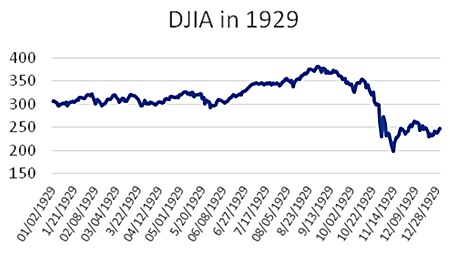

Despite all the warning signs, including stock market prices dropping in March and May 1929, the Dow Jones Industrial Average gained around 28% between June and September 1929.

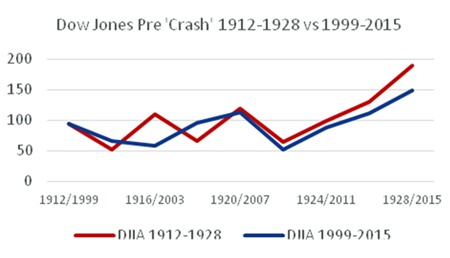

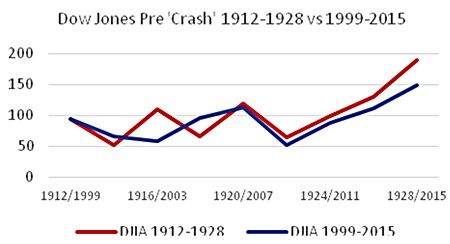

In fact by September 1929, there had been a near 200% rise in stock market prices in 7 years. Whilst this was not something which happened prior to the GFC, it is in fact a trend that is happening today – evolution between prices in 1922-1928 and 2009-2015 is eerily similar: (See Graphs 1, 2 & 3)

Graph 1 – Data: St Louis Federal Reserve; Chart: author

Graph 1 – Data: St Louis Federal Reserve; Chart: author

Graph 2 – Data: St Louis Federal Reserve; Chart: author

Graph 2 – Data: St Louis Federal Reserve; Chart: author

Graph 3 – Source: NYSE

Graph 3 – Source: NYSE

Any remote event can be the trigger

The 1922-1929 rise may have given the likes of Irving Fisher the impression that it was permanent but things began to unravel in the autumn of 1929. In September, American optimism in overseas markets took a blow thanks to a case involving Clarence Hatry, described by John Kenneth Galbraith as “one of those curiously un-English figures with whom the English periodically find themselves unable to cope”.1 Hatry had built up a business around vending machines but was discovered by the London Stock Exchange Committee to have expanded his empire through issuing unauthorized stock.2 The fraud was for a significant amount of money, but it was nevertheless committed in England – a world away from the big banks of Wall Street.

This event may not have been solely responsible for a sudden lack in confidence; however, it did nothing to ease public concern just seven years after Charles Ponzi was jailed.3

We would do well to take heed from the Hatry example. When markets become vulnerable, any remote incident can burst it. For example, the first quarter of 2015 was marked by a sharp drop in oil prices. As some commentators lauded this as positive news for the consumer, it is worth noting North American oil companies have since reduced plans for 2015 capital expenditure by 41%. One way of reducing spending so rapidly is to make redundancies – it has been estimated that by March this year, 75,000 global oil industry workers had already been laid off.

Lower oil prices puts pressure on shale gas producers, whose exploration funding has largely been financed by junk bonds.4 Once enough investors get twitchy about shale gas companies’ ability to repay, it could trigger a financial crisis.5

Once the scene had been set in 1929, governments’ reactions globally were to adopt beggar-thy-neighbour policies to advantage their economy of competing countries. The US government passed the Smoot-Hawley Tariff Act6 which raised import tariffs to record levels. Since the 2008 GFC, this mentally has returned, particularly in the form of competitive devaluations, sanctions and through easing interest rates.7 The US, the UK, Japan and the Eurozone have embarked on unprecedented policy experiments.

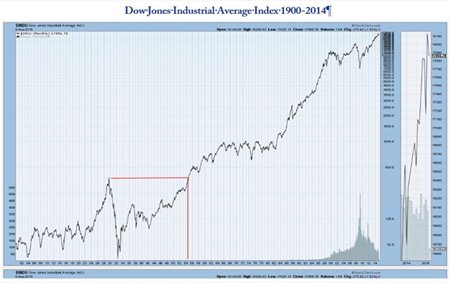

Despite a one-day respite the day after Black Thursday, the Dow continued to fall until mid-November. Recoveries and putative bounces followed – including a long slide from April 1931 to July 1932 when it hit the lowest point in the whole twentieth century. Consistent upturn did not come about until after the US had entered World War II and it only came back to pre-crash levels in 1954. (See Graph 4)

Graph 4 – Source: Stockcharts.com

Graph 4 – Source: Stockcharts.com

To be continued…

Footnotes:

1 John Kenneth Galbraith, The Great Crash 1929 (1955)

Mariner Books; Reprint edition (2009)

2 ibid

3 Barry Eichengreen & Kris Mitchener (2003), BIS Working Papers,

No 137, The Great Depression as a credit boom gone wrong).

4 http://www.nytimes.com/aponline/2014/12/19/business/

ap-us-junk-bond-slump.html?_r=0

5 See MBMG IA Update Oil Price drop could fuel crisis, December 2014

http://www.mbmg-investment.com/in-the-media/inthemedia/34

6 19 U.S. C ch. 4

7 http://www.zerohedge.com/news/2013-11-11/beggar-thy-

neighbor-back-goldmans-five-things-watch-currency-wars-return

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook:/MBMGGroup |