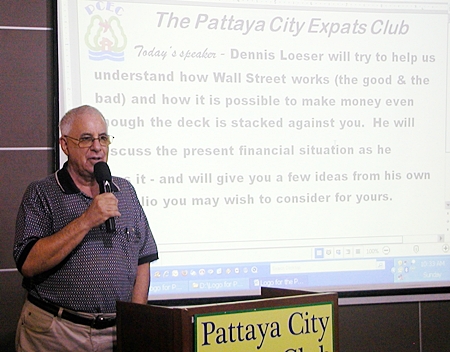

If you can’t afford to lose, then don’t invest. That was the concluding advice from speaker Dennis Loeser after he gave an interesting talk to the Sunday, April 1, meeting of the Pattaya City Expats Club. Dennis spoke about his 55 year career in the investment business going from a Wall Street messenger to a manager of up to $500 million dollars including assets of some of the world’s richest people (according to Forbes). And his average annual rate of return for clients was above 22% during this period.

Dennis started by referencing the recent public resignation of Greg Smith, a former executive with Goldman Sachs who accused the firm of putting their interest in making money above that of their clients. Dennis pointed out that Goldman Sachs is one of the most powerful companies on Wall Street, but what Mr. Smith had to say was not anything new, it has always been that way since he started as a messenger those many years ago.

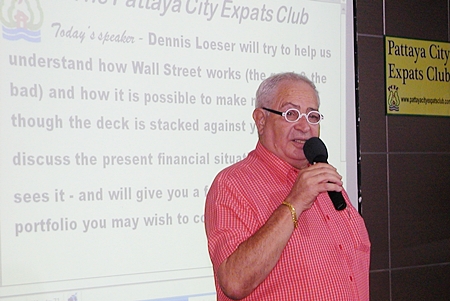

Richard Silverberg, MC, opens the PCEC April 1 meeting by inviting visitors to introduce themselves. Richard then introduced the speaker of the day, Dennis Loeser, who shared a very interesting life in finance, much of it on Wall Street.

Richard Silverberg, MC, opens the PCEC April 1 meeting by inviting visitors to introduce themselves. Richard then introduced the speaker of the day, Dennis Loeser, who shared a very interesting life in finance, much of it on Wall Street.

Dennis gave an overall summary of his career, noting that he wanted to quit high school and go to work on Wall Street, much against his mother’s wishes. After much effort to persuade her, she relented by saying he could have one day to land a job; if he did, then she would consent. Of course, she wasn’t expecting it to happen – but it did. So Dennis at the age of 16 started working as a messenger taking messages from one part of the floor to another. From there, he progressed to Order Clerk, which was much the same, but he was working for one company rather than the Exchange.

Dennis wanted to leave school at 16 & get a job in Wall Street. His mother refused, eventually relenting by allowing Dennis one day off school to get a job; if he could get one, ok he could leave school. Thus started a 55 year career in investment as a messenger, and then gradually rising through the ranks to partner.

Dennis wanted to leave school at 16 & get a job in Wall Street. His mother refused, eventually relenting by allowing Dennis one day off school to get a job; if he could get one, ok he could leave school. Thus started a 55 year career in investment as a messenger, and then gradually rising through the ranks to partner.

At the age of 19, he said the company felt he needed more training and sent him to Amsterdam to work at a Dutch bank. After spending time there, he returned to New York and became a Trader for his old company.

Dennis then described some of the things that he considers bad about Wall Street. He said when you were told to recommend a buy for a particular stock; it meant the company wanted to sell it. Likewise, when you were told to recommend a sell; it was so the company could buy those shares. Of course, commissions were made on all transactions.

Board member & past chairman Richard Smith updates members on the activities of the Banglamung Cross Culture Group, providing free English lessons to many Thais living in and around Pattaya.

Board member & past chairman Richard Smith updates members on the activities of the Banglamung Cross Culture Group, providing free English lessons to many Thais living in and around Pattaya.

Insider trading was also very common and if you were on good terms with the underwriter for an Initial Public Offering (IPO), there was money to be made. Dennis also described some of the differences on how things operated from when he started and have continued to change. It was during some of these changes, that he decided to become an Analyst, which wasn’t difficult at that time. All you had to do was call yourself an Analyst and start doing your own research and writing about is. Of course, he said, you can’t do that today because education qualifications have been imposed.

He continued with how he became an investment banker and an asset manager. He also mentioned his meeting a lady with whom he wanted to share his life and how that helped him decide it was time to get out of the investment business. They acquired and operated a hotel for a while.

After disposing of the hotel, he found himself without much to do, so he approached a newspaper that had a “stock” section, but did not have any real content. He offered his services to write a twice weekly column. When they asked how much he wanted, he said nothing, he would do it for free. Thus, he began writing the articles and that led to people contacting him to manage their investments. Dennis said that he decided that he would not invest other people’s money in a company unless he himself was willing to invest in it. Thus, this removed a conflict of interest. He was now looking after their investments as if it was his own money, because his money was involved.

Dennis said that he had been semiretired, but now plans to be fully retired with this being most likely his last public talk on the subject. In conclusion, he mentioned some specific stocks that he currently has his funds invested in and why he chose those investments. But, he cautioned one and all, if you can’t afford to lose, you have no business investing in the stock market.

Master of Ceremonies Richard Silverberg called on Al Serrato to conduct the always informative and sometime humorous Open Forum where questions are asked and answered about expat living in Thailand, Pattaya in particular. The Pattaya City Expats Club meets every Sunday at the Amari Orchid’s Tavern by the Sea Restaurant. Read more about the Club’s activities on their website at www.pattayacityexpatsclub.com.