Recently, my business partner, Paul Gambles, appeared on CNBC’s Asia Squawk Box when he was on a trip to Singapore. At MBMG Asset Management, we have been talking about the Fiscal Cliff for some time now. This is where the combination of automatic spending hikes and tax cuts expiries that will happen at the start of the year unless US politicians finally rediscover the ability to compromise. The negative impact on GDP could be around 2%, sending the US and, mostly likely, the world into another recession – though many in Europe might protest that they have not yet come through the first one.

If you switch on any American news network, of which we are blessed (or cursed) to have access to many here in Thailand, you will be positively bombarded by US politicians on both sides of the house stressing the grave nature of the situation, the importance of avoiding the fiscal cliff, and then making a lot of white noise on compromise whilst offering few suggestions of what they would actually be prepared to budge on. However, the intransigence of the election season is slowly wearing off. The most likely outcome is a fudge, the debt ceiling will be pushed higher and sequestration (the automatic cuts and hikes) will be avoided.

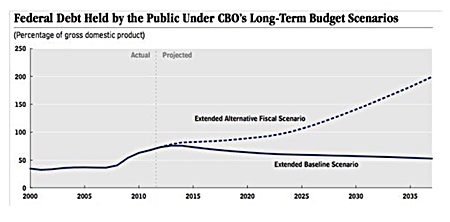

Graph 1

Graph 1

So now that everyone has decided to start panicking, why have I stopped worrying and learned to love the Fiscal Cliff? Why did Paul Gambles say on CNBC that, likely a slightly beardier and more wonkish Thelma and Louise, Geithner and Bernanke should stop worrying too, and drive the American economy over the Fiscal Cliff with as much gusto and conviction as Thelma when she stepped on the accelerator of the 1966 Ford Thunderbird?

It is quite simple really. The US Congressional Budget Office’s Long-Term Budget Scenario projections for debt illustrate it clearly. The Thelma and Louise scenario, where the initial pain of the recession is endured, puts the US national debt back on a sustainable path to steadily decrease to around 50% of GDP by 2040. This is represented in graph 1 by the Extended Baseline Scenario. The fudge option, sends US publically held debt (which is currently around 72% of GDP) spiraling off the map towards 200% of GDP by 2040.

These projections look scary, and they are far enough in the future that the hope this can be avoided is still firmly within our minds. But you only have to look at Japan to see the future today.

In the UK, the Bank of England changed its governor a few weeks ago. There was surprise when it was, shock-horror, given to a Canadian. A foreigner leading the Old Lady of Threadneedle Street for the first time in its history! Perhaps it is also time for a change at the top of the Federal Reserve. Let’s face it they could not do any worse than the recent incumbents.

The above economic summary is great but as with all US or European issues at present, we do not need degrees in economics, we need political degrees to establish odds. What makes economic sense may not be how the voters cause political leaders to behave. Everyone is assuming or convinced the Washington politicians will not cause a US recession, the very same bunch just spent US$6bn re-electing someone into the same job.

The above economic summary is great but as with all US or European issues at present, we do not need degrees in economics, we need political degrees to establish odds. What makes economic sense may not be how the voters cause political leaders to behave. Everyone is assuming or convinced the Washington politicians will not cause a US recession, the very same bunch just spent US$6bn re-electing someone into the same job.

Some are complaining about the cost of bringing in this chap. However, let’s look at this in perspective. The US electoral marathon is thought to have cost a combined USD6 billion. By contrast, the Chinese elected their new leader this week for about 0.001% of that astronomical figure. But the selection of China’s new leader is arguably even more important than the US media showpiece that has overshadowed it. Of which there is no doubt, the leader of the not-so free-world will not be tweeting his devotion for his folk singer wife, or taking anything else viral online.

The Chinese leadership transfer from Hu Jintao to Xi Jinping faces different “fiscal cliff” issues to the US. The former being a ten year planning debate over moving to a consumer driven and internally focused economy, with significant balance sheet strength. The latter being one of what needs to be done to improve the diabolical balance sheet, with serious politically wrangling in the short term.

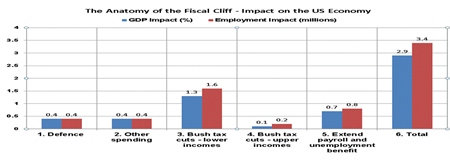

Standard Life, an Edinburgh based asset manager wrote a very good summary of the economic issues, or the “fiscal cliff”, faced by the US economy. Based on the Congressional Office estimates they concluded (emphasis in brackets):

* The impact of even the full fiscal cliff has been exaggerated. (For a full 4% to be shaved off GDP next year, then the full tax increases need to be enacted and the full spending cuts need to be implemented.)

* A positive monetary policy tailwind (i.e. QE Infinity) will at least partially offset the fiscal headwinds.

* An expected pick-up in private sector borrowing will partially offset the public sector contrarian.

* The fiscal cliff will be cut down to size with a GDP hit of 1.0-1.5% a year, rather than max 4.0%.

* A meaningful deficit reduction program will be established.

* The US economy will not be derailed (because everyone is too scared to cause a recession, which is what is actually required).

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |