Bangkok has been ranked among the cheapest office locations in the world while other Asian cities continue to dominate the world’s most expensive office locations, accounting for four of the top five markets, according to a report recently issued by property management and advisory company CBRE. London’s West End however remains the world’s highest-priced office market.

Bangkok was ranked at 105th place out of 127 cities worldwide surveyed by CBRE Research in Q1 2015 for overall occupancy costs for Grade A office space. Canberra in Australia was the only city in the Asia Pacific that is cheaper than Bangkok at 111th position.

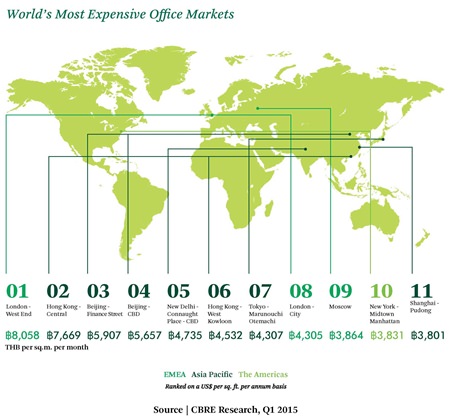

London’s West End’s overall prime occupancy costs topped the ‘most expensive’ list at THB 8,058 per sq.m. per month. Hong Kong (Central) followed in second place at THB 7,669 per sq.m. per month. Beijing (Finance Street) (THB 5,907 per sq.m.), Beijing (Central Business District (CBD)) (THB 5,657 per sq.m.) and New Delhi (Connaught Place –CBD) (THB 4,735 per sq.m.) rounded out the top five.

The change in prime office occupancy costs mirrored the gradual recovery of the global economy. Overall global prime office occupancy costs rose 2% year-over-year, with Asia Pacific up 1.4%.

“Occupier caution has declined and corporate confidence has been on the rise, and this confidence is starting to translate into a degree of expansionary momentum,” said Richard Barkham, Global Chief Economist, CBRE. “At the same time, many office markets are increasingly short of the quality, modern, flexible and highly accessible or CBD-located office buildings which corporations are seeking to execute workplace strategies that will drive productivity and attract or retain talent.”

Dr. Henry Chin, Head of Research, CBRE Asia Pacific, commented: “In the Asia Pacific region, occupancy cost trends were mixed, with regional surveys showing stronger hiring intentions among employers in India, Taiwan, New Zealand, the Philippines and Japan while corporate hiring activity remained muted in other locations. India and the Philippines also continued to benefit from growing IT back office services looking for operational and costs efficiency.

“Throughout Asia, technology firms, business process outsourcing (BPO) firms and non-banking financial institutions are in expansionary mode, stimulating demand for office space. However, we are also seeing diverse occupier activity in the region with less expansionary markets—some occupiers are looking to optimize existing accommodations rather than expand.”

In Q1 2015, average Grade A CBD rents in Bangkok increased by 3.2% year-over-year to THB 859 per sq.m. per month. There is limited supply due for completion between 2015 and 2017. Less than 400,000 square meters of office space is under construction. About 20% of space under construction will be Grade A in the CBD. The total net take-up in Bangkok for Q1 2015 was around 65,000 sq.m., increased by 17% year-over-year.

“The space taken up at owner occupied buildings was a significant part of net take-up this quarter. A reasonable level of demand and limited supply has caused office rents to rise by 3% – 12% year-over-year in all grades and areas,” reported James Pitchon, Executive Director – Head of Research, CBRE Thailand.

CBRE tracks occupancy costs for Grade A or prime office space in 127 markets around the globe. Of the top 50 ‘most expensive’ markets, Asia Pacific had the most number of markets featured, with 20 markets ranked.