult, Cantonese has 10 tones!”

Following his secondary education in Australia, Gerrit

trained and worked in civil engineering for a year before taking his new wife

Barbara and 5 week old baby to Hong Kong, a city which became their life for

the next twenty years. “My forte is building businesses. I was the

production manager but with no management training. It was a natural

progression. I was a born leader, as a kid I was a top Boy Scout always

shouting at the others.” This was said with a disarming frankness.

Gerrit was head of Pioneer concrete in Hong Kong for four

years, then was transferred to Israel and ran Pioneer in Israel for three

years. After this, he then went back to Hong Kong and set up a concrete

company in opposition to Pioneer, involved in quarrying, civil engineering and

testing. Then Gerrit set up a construction and construction materials group

chain called Shui-On and was Group Chief Executive.

It seemed as if there was no end to his meteoric rise, but

political unrest became a factor in his life. “I was at the height of my

career in 1989 when the Tiannaman Square massacre happened in China and I

decided to give twelve months notice and went back to Australia. It was the

first down turn in my life, as previously my personal and business life had

been on the rise. I guess you have to have at least one set back to make you

develop.” In Australia, he developed two businesses, one a kit home

construction firm with forty employees and one a leisure car hire firm with a

fleet of Mustang convertibles on the Gold Coast.

“One night, after endless fighting with the bureaucracy

there I decided to sell up and called in the liquidators. It was an expensive

exercise; it cost me close to a million dollars. I kept the Mustangs, though I

closed that business down just nine months ago.”

After that, Gerrit and his wife came to Thailand in 1994.

His daughter was married and in Australia and his son in the U.K. “Through

my contacts in Hong Kong I was asked to head the Unithai group here. It is

very much a Thai company but it is Hong Kong financed. I took over as managing

director of the shipyard and commuted here three times a week. In ’97 I

became chief executive. It is the hardest job I ever imagined having,

especially in Thailand. We came here to set up a business with no shipyard

skills and managerial skills very weak. It was a time when you couldn’t get

local people for love or money.” He sat back, with an obvious pride. “My

hobby is my work. I get a kick out of achieving even though it is as hard as

hell.”

Making a success of your life means to Gerrit, “Doing

something where you achieve, you build. By co-incidence, I consider myself a

builder of companies. The experience in Australia knocked the rough edges off

me. Being a personal success is being happy and at ease with yourself and

everything you are doing. Having your kids grow up to be decent citizens with

their own principles and values.”

The qualities that Gerrit holds as most important values

are hard work, commitment and personal integrity. “Loyalty is important too,

but it is difficult to define; it takes time to build.”

What motivates Gerrit is accomplishment and challenge. He

laughs again and says, “I’m a pusher. I don’t give up. I’ll probably

die with my boots on. Some people say that may be sooner rather than later.

Working gives me an adrenaline rush. I can’t imagine retiring. I’d be so

bored.”

Whatever, or wherever, Gerrit de Nys will undoubtedly be beavering away,

getting his kicks out of building anything, anywhere.

Life Force: Young

children

by Tracy Murdoch

Starting school can mean exciting new foods for some

children. They may also rebel against the usual family foods in favour of

what their friends are eating. We should embrace this rather than view it

as a problem. Although food is for nourishment and growth of the body it

also plays a key role in our social development. If you have been working

hard to help your under 5 to develop the taste for wholesome food, then

perhaps you can relax a little when they start to experiment. They may be

more inclined to “bargain” with you if you allow them to have the

foods they want.

Food is used to communicate, to show affection, to

reward and provide a feeling of security. When children first go to school

it can be a difficult period of adjustment so maybe meal times can be used

for more than just nutrition. Young children have increasing control over

what they eat and develop a thirst for knowledge, so this is a good

opportunity to teach them that there is a wide variety of foods and what

they are for. This is really important for youngsters to make informed

choices. Try to encourage children to help prepare and cook foods. Allow

them to develop a liking for eating with other people and sharing food.

These are just as important as the healthy eating guidelines below:

* Eat a variety of foods from all the food groups

* Enjoy your food

* Eat plenty to grow and be active

* Don’t skip meals

* Keep sugary foods to mealtimes and clean your teeth regularly

Snap Shots: Filter

Factory!

by Harry Flashman

Last week Harry here spoke about using soft focus

filters to enhance and produce a pleasing portrait, and this produced

enough interest for us to devote some space to making your own range of

interesting filters. The entire project will only take a few hours and you

will end up with some photographic accessories you can use for years.

The

starting off point for the majority of all filters is some optical plastic

sheet. You can get this at optical stores, or even at hardware stores. It

does not have to be 100% flaw free, just like a window glass is fine. In

fact, try the framing shops as well. The plastic “glass” they use will

work just as well too. In desperation, you can even use very thin glass

sheet, but beware, as it does not travel so well, and cut fingers can

result if you do not watch. Cut the sheet into squares about

3"x3" (or about the size of a computer floppy disk). The

starting off point for the majority of all filters is some optical plastic

sheet. You can get this at optical stores, or even at hardware stores. It

does not have to be 100% flaw free, just like a window glass is fine. In

fact, try the framing shops as well. The plastic “glass” they use will

work just as well too. In desperation, you can even use very thin glass

sheet, but beware, as it does not travel so well, and cut fingers can

result if you do not watch. Cut the sheet into squares about

3"x3" (or about the size of a computer floppy disk).

Let’s do a Central Spot soft focus filter first. In

the centre of the sheet place a 50 Satang coin. Now take an aerosol can of

hair spray lacquer and wave it a few times over the sheet. Wait a couple

of minutes till it is dry, shake the coin off and you have your first

home-made filter. This will give you normal focus in the middle of the

print and a “foggy” area around the outside. The more hair spray - the

greater the fog. This is best used with an f-stop of around f4.

Now we’ll make a true graduated fog filter, or

“grad fog”. Take another square of plastic or glass and the hair

spray. The idea is to evenly spray over the filter and then build up more

along the top half. With a little practice you will get quite good at this

“spray painting” technique and you should end up with a heavy coat

along the top and then gradually clearing by the bottom of the square.

With this filter you can take shots on a cloudy day and get very

“atmospheric early morning” shots (even though you do it a 4:30 in the

afternoon).

The next filter is incredibly easy to make and yet

produces some incredible results. Start off with the 3" square and a

pot of Vaseline (petroleum jelly). Now with your finger, lightly smear the

surface of the square. Rub diagonally to leave a pattern on the surface.

Now use this filter, shooting into the light, and you will get light

trails diagonally across the photograph.

The last filter uses the same optical technique, but is

slightly more difficult to produce. If the square is plastic, with a very

sharp knife and a steel rule make around ten diagonal scores across the

surface. Now make another ten in the opposite diagonal which means you now

have a criss-cross effect. If you have to use glass squares, then you can

do this by using a glass cutting wheel hand tool to make the scores. Now

if you use this filter and photograph street lights, or have any strong

light source in the shot, you will get cross stars of light coming from

the light.

Those four filters will work for even the most humble

point and shooter. The hardest part is merely holding them up in front of

the lens. With an SLR you do look through the lens so you have an idea of

what you are going to get - but believe Harry that it still works with the

compacts.

With this not being what you could call an “exact”

science, there is a little trial and error to be done in using these

filters. Shoot plenty of film (it’s the cheapest thing in photography)

and remember how you ended up with certain effects so that you can

reproduce it next time. Happy snapping!

Modern Medicine: Sprains

by Dr Iain Corness

Sprains are not fun. How many times have you “gone

over” your ankle and ended up with a huge fat swollen ankle the next

morning which has made it almost impossible for you to walk upon? Lots,

I’m sure, in your lifetime.

A “sprain” is just a partial tear of the ligaments

and protective capsule around any joint and is very easy to do. A quick

overextension or wrenching of the joint and it has happened in a split

second. And that can be any joint, not just the ankle. It can happen with

simple manoeuvres like backing the car and getting your thumb caught in

the steering wheel. Going to open the gate and bending your finger back as

you catch it in the wrought ironwork. It is very easy to do.

The problems associated with sprains are three: pain,

dysfunction and time.

Pain from a sprain is immediate, as you could imagine,

after partially tearing fibres around the joint. However, the result of

the tearing is then swelling into the tissues which in turn makes the pain

even more acute! The effect is bad enough when it happens, but it then

gets worse!

With the joint now swollen, you cannot bend it. This is

fine in the early stages of the condition, as it stops you moving the torn

tissues, but the secret of early recovery is a return to functional

movement - something you cannot do with the joint surrounded by firm

swelling.

The third element is Time. That’s time with a capital

“T”. Sprains seem to take forever to get better. In fact, sprains in a

finger take longer to return to normal than a fracture. That’s right! A

sprained joint can take anything up to six to twelve months to get better,

while a simple fracture is healing at three weeks and completely better by

six weeks. A big difference!

So what should you do next time you sprain a joint?

It’s the I.C.E. treatment as much as possible. That’s Ice around the

joint, Compression of the joint with bandages and Elevation of the joint,

where feasible. By controlling the swelling, you will reduce pain, and by

wrapping the joint with bandages you are supporting and immobilizing the

torn tissues.

After a few days you can gradually decrease the amount

of strapping to the joint and begin passive movement. Stop if it’s too

painful, as there is no need to aggravate the problem. Try again a few

days later and slowly and gradually begin active movement, but still with

some degree of support from bandaging.

If the sprain is in a finger, it also helps if you

strap the injured finger to the next larger finger to it. This supports

and yet allows for passive movement following the movement in the

uninjured digit.

Of course, if the pain does not settle, it might be

wise to pop up to see my colleagues at the Bangkok Pattaya Hospital just

to make sure you haven’t got a little fracture around the joint itself.

One simple X-Ray is generally enough.

Dear

Hillary, Dear

Hillary,

The other night I saw my boss’s wife, who is Thai, at

a Boys Town club. She was there with another woman and they bought a

couple of drinks for some of the dancers (boys). They were laughing and

having a good time it seemed. Should I tell him, or should I just leave

him an anonymous note to check on what she is doing?

Vigilant employee

Dear Vigilant (or is that Vigilante?),

Are you serious and do you seriously wish to remain

employed? I suggest you mind your own business. What were you doing there

anyway? Everyone is entitled to have some fun in their lives. Time you did

too! Haven’t you heard that Pattaya is “Fun City by the Sea”? Nasty

little voyeur!

Dear Hillary,

Is there some reason the phone bills seem to come every

two weeks? I am worried that they might cut the phone off, so I am always

anxiously looking in the letter box. Also the electricity bill comes and

you only get about three days to pay locally, otherwise you have to go to

Naklua and stand and wait in a queue for hours. Why can’t they

standardise things and let you pay at the banks or somewhere?

Bills, bills, bills!

Dear Bills!

Have you ever heard the expression TIT - This is

Thailand? Well, part of the charm and infuriation of living here is that

it is not the same as back home. I do not think it would be possible to

standardize telephone bills, do you? Anyway, you should personally check

your phone bills to make sure you actually did make those trunk line calls

to Finland. However, you can make arrangements to pay your electricity and

water bills through the bank. Meanwhile keep up your vigilance at the

letter box.

Dear Hillary,

There does not appear to be any “wholesalers” here

as there is in the UK. I notice that the restaurant owners all shop for

their meat and other supplies at the same supermarkets I go to. Is this

the reason why the meals in restaurants are so expensive?

Mandy marketplace

Dear Mandy,

Which restaurants are you going to? Even the most

expensive here are very much cheaper than your U.K. prices. If you are on

a budget, try out the local markets. There is one in town on Pattaya Tai

opposite Wat Chaiyamongkol, where you can buy meat and vegetables cheaply.

However, the meat is locally butchered, un-refrigerated chicken, pork and

duck as well as fish. It is not for the squeamish and certainly not export

quality fillet. This may explain why many restaurateurs prefer the

supermarkets - perhaps they want to keep the quality up and the people to

keep coming back?

Dear Hillary,

With the mad social rounds that my husband has to do

with his job, there is always alcohol involved somewhere. It was the same

in America, before we were transferred over here. I am worried that he is

going to turn into an alcoholic. What should he do?

Worried

Dear Worried,

Have you spoken to your husband about this? Does he

think he is overdoing it? Or is it you that is going overboard? It takes

more than just available alcohol to turn people into demon drink

devourers, you know. If he managed to contain it all in the States and has

held a responsible position for all those years, he doesn’t sound like

an alcoholic to me.

Dear Hillary,

I am a reasonably handsome bloke and nice natured, but

when I asked a girl in the bar the other night if she would like to go out

with me she said no. I like her a lot and this surprised me. Should I risk

asking her again or just forget her?

Shunned

Dear Shunned,

Risk what? Damaging your pride, you vain beast! She is

just as entitled to her decision as you are. Ask her again if you must,

but there’s plenty more fish in the sea.

Dear Hillary,

The lads at work all love your column, but why are you

so “bitchy” some days?

The Workers

Dear Workers,

What do you want? Sweetness and roses every day. Wake

up to yourselves and get back to work before I let your boss know what you

do with company stationery. Anyway, I’m a woman and I’m allowed to be!

Dear Hillary,

My girlfriend’s sister has no husband, and has moved

in with us from Petchabun. While this would not be too bad, she has

brought her three kids with her. We’ve got two already so that makes 8

people in a small town house. There’s another sister who is also talking

about coming down to Pattaya. I’m a little worried that I’m being used

as I end up with all the bills for the very large household. Any advice

for me, Hillary?

Bernie

Dear Bernie,

Simple, Bernie, get a bigger house and a bigger income.

If this is not possible, then it’s time you put your foot down and took

charge of the household. Thais do live in the extended family scene, but

you have to say where the limits are. Lots of luck.

GRAPEVINE

Seen

the light

Reformed sex tourist and born again

Christian Leon Justin claims to have just spent a month in Pattaya

without touching alcohol or indulging in sins of the flesh. 54 year

old Leon said his personal pilgrimage was proof that you can enjoy

Pattaya whilst remaining true to your religious convictions. He

explained he had had a wonderful holiday visiting the resort’s

second hand bookshops and listening to classical music in his room

virtually round the clock. However, some doubt was cast on Leon’s

claims after police were summoned by an angry hotel management. The

hotel said the Englishman had run out of cash to pay them 38,000 baht.

This amount was needed to cover constant restocking of his mini bar

and unpaid bar fines from the go go club in the basement.

Chinese choices

Shanghai has further simplified visa

requirements for short term visitors. Air passengers from most

European countries and USA can now obtain a temporary permit which

allows them to remain in the city for 48 hours even if they arrived

without a Chinese visa. Obviously, you must have a return airticket

and a valid passport to show immigration authorities. The new

discretion could be useful for farangs who are leaving Thailand

briefly, who want to use the second entry on their Thai visa or who

are merely seeking a thirty days on arrival stamp on their return to

Bangkok. Currently, only Shanghai is offering this opportunity to

foreign visitors.

First class grub

Plenty of English homely fare at the

Rose Garden Hotel and Restaurant which is on the right hand side as

you proceed up the hill to the Fitness Park. Their sausages and mash

are among the best in town, but they wisely purchase their bangers

from Yorkie’s Pork Platter in Jomtien. The Manchester born member of

GEOC (Grapevine Eating Out Collective) thought the mince and tatties

were absolutely spot on. Beer prices are reasonable in a spacious

lounge that appears to be frequented by sociable Brits. Another plus

is the easy parking, no small bonus in our increasingly congested

city.

Breaking world news

Glasgow: Hackers have managed to

break into the telephone system of a Weight Watchers group whose

answer phone message now reads, “Hello, you fat bastard”...

Manila: Suspected drug dealer Alfredo Laurel tried to evade police

capture by running into a wood. Officers had no trouble locating him

as he was wearing a pair of trainers with battery powered lights which

flash on and off... Phnom Penh: The defence in a grisly murder trial

hung on whether the accused could draw a gun from his pocket without

shooting himself in the foot. He proved that he could manage that but

then fired on two lawyers and the judge before escaping through a

toilet window.

|

Reader query

AH asks why she has had no problem

paying her water and electric bills by bank direct debit but keeps

getting warning letters from the international phone company. These

state that there is no money in her account and that the line will be

disconnected. The answer probably lies in the major banks’ debit

procedures. Water and electric debits are handled directly by your

local Pattaya branch. But telephone debits are organized centrally

from the Bangkok headquarters of your bank, which happens to be Siam

Commercial. Ask your local branch to check that head office has your

correct account number and that your debit authorization form has been

forwarded to the right section.

Credit card woes

An increasing number of readers

complain that overseas companies in USA and Europe won’t accept Visa

and Amex card numbers for payment of goods on the Internet. The

problem arises when they are asked to type in their full shipping

address on the secure server only to discover that Thailand is not

listed as a country in the destinations’ scroll down. The overseas

companies reply that there are so many thefts of cards in this part of

the world that payment to them from the credit card people takes six

months or is never approved at all. Another case of TIT (This Is

Thailand) about which nothing can be done. Or so we’re told.

That’s media life

From The Churchdown Parish Magazine:

Would the congregation please note that the bowl at the back of the

church labelled “For The Sick” is for monetary donations only.

From The Times: A young girl, who

was blown out to sea on a set of inflatable teeth, was rescued by a

man on an inflatable lobster. A spokesman for the coast guard

commented, “This sort of thing is all too common these days.”

From The Daily Telegraph: Brussels

is to pay 500,000 euros to save prostitutes. The money will be going

directly into the prostitutes’ pockets, but will be used to

encourage them to lead a better life. We will be training them for new

positions in hotels.

From The Derby Abbey Community News:

We apologise for the error in the last edition which stated that Mr

Fred Nicolme is a defective in the police force. This was a

typographical error. We meant, of course, that Mr Nicolme is a

detective in the police farce.”

From The Observer: Genuine Charles The Second silver

sovereign for sale from mid Stuart period. In mint condition. Carries

the date 1977. |

Dining Out: Steak

Lao - a sizzling surprise!

by Miss Terry Diner

The Steak Lao restaurant has now been open for about five

months, and this was the first visit for the Dining Out Team. This is actually

the sixth Steak Lao restaurant, with four in Bangkok and one in Sri Racha. It

is very centrally placed on Beach Road, on the corner with Soi 10 and features

an open garden setting with wooden tables and chairs, or an air-conditioned

enclosed area at the back. There are also two kitchens - one for deep fries,

stir fries, etc., and another for charcoal grills (done incidentally over a

huge dao tarn).

The menu is extensive, with around 150 items, and is mainly

Isaan and Eastern food - but with a difference, as we found out. It begins

with Special Dishes (between 80-220 Baht) and is mainly seafood (fish, prawns

but also frog legs and an interesting Sukiyaki called Suki Lao - more on this

later). Appetizers and snacks are next with Hors d’oeuvres and some deep

fried “nibbly” items (60-220 Baht). This is followed by another dedicated

Deep Fried section (80-200 Baht) with fish, chicken, spare ribs, pork, duck

and frog. The next items come under a heading of Fried and are mainly stir

fries with all the usual dishes but in addition, frog, bird, pickled eggs and

vegetables all around 90 Baht. The section called “Yum” has 20 items

covering every conceivable combination at around 80 Baht. From there it is

into Isaan Soups and Curries, Laab, Tom Yums (all about 90 Baht) and Isaan

Salads around 45 Baht. But it isn’t over yet! Thereafter come the grills and

charcoal grills, with everything from Sizzling Beef at 100 Baht, through the

Steak Lao Special (120 Baht), to T-Bones at 250 Baht or New York Cuts at 450

Baht. The last page (whew!) covers the beverages and desserts, with the usual

range of whiskeys and beers at very reasonable prices (and yes, they had

Singha Gold for Miss Terry)!

With Manager Michael assisting, we began with Poo Tanoy.

These are miniature deep sea crabs, deep fried and crispy - and you just

crunch up the lot with a spicy sauce and was wonderful! I must admit that when

the dish arrived I was a trifle apprehensive, but I had no need.

Another great feature about the Steak Lao Restaurant is

that they understand that the farang palate may not be able to handle some

Isaan items, and the “fire” is less if you request it (we did!).

We then had the Hors d’ouevres Isaan - a selection of

different pork sausage and dried pork to whet our appetite for what was to

come. I had ordered a Tom Kha Gai (chicken in coconut soup) and this arrived

in a pottery crucible, with the best Tom Kha in Pattaya. Made with proper

coconut milk (not the reconstituted stuff) it was smooth, creamy and full of

chicken. The best!

This was followed by a Steak Lao special - a hot plate with

pork pieces done in a slightly sweet (honey?) sauce, with accompanying papaya

salad and a dipping sauce. Once again, it was not too spicy hot and the papaya

salad was sensational.

By now we were starting to flag, but Michael insisted we

try the Duck Laab, a little spicy, but very nice and then came out with his

Suki Lao (seafood). This arrives on a sizzling hot plate, with prawn, squid,

crab and fish balls along with a green vegetable and a special sauce. Again an

excellent, and different dish.

The cuisine here is very distinctive - and very good! The fact that it is

prepared to your taste makes it suitable for everyone. If you are unsure of

what to order - just ask Michael, but we are sure you will not regret any

choice. Earmark this place as a “must visit”, especially if you are

entertaining overseas guests. Highly recommended.

Shaman’s Rattle:

Religions and do we need one

by Mirin MacCartry

Noted psychologist C.G. Jung is reported as having said

that Religion was the psychological crutch of the masses, a phrase that many

of those who would decry religions use as their prop! But methinks that too

much has been ascribed to those words of Jung’s. The protestors are being

just a little glib!

When you look into it more deeply, all he has said is the

equivalent of putting forward the notion that busses are the transport

medium of the masses. What is “wrong” with having a psychological

“salve” (as opposed to “saviour”)? Almost every society has had its

religion as part of its make up, so in fact, the masses have given the

concept of religion its stamp of approval. It is something we want,

something we feel comfortable with, and something which we feel helps our

society continue. Is this really a psychological “crutch” - something to

hold up an injured or lame being, or is it rather one of the integral

building blocks of a strong and healthy society?

To bolster up their arguments, the non-believers will

cite the cases of the clerics who are unfaithful to their cloth, but this

does not mean the religion is incorrect! Man is a very imperfect animal and

the fact that a man can fail to uphold the tenets of their religion cannot

be used to decry the principles of the religion itself. For example, the law

of not driving while under the influence of alcohol reflects a fundamental

truth, the fact that people do drive drunk reflects on the individual, it

does not mean the law is wrong.

Looking widely at religions, there are many similarities,

showing that perhaps there is a fundamental truth for mankind that has been

adapted by the different peoples over the ages to suit local conditions and

even local climatic events. Most adhere to the concept that there is a

“supreme” being (or beings) - that there is something higher than

“self”.

Selfishness, as mooted by the once popular cult Randism

(after Ayn Rand’s books), unfortunately does not stand the test of time.

For man to work in a society and for that society to flourish, it does need

leaders and followers. And in many societies, that leader was also the

leader of the religion, or the constitutional head. However, the societal

leader also acquiesced to a “leader” even higher than he (or she) - the

“supreme being”.

This being was often given the form of a god or goddess,

but could also be embodied in the sun, moon or even the earth itself.

Primitive man felt a need to be in tune with the environment, acknowledging

that he was part of it, one part of a very large whole. In other words,

describing his part in a society - one small cog in a very large system of

wheels. That fundamental truth still exists today.

So why are there so many religions today? For the same

reasons that there are different countries, different peoples and different

societies. But while those religions may look to be very different, they are

really very much the same under the surface. Each one puts forward some

basic rules or commandments or tenets - these cover the simple rules

necessary to maintain any society - warning against killing, stealing and

actions to jeopardise the family unit such as adultery. All fairly simple

and straightforward, and with all the religions, good common sense to keep

the society whole. While the religion may have documented the rules, there

is no “magical” nonsense in the basics.

Again, the religions generally embody a “promise”.

For most, that promise is another life after this one. That may be a

reincarnation on earth, or may be life in the spirit world, be it your

heaven or your hell. But in them all, your eventual fate is decided by your

actions in the “now” world. Following the basic commandments of the

religion will get you “Brownie” points - but it is up to the individual

to do this. And there is someone in the “higher world” that keeps the

score!

As collective peoples, the religions have then worked for

the individual societies. Certainly there has been, and unfortunately still

is, what I would call “misdirected” applications of religion, resulting

in wars, but in its pure forms, there is no doubt that religion has been

beneficial in keeping societies together, so that the individuals within

that society can enjoy their lives under the safe umbrella of that society.

Do we really need a religion then? The answer must be a resounding

“Yes” - the societies that have stood the test of time all espouse a

religion, a code of conduct prescribed by it, and its members are happy to

wear a sign or symbol of their faith. This is not a crutch, this is a

fundamental that we need to grow, and as such, all the major religions must

play their part. Hopefully in harmony!

Down

The Iron Road:

Engines of War 4 - The Third German ‘Kriegslok’ Down

The Iron Road:

Engines of War 4 - The Third German ‘Kriegslok’

by John D. Blyth

Foreword

I see that I have been using the ‘Whyte’ formula for

the arrangement of wheels on a steam locomotive without an explanation. It

is so simple that some may have guessed how it works! Whyte was an American

railways engineer who, almost 100 years ago said, “Let’s assume that all

locomotives may have leading, driving or coupled, and trailing wheels; then

let us set down how many of each a certain locomotive has, with a dash

between and a ‘0’ where it has none; and if it is a ‘Tank’ engine

with no separate tender for fuel and water. Let us put a ‘T’ at the end.

So we may have a 4-6-2, with four leading wheels, six coupled wheels, and

two trailing wheels.”

The Third ‘Kriegslok’

There were at least nineteen designs from ten builders,

and one from a consortium, but no locomotives were ever built! In 1941 Nazi

Germany had attacked Russia with such fury that soon the fighting was well

within Russia itself. About the time that the first Class 42 2-10-0

appeared, in late 1943, the concept of a big fleet of medium sized 2-10-0s

was questioned, and the building industry was invited to submit designs for

a heavy freight locomotive, especially for the Eastern Front, where demands

were ever increasing and the supply line ever lengthening. The specification

has survived, and I set out the main points below:

To haul trains of 1700 tons on rising gradients of 1 in

125 (i.e. 1 unit vertically for every 125 units on the level), with

continuous curvature of 36m radius, at not less than 20 km/hr.

Able to run in either direction at 80km/hr

Weight per metre run not to exceed 8.18 tons

Occasional running through switches angled at 1:7,

followed by curves of 140m radius.

To be able to use turntables of 23m diameter

To have feed-water heater (for economy), and have

mechanical stoker (for heavy work)

Increased water and coal capacity, and the use of Donetz

Basin Coal (with high ash content) to be considered

Some existing types, e.g. the Class 44 2-10-0 and the

Class 45 2-10-2 could do much of the work but could not be considered as war

locomotives, as they needed skilled maintenance - but the Class 44 was built

throughout the war, many by factories in occupied France. Not all builders

approached submitted designs, but of those that did, most submitted more

than one design.

The

Schichau 2-14-0, a rare 2-cylinder proposal The

Schichau 2-14-0, a rare 2-cylinder proposal

Two features new to German steam practice were the

‘Booster’ and the combustion chamber. The first, an American feature,

was a small two-cylinder unit mounted on the frame holding the rear carrying

wheels, which could be connected to those wheels through gearing and so

drive them at speeds up to about 40 km/hr, when it would disconnect

automatically; it was useful assistance at starting and slow work on steep

grades. No drawing of a German booster has been seen. The combustion chamber

was an extension of the inner firebox into the boiler barrel, to give extra

heating surface where the heat is the greatest. The locomotives were of

2-12-0, 2-10-4, 2-12-2 and 2-10-2 wheel arrangements, those with 10-coupled

wheels having also a Booster. There were four which were not so orthodox,

one of which was a ‘ghost’, and not what it was stated to be.

Model

of the Borsig 2-6-8-0 ‘Mallet’ proposal, by Marklin Model

of the Borsig 2-6-8-0 ‘Mallet’ proposal, by Marklin

The other three were very odd in one way or another and

these are illustrated. First is one from Schichau of Elbing (now in Poland),

for a locomotive with no less than seven pairs of wheels coupled. Never

before attempted on the 1435mm standard gauge, only in Russia had it been

tried, just once, on a huge 4-14-4, which could not be kept on the track and

did no work at all. The Schichau proposal was more sensible, with plenty of

ways of providing side-play; also the wheels were smaller than on the other

proposals, and the wheelbase was thus only one metre longer than on the

six-coupled axle designs. I would have had some doubts about those small

wheels and all that driving gear rotating rather fast at 80km/hr, especially

when running backwards!

The

proposed 2-6-6-2 rigid locomotive by Floridsdorf The

proposed 2-6-6-2 rigid locomotive by Floridsdorf

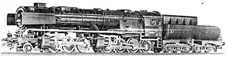

One of the two proposals from Borsig of Berlin was the

first ‘Mallet’ locomotive to be proposed for the German 1435mm gauge.

The Mallet is an ‘articulated’ type, having its coupled wheels in two

groups, the rear eight (in this case) on a rigid frame on which the boiler

is mounted, and the leading six wheels on a truck which, also supporting the

front end of the boiler, can move from side to side, giving flexibility on

curved track. Very many Mallet locomotives have been built, including some

of the very biggest in the U.S.A., but when the drive is divided, the

adhesion, which presses the wheels down on the rails and prevents

wheel-spin, is not so effective. I do not like the unequal number of coupled

wheels on the two units, even though the smaller cylinders on the front unit

would transmit less power through the six wheels than that with which the

eight could cope with. I also have in mind that these were war engines, and

the complexity of the Mallet layout would not be an advantage! It is

interesting to note that this type did come into three dimensions, in the

form of a fine model ‘HO’ scale, made by the German Marklin firm!

I have sometimes wondered if the Wiener Lokomotivfabrik

in Floridsdorf, Vienna had its tongue in its cheek when designing

locomotives for their Nazi overlords, who had their country since 1938! Two

variants on a 2-6-6-2 type, one with a Brotan boiler (for which the

materials were unavailable) were said to have been the result of comparative

study with a 2-12-2 design. The cylinder, four in number, were disposed as

two as normal below the smoke box, the other two badly sited under the cab,

alongside the firebox. There was not ‘articulation’ as in the Borsig

‘Mallet’, just two groups of wheels in a rigid frame with a little

side-play. The justification for this curious layout was that although there

would be more actual parts, there was no crank axle, and the number of

different parts would be smaller, e.g. three types of wheel instead of five;

four identical sets of motion instead of three, which compared with two the

same and one different. There was more of this - I think it was all in the

mind!

And the outcome?

... was that the fortunes of war can change so fast that you finish with

scrap paper! The great Russian victory at Stalingrad changed the Eastern

front so quickly that the supply lines soon became very short indeed, and

the need for this big engine was no more. No Reichsbahn preference was ever

made known, and none of them had potential: my own preference was for the

2-12-2 by Henschel, a big but simple design, no booster or articulation,

backed up by a fine design team led by the famous Dr. Roosen. Had the need

been there, this type would have fulfilled it well.

Coins of the Realm:

1 SKILLING 1771

by Jan Olav

Amalid,

President House of the Golden Coin

http://www.thaicoins.com

What makes a coin valuable? A lot of people believe that

the older the coin is, the more valuable it is. This is not the case.

Often someone who has some old coins contacts me. They

want me to estimate the value. The first thing I have to explain is that to

make estimation I need to see the coins. I also warn people not to clean or

polish the coins before they show them to me. The reason for this is that a

cleaned or polished coin is worth less than half of a coin that is not

cleaned. This is hard for many to understand, but a collector prefers their

coins to look like they just came out of the minting-machine. Dark, nice

toning, called patina, also increase the value of a coin.

More than half of the calls I get in Norway about

estimations are from someone who has a very old coin. I am told it is from

1771, and I immediately know that this is a 1 skilling coin of 1771.

Inevitably, the caller is surprised that I can tell them what coin they

have. The reason for this is that the 1 skilling of 1771 is one of the most

common coins from Denmark/Norway. It was struck in Copenhagen in Denmark,

Altona in Germany and Kongsberg in Norway.

It was the only copper coin from Denmark/Norway up to

1809. It was for struck with the same date, 1771, for more than 30 years.

There are some varieties where the spelling is wrong. It should say on the

coin “1 SKILLING DANSKE K.M. 1771”, but some of the coins have spelling

mistakes like DANKSE, DANAKE or DNASKE instead of DANSKE. These varieties

can cost up to Baht 30,000.

1

skilling 1771 from Denmark/Norway. Value: Baht 100 to 200. 1

skilling 1771 from Denmark/Norway. Value: Baht 100 to 200.

Sometimes it is very hard to explain to the caller that

if it is not one of these varieties, their coin is not worth more than Baht

100 to 200, depending of the grade. The caller argues that the coin is more

than 200 years old, and should be worth a fortune. Unfortunately the value

has nothing to do with age. Roman coins from around 300 A. D., that is to

say about 1,700-year-old coins, can be bought for Baht 200 to 300 in nice

condition.

Many people are very surprised to hear this. Some become curious and

later visit my shop to have a look at these old coins. Many become so

fascinated after seeing these old, inexpensive coins, they end up buying one

of these historically interesting objects. I always try to tell these people

to get some books about coins, and often they return after studying a little

to buy some more coins.

Animal Crackers:

Eohippus, a cute little horse!

by Mirin

MacCarthy

Would you like to cuddle a little horse only 300 mm

(12") tall? No, this is not the world’s smallest baby Shetland Pony;

this is the very first horse of all time. Called Eohippus, or the Dawn Horse

of evolution, this tiny horse-like creature roamed the world in the Eocene

Epoch, a scant 58 million years ago!

While the world knows this little horse as Eohippus, its

correct name is Hyracotherium, given to it by the discoverer in Europe, the

famous British anatomist and palaeontologist, Richard Owen. It was later

that remains were also found in North America, and there the creature had

been called Eohippus.

It

is surmised that there was actually a land bridge, in those prehistoric

times, between North America and Europe and little Eohippus migrated. It

is surmised that there was actually a land bridge, in those prehistoric

times, between North America and Europe and little Eohippus migrated.

The natural habitat for Eohippus was in the damp hot

jungles and it was a herbivore, eating leaves that had fallen from the

trees.

Although there are some scientists who will debate that

Eohippus, with its four front toes and three hind toes, is not really the

evolutionary horse fore-runner, little Eohippus certainly caught the

imagination of the world, with the United States of America even having the

tiny horse commemorated on a postage stamp issued in 1996.

The next phase for horses in general came in the

Oligocene Epoch, 40 million years ago. This next horse was larger than

Eohippus and is called Mesohippus. Around this time, the boggy forests also

changed and grasslands became more prevalent. As the ground was harder,

Mesohippus developed its central toe and the side toes became smaller, as

they did little supporting function. But Mesohippus was a grazer, not a

galloper.

The first hoofed galloper was Merychippus, which appeared

around 25 million years ago. This horse was now up to 1 metre tall and it

carried all its weight on the one central toe, which was now a real hoof,

with the two little side toes even smaller than those of Mesohippus. These

horses also roamed in herds, eating the dry rough grass, which developed

their teeth for specialised grinding - much as the horses’ teeth of today.

Our next stage of development was Pliohippus, which

emerged around 10 million years ago. This was much like the horse as we know

it today. One hoof only and this animal could really gallop, and it had to.

We used to hunt this horse for food. Only in the relatively recent past

(between 4,000 and 3,000 B.C.) did we domesticate the horse and begin to use

it for transportation and hunting other animals.

No, next time you see a cute little horse, spare a thought for little

Eohippus, the Dawn Horse of Evolution that ended up giving us the horse of

today!

Copyright 2000 Pattaya Mail Publishing Co.Ltd.

370/7-8 Pattaya Second Road, Pattaya City, Chonburi 20260, Thailand

Tel.66-38 411 240-1, 413 240-1, Fax:66-38 427 596; e-mail: [email protected]

Updated by Chinnaporn Sangwanlek, assisted by

Boonsiri Suansuk. |

|

Gerrit J de Nys is the Chief Executive of the Unithai

Group, the Thailand arm of the IMC Pan Asia Alliance Group, a large regional

organization with primary business interests in shipping, distribution,

logistics, engineering and infrastructure.

Gerrit J de Nys is the Chief Executive of the Unithai

Group, the Thailand arm of the IMC Pan Asia Alliance Group, a large regional

organization with primary business interests in shipping, distribution,

logistics, engineering and infrastructure. The

starting off point for the majority of all filters is some optical plastic

sheet. You can get this at optical stores, or even at hardware stores. It

does not have to be 100% flaw free, just like a window glass is fine. In

fact, try the framing shops as well. The plastic “glass” they use will

work just as well too. In desperation, you can even use very thin glass

sheet, but beware, as it does not travel so well, and cut fingers can

result if you do not watch. Cut the sheet into squares about

3"x3" (or about the size of a computer floppy disk).

The

starting off point for the majority of all filters is some optical plastic

sheet. You can get this at optical stores, or even at hardware stores. It

does not have to be 100% flaw free, just like a window glass is fine. In

fact, try the framing shops as well. The plastic “glass” they use will

work just as well too. In desperation, you can even use very thin glass

sheet, but beware, as it does not travel so well, and cut fingers can

result if you do not watch. Cut the sheet into squares about

3"x3" (or about the size of a computer floppy disk). Dear

Hillary,

Dear

Hillary,

The

Schichau 2-14-0, a rare 2-cylinder proposal

The

Schichau 2-14-0, a rare 2-cylinder proposal Model

of the Borsig 2-6-8-0 ‘Mallet’ proposal, by Marklin

Model

of the Borsig 2-6-8-0 ‘Mallet’ proposal, by Marklin The

proposed 2-6-6-2 rigid locomotive by Floridsdorf

The

proposed 2-6-6-2 rigid locomotive by Floridsdorf 1

skilling 1771 from Denmark/Norway. Value: Baht 100 to 200.

1

skilling 1771 from Denmark/Norway. Value: Baht 100 to 200. It

is surmised that there was actually a land bridge, in those prehistoric

times, between North America and Europe and little Eohippus migrated.

It

is surmised that there was actually a land bridge, in those prehistoric

times, between North America and Europe and little Eohippus migrated.