Let’s start at the beginning: what is currency hedging (CH)? If we just go straight for the basics then it is a situation where investors have assets in countries where they are not resident and so use CH to try and protect themselves from any fluctuations (especially sudden ones) in the foreign currencies and how they will affect the money invested when it is valued in the home currency of the investor. These changes in the different value of currencies can be caused by various things such as economic fundamentals et al. CH should limit the effect of any wild shifts in exchange rate valuations.

The benefits of hedging are very much reliant of the aims of the investor and the currencies being hedged.

Working out the cost of hedging is also very important. If any potential hedging is only a small part of a portfolio then the costs of setting up the hedge may well not be worth it. Costs include payments to currency dealers, banks and investment managers. These costs are for such things as:

– Bid/Offer spreads

– Rebalancing the actual hedge back to within the acceptable parameters

– Liquidity in a particular currency

– Offsetting risk, i.e. such things as a default, etc.

The next question is if there is such a thing as the perfect hedge ratio? As with almost everything in the economic world there are a number of varying opinions on this one. They range from people saying that no hedge is best to others saying that a portfolio can only achieve optimal performance if there is a total hedge. What it basically comes down to, though, is the investor’s risk/reward ratio and over what time period any portfolio is going for. One other thing that is vital is for the investment to be monitored regularly. If everything with the hedge works well then the investor will be guarded against inflation, market volatility (especially commodities), changes in interest rates, and forex fluctuations. That is all the good news. The downside of hedging means that people may not be as liquid as they would wish to be. It must also be remembered that the idea of a hedge is to minimize risk, therefore, by nature this will potentially reduce gains.

As a simple example, let’s look at what happens when you compare the US Dollar against the British Pound in the marketplace. So, should a Sterling-based investor have the same global equity exposure as a US Dollar-based investor?

Fig.1

Fig.1

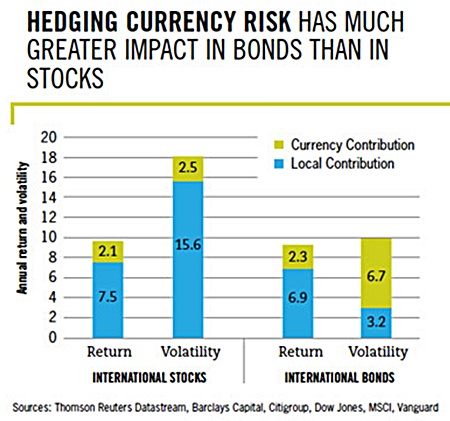

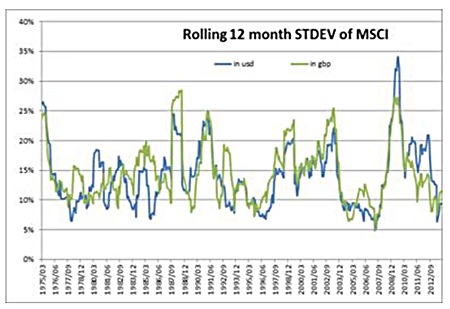

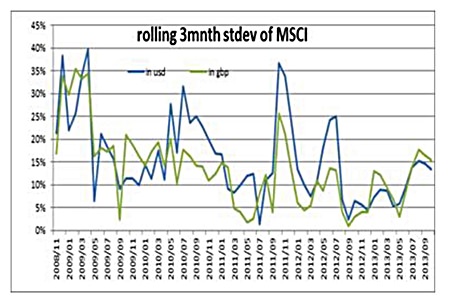

As most people know, the American US equity market makes up nearly 50% of global equity whereas the British one is only around 10%. This obviously shows that there is less need for an American to hedge than a Brit. But what about the levels of volatility, are they the same and can worldwide access give a better rate of return? If you look at figures 1 and 2 you can see that, apart from a couple of short term differences, the volatility for both American and British investors with access to world markets is roughly the same.

Fig.2

Fig.2

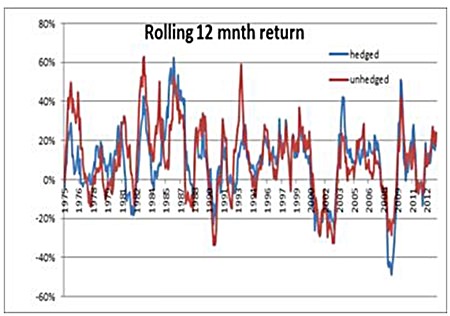

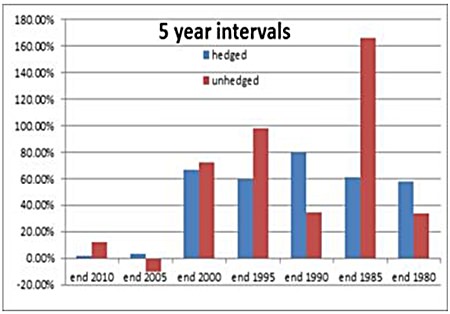

However, where things do start to differ are on a one or five year interval as these can show large differences in the rates of return. Figures 4 and 5 show this as these charts show hedged being USD returns and un-hedged are in GBP terms.

Fig.3

Fig.3

It is noticeable that at the height of the crisis in 2008, the Morgan Stanley Capital Index (MSCI) World Annual rolling returns were down only 25% in GBP terms as opposed to minus 50% in US Dollars. This was mostly due to how weak the British pound was five years ago. The five year chart indicates exactly how returns can vary on a large scale, i.e. the five year period ending in 1985 shows a GBP return of 160% as against only 60% in US Dollars.

Fig.4

Fig.4

So what does all of this indicate? Well, an investor needs to know what his/her risk/reward ratio is and the length of time that the investment is needed as it is obvious that any swings over longer periods of time even themselves out. However, on the downside, they can distort monthly returns significantly. Hedging definitely has its place in the market and can protect an investor dramatically. However, it can also cause chaos in the wrong hands. Caveat emptor!

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |