I’m increasingly described these days as a perma-bear or something of a pessimist. I think this is a little unfair because as I often point out, I’ve only been bearish for only most of the last 18 or 19 years or so and only in respect of most aspects of the global economy. Plus, it’s not so much that I’m being unduly pessimistic in my assessment of the global outlook as the fact that things are grim out in the world and they’re getting worse every day.

But I suppose that is what a perma-bear would say.

Global Debt-deflation

In fact, my only permanent economic belief is in cyclicality. Where we are now is just part of the cycle, albeit the worst part; debt-deflation.

At least 15 years into the current phase, we’re far from through this. We may even be barely halfway through, but once this phase of the cycle is complete then we have several decades of increasing relative prosperity to look forward to.

Every economic cycle since time began has started off with a relatively clean slate – with low asset values, low prices, low debt, an underemployed population and low levels of economic activity. People then get new jobs, open new businesses, buy new cars (or in the past chariots?) and houses (maybe caves?) and all this generally creates an upswing, from ground zero or at least from a very low base, to a gradually higher level of economic activity.

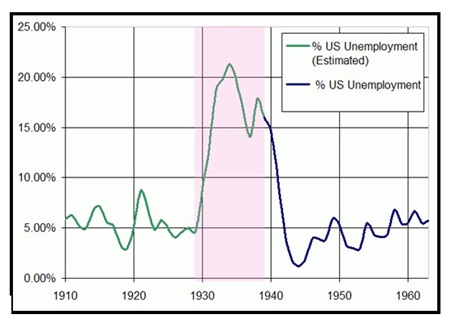

At that point, everyone feels good because things are going so well; everyone sees this and wants some part of the action. This tends to result in initially tentative private borrowing from initially low but gradually rising interest rates. The borrowing tends to be largely directed into production and increases employment, incomes and profitability. A look at the period prior to and after the Wall Street Crash demonstrates this (see charts 1-5).

US Unemployment 1910-1960

Chart 1 Source: BLS, Peace01234

Chart 1 Source: BLS, Peace01234

Then private borrowing starts to accelerate and becomes more focused on consumption (which of course drives more consumption) and also on assets such as property.

The upswing then turns into a full-on boom – salaries and the values of assets tend to go up, as do interest rates and eventually inflation starts to run away and we tend to enter a bubble.

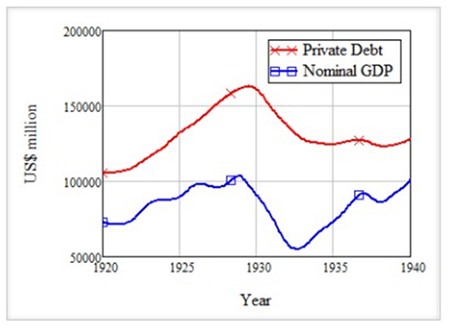

US Debt & GDP 1920-1940

Chart 2 Source: Steve Keen’s Debtwatch: Debtdeflation.com

Chart 2 Source: Steve Keen’s Debtwatch: Debtdeflation.com

The combined impact of higher private debt and higher interest rates causes a gradual slowdown, which initially looks healthy because inflation and interest rates start to moderate. However, the consumer debt that has been borrowed becomes much harder to repay, even as interest rates fall, because wages start declining in real terms. All the speculative assets that were bought stop going up in value and the world finds itself facing debt deflation.

Heavily in debt, unable to increase salaries in real terms and struggling to get the kinds of investment returns that you used to get – welcome to debt-deflation, where the global economy has been trapped for a long time now.

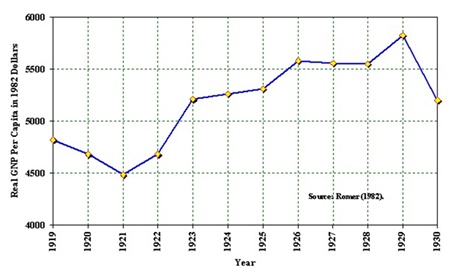

US: Real GNP Per Capita 1919-1930

Chart 3 Source: Economic History Association

Chart 3 Source: Economic History Association

Treating the symptoms not the causes of debt-deflation, which is what global policy makers have done throughout this period, actually makes things worse not better.

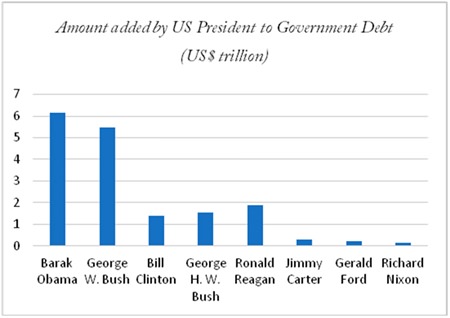

The world is in debt like never before – George W. Bush created more debt than every preceding US president added together since Richard Nixon took office in 1969;1 and now President Obama has outdone him.

US: Price Changes 1920-1930

Chart 4 Source: Economic History Association

Chart 4 Source: Economic History Association

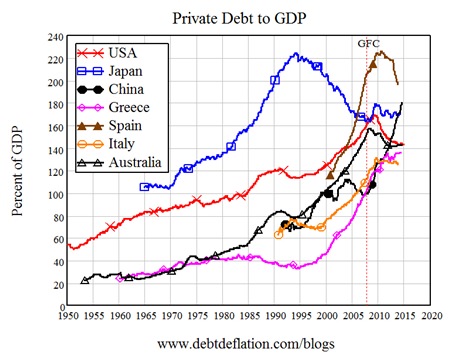

Having said that, one major misconception is that government debt is the real issue. It’s not; it’s much less important than private debt in terms of making national economies and the global economy tick – both up and down. Private debt, created by commercial banks, represents the vast majority of the money that is deemed to exist – in the UK, it’s at more than 97%, for example.2 Relatively small percentage changes in these figures make huge differences to the economy.

Where does that leave Thailand?

Like everywhere, the situation leaves Thailand on a pretty sticky wicket (‘in a difficult situation’ for those unfortunate people uninitiated in cricket – for such uninitiates, the key fact is that this is a game in which Yorkshire County Cricket Club once again excel!).

Chart 5

Chart 5

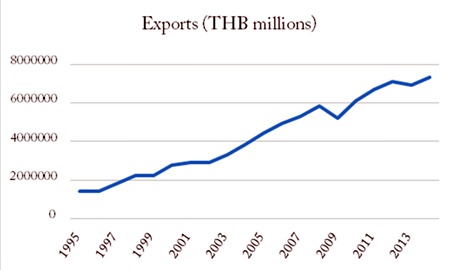

Meanwhile, back in Thailand, exports have been the primary mover of economic growth here ever since 1997 when the country exited its own version of the Euro – the ASEAN region’s obsessively rigid peg to the US$.

However, exports will be increasingly difficult in a slowing global economy. Over the past few weeks and months, I’ve been asked by countless people, “Isn’t it good for the economy that oil, which Thailand imports more than any other ASEAN country except Singapore, has fallen to $60, then $50 and even $40 a barrel?”

Chart 6 Figures: the Whitehouse: Office of Management and Budget

Chart 6 Figures: the Whitehouse: Office of Management and Budget

My answer has been, “No it isn’t – it’s terrible. Because it’s telling us that private demand is falling off a cliff.”

We know that, because all other commodities are struggling.

We also know that because, if you take out the addicts buying iPhone 6’s, then sales revenues for the global companies listed in New York were weak in quarter 4 last year.3 And we also know that because Thai export and GDP growth hit a brick wall at that same time.4 That wasn’t really a Thai problem – it was a global ripple reaching Thai shores which is building in intensity the longer the world remains trapped in debt-deflation.

Chart 7 Source: Bank of Thailand

Chart 7 Source: Bank of Thailand

Footnotes:

1 Data from the Whitehouse: Office of Management and Budget.

2 http://www.positivemoney .org/how-money

-works/proof-that-banks-create-money/

3 http://www.zacks.com/commentary/37843/retail

-sector-in-focus-as-q4-earnings-season-winds-down

4 http://www.cnbc.com/id/102427944

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |