I was serious the other week when I told CNBC’s Stephen Sedgwick that we are in a really scary, over-priced asset market and that the best thing the Fed could do for the US and world economy would be to raise interest rates to 10% and allow the biggest implosion of asset prices in history to force deleveraging.

Now that the hysteria over the will they? won’t they? saga over raising the Federal Reserve’s base interest rate is over, it’s high time the world’s central banks and governments actually focus on the ever-precarious possibility of a bubble burst.

Of course, history tells us that the sages in charge of national and regional economic policies will pay no attention to any of this. In 17th-century Amsterdam, for example, the average price of a single tulip was allowed to rise higher than the annual income of a skilled worker.2 Then there was the South Sea Bubble a century later, where shares were bought on the assumption that Central and South Americans were desperate to trade their jewels and gold for wool.3

Granted, those are two old examples and the world has changed a lot since then. Yet in 1990, highly-regulated Japan suffered a crippling property and stock market bubble burst, from which the economy has yet to recover.4 A decade later came the dot-com bubble, where large amounts were lent to new companies which never turned a profit (such as boo.com)5 and the NASDAQ Composite Index rose from around 3,000 points on 1st November 1999, to almost 5,050 in March 2000, back to 3,000 in November 2000.6

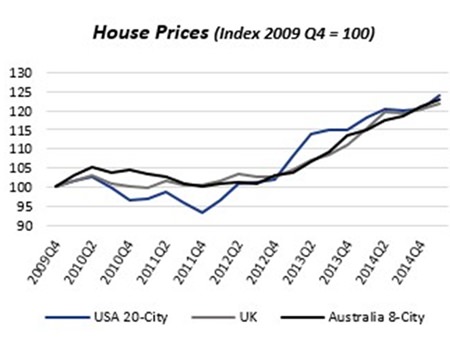

Then of course, there was the US housing bubble which lit the blue-touch paper on the global financial crisis. Amidst a cocktail of sub-prime mortgages and condo flipping came a huge increase in house prices: between January 1996 and April 2007, the house price index had almost doubled – two-thirds of that rise came between 2002 and 2006 alone.7 Then came a long decline, which only bottomed out in 2012 at 19% below its peak, leaving mortgage associations and banks needing government capital to remain afloat.8

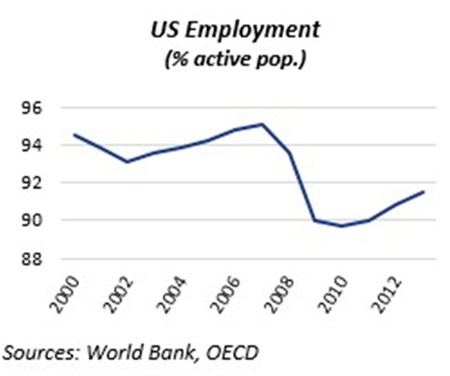

Today we are living in another bubble; one which has fundamental similarities to the events leading to the 1929 Wall Street Crash.9 US and economies’ asset prices are high; yet there isn’t the Main Street economic performance to justify these prices as evidenced by pitiful year-on-year GDP change, low net disposable income and historically low employment (see charts).

It’s very hard to say what’s going to be the trigger for the bubble burst but at some point reality has to bite. In 1929 it was a combination of unrelated events – including a fraud case in London, which had seemingly little to do with Wall Street.10

What we do know is that we’ve got this incredibly vulnerable situation, where any one factor is going to knock over the whole thing. We don’t know what that will be but, if there’s any significance to the Fed’s non-decision, it’s the fact that America’s central bankers are admitting that they can’t raise rates at this time because maybe they’re worried that doing so would highlight the problems that exist – just as the Chinese GDP and growth slowdown highlighted that country’s issues.11

China, in fact, has the biggest debt bubble the world has ever seen in terms of % to GDP for a major economy and also in outright terms.12 I think this is going to lead us to the biggest depression we’ve ever seen.

Following the GFC, the Chinese private sector (with government encouragement) has taken and is still taking on extreme amounts of debt. Corporate debt alone has grown from nowhere to officially over 125% (and, in my view, probably closer to 200%, in reality) of China’s GDP in 2014 Q2.13

Also, it doesn’t seem beyond the realms of possibility to me that the Chinese banking sector has ‘restructured’ extreme amounts of historic bad debt and is understating current non-performing loans. Added to these are local government loan platforms where the banks repackage loans into wealth management packages, passing on risk in bite-sized chunks to investors.14

The simple fact is that the People’s Bank of China and the other major central banks need to constructively tackle debt. This isn’t a short-term crisis but an exceptionally large structural debt crisis15 and most of the central bankers who are running the major economies don’t seem to have a game plan or seem to understand the problems of the debt they’ve created.

As for the rest of Asia, UBS Group chairman Axel Weber was partly right when he said that the region had learned its lesson from 1997 and 2000, thus avoiding heavy indebtedness. I do think he’s missing the bigger picture, though: if any kind of credit event happens in China, the level of outflows that this will create will affect Asia and the rest of the world even if they have some economic protection.

Having said that, I do think that a lot of the Southeast Asian emerging economies in particular are perhaps better placed to make a long-term recovery. However, they’d first have to endure a lot of pain before they see the light at the end of the tunnel.

Footnotes:

1 http://video.cnbc.com/gallery/?video=3000425810

2 http://www.investopedia.com/terms/t/tulipmania.asp

3 http://www.investopedia.com/features/crashes/crashes3.asp

4 Steve Keen’s Economic Outlook 2015, IDEA Economics. www.ideaeconomics.org

5 http://www.theguardian.com/technology/2005/may/16/media.business

6 NASDAQ

7 St. Louis Federal Reserve

8 http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/

2795920/Fannie-Mae-and-Freddie-Mac-US-rescue-

spurs-world-markets-into-fightback.html

9 See MBMG IA Updates is there anything we can learn from 1929?

http://www.mbmg-investment.com/in-the-media/inthemedia/44 and

http://www.mbmg-investment.com/in-the-media/inthemedia/45

10 ibid

11 http://www.mbmg-investment.com/in-the-media/inthemedia/59

12 http://theeconomiccollapseblog.com/archives/tag/debt-bubble-in-china

13 MGI Country Debt database; McKinsey Global Institute analysis

14 http://www.zerohedge.com/news/2013-06-24/presenting-

chinese-wealth-management-products-infinite-risk-loop

15 Steve Keen’s Economic Outlook 2015, IDEA Economics. www.ideaeconomics.org

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |