It’s an asylum run by the inmates

– Ernest Borgnine, on Hollywood

Here we go again! The hints are there but whether the decision-makers at the Federal Reserve will actually raise their base interest rate up from the minimal 0.25%1 remains to be seen. Despite all the conflicting opinions and data, they may stay put again.

From last week: For me, one really useful indicator is the sector which played a major role in starting off the global financial crisis in the first place – property. It paints a revealing picture of the state of the US economy because it shows the public taste for taking on debt to buy more. After all, the low interest rates are designed to encourage people to consume, thus kick-starting the economy.8

The problem is that US housing market charts show one good period for house prices, followed by a bad period. Since 2008, the regular seasonal peaks and troughs have become more and more exaggerated each year. Consequently, despite the Fed trying to help, real estate in the US looks like facing far greater headwinds than seem to be realised.

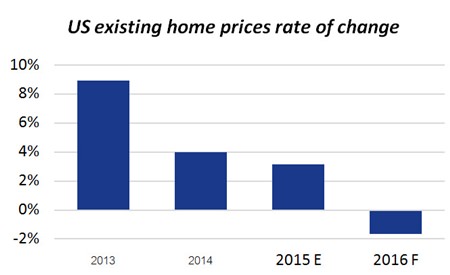

That’s not the only revealing statistic amongst US house prices. Prices have been going down sharply over the last couple of months and are expected to continue doing so next year (see chart 1).

Chart 1 – Source: US National Association of Realtors.

Chart 1 – Source: US National Association of Realtors.

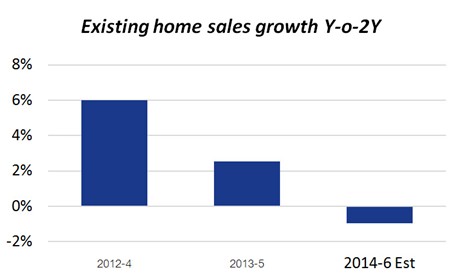

These low prices, coupled with theoretically low rates for mortgages (presuming the banks follow the Fed’s lead in keeping their lending rates down – they’re not obliged to), have not translated into a growth in sales. In fact, sales are actually dropping (see chart 2).

Chart 2 – Estimate = MBMG’s own extrapolation Source: US National Association of Realtors.

Chart 2 – Estimate = MBMG’s own extrapolation Source: US National Association of Realtors.

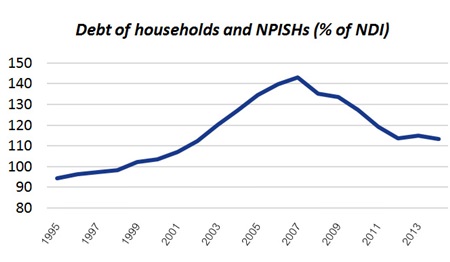

Thus, the housing market shows us that the Fed’s policy hasn’t worked and that deflation remains the main threat. Private debt levels became so high in the late 2000s – and even after over five years of deleveraging, they remain at more than 100% of net disposable income (see chart 3) – that people have rightly been scared away from taking on any more loans.

Chart 3 – Forecast= = MBMG’s own extrapolation Source: US National Association of Realtors.

Chart 3 – Forecast= = MBMG’s own extrapolation Source: US National Association of Realtors.

The Fed’s decision-makers must have seen this data as well and, assuming that they’re capable of drawing straight extrapolation lines too, that must be putting their heads in a spin ahead of the FOMC meeting – so much so that they appear exhausted, dehydrated and ever-so-slightly losing it (see Janet Yellen’s speech in September, where she was clearly struggling).1

More recently San Francisco Federal Reserve President John Williams admitted to the Brookings Institute that low neutral interest rates may be a warning sign of possible changes in the U.S. economy that the central bank does not fully understand:

I see this as more of a warning, a red flag that there’s something going on here that isn’t in the models, that we maybe don’t understand as well as we think, and we should dig down deeper and try to figure this out better.2

I can help you there John, it’s an indication of a deflationary environment that hasn’t been ameliorated by policy supportive of market participants, such as banks, and of asset prices.

Nevertheless, with the past evidence of the FOMC’s reluctance to quit the minimal rate, we have to allow for a greater chance than the 25-30% allowed by the markets that it will duck the call yet again. That would be good for US treasury bonds but bad for the Dollar, with all the secondary derivative consequences of that: good for the Chinese Yuan but bad for Chinese stocks; good for the Baht but bad for SET etc., etc.

All-in-all the Fed seems to be concentrated on those two variables – employment and inflation – without considering the bigger picture. If it wants to promote consumer and corporate confidence, it needs to find a way to promote the increase of net disposable income, not monthly loan repayments. Maybe then inflation will rise to a healthy level, prompting greater profits and greater levels of employment, meaning more consumers.

Footnotes:

1 http://www.bloomberg. com/news/videos/2015-09-24/

yellen-feels-dehydrated-near-end-of-amherst-speech

2 http://www.cnbc.com/2015/10/30/feds-

williams-low-neutral-interest-rates-a-warning-sign.html

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |