I recently noticed a report which concluded that members of Generation X are poorer than those from the Baby Boom generation.

The Pew Charitable Trusts’ financial security and mobility project released the report late last year.1 It concluded that in America, those born between the 1960s and the 1980s – what has come to be known as Generation X2 – have, on average, larger incomes than those of their parents’ generation (the post-war Baby-Boomers).

That may seem logical; as would the assumption that this would make Generation X-ers wealthier than their elders. Yet this is where the report’s findings really catch the eye.

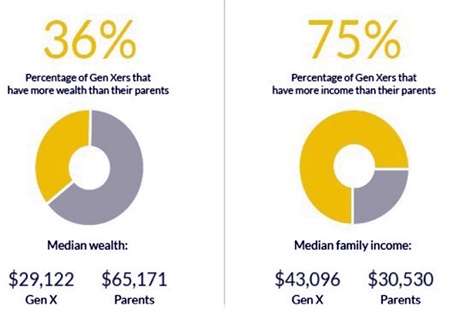

Believe it or not, the report found that the average Gen. X-er has an accumulated wealth of USD 29,100 – as opposed to the Baby Boomers’ average of USD 65,200 (see chart 1).

Chart 1 Source: moneyeconomics.com

Chart 1 Source: moneyeconomics.com

This is because Pew measured wealth by including savings, retirement funds, value of homes and other investments. Once these factors were taken into account, the report revealed that only around one third of Gen. X-ers have more wealth than the Baby-Boomers.

Predictably, it is private debt that’s the key. The post-war generation owes less money, thus is wealthier. Major sources of debt for the Gen. X people are student loans and credit cards.

The Pew report found that four in ten “upwardly income mobile college-educated Gen. X-ers have education debt, with a median balance of USD 25,000.”3 Of course, it can be argued that because college graduates tend to come from families at the wealthier end of society, it is inherently more difficult to become richer than their parents, in comparison with those with less education. Amongst those raised at the bottom, two-thirds exceed the wealth and home equity of their own parents, but fewer than 3 in 10 of those raised at the middle and higher rungs have more assets than their parents held at the same age.4

Nevertheless, the debt levels are staggering. The Federal Reserve Bank of New York reported5 that while the level of house-based debt fell by 1.1% between Q3 & Q4 2013, non-housing debt rose by 3.3%, including increases of USD 11 billion on credit cards and a huge USD 53 billion increase in student loans.

Also according to the Federal Reserve Bank of New York, at the end of 2012 people between the ages of 30 and 39 held about $321 billion in total student debt at the end of 2012 – almost 260% more debt than in 2005. Those between 40 and 49 owed $168 billion, up from $53 billion.6 Overall, the typical household had $5,000 less wealth than their parents did at the same age, once debts were subtracted from assets.7 Considering that, according to the last official census taken in 2010, around 27% of the US population was aged between 25 and 448, there are a lot of people in debt.

In fact, the Pew report found that although the bottom of the income ladder was understandably dominated by those without a college degree, 17% of Gen. X-ers in the low income bracket had actually graduated.9 These people actually hold a higher median level of debt than their peers without a degree. That said, 22% of the bottom of the income ladder from their parents’ generation were college graduates as well.

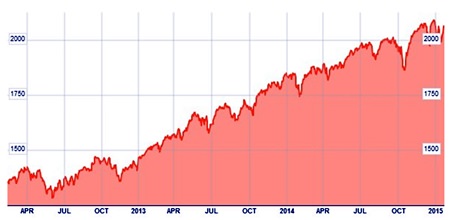

Whilst share values may be up and the US government’s unemployment figures may look more encouraging than in recent times, private debt levels are still worryingly high (see charts 2 & 3).

S&P 500 Prices last 3 years

Chart 2 Source: Bloomberg

Chart 2 Source: Bloomberg

Chart 3

Chart 3

This is a concern; despite former Fed chairman Ben Bernanke’s claims that private debt levels have “no significant macroeconomic effects.”10 After all, if Fed policy is aimed at encouraging people to kick-start the US economy by consuming more, how are they expected to do that if they are choking in debt?

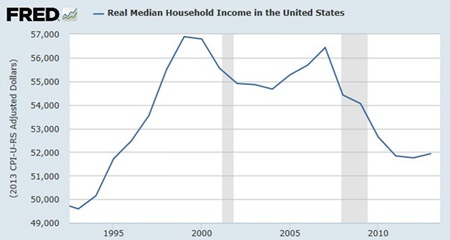

A look at the levels of real median income in the US is far from encouraging – in 2013, median household income levels were that of 1995 (see chart 4).

Chart 4

Chart 4

The underlying issue with the type of debt America has won’t go away; neither metaphorically nor physically. Student loans put people in debt while they’re still young; meaning people are playing catch-up right from the beginning of their careers. The system has barely changed in the last twenty years; thus if both Gen. X-ers, their children and future generations spend large parts of their lives in debt, when will Americans start to have the confidence to consume, increase demand and boost the real economy?

Footnotes:

1 http://www.pewtrusts.org/en/research-and-analysis/

reports/2014/09/a-new-financial-reality

2 A term popularized by Douglas Coupland’s book Generation X:

Tales for an Accelerated Culture, St Martin’s Griffin (1991).

3 http://www.pewtrusts.org/en/research-and-analysis

/reports/2014/09/a-new-financial-reality

4 idem

5 http://www.newyorkfed.org/householdcredit

/2013-Q4/HHDC_2013Q4.pdf

6 http://www.bloomberg.com/news/articles/2014-09-18/

college-debt-leaves-generation-x-grads-less-wealthy-than-parents

7 http://www.bloomberg.com/news/articles/2014-09-18/college-

debt-leaves-generation-x-grads-less-wealthy-than-parents

8 http://www.census.gov/prod/cen2010/briefs/c2010br-03.pdf

9 http://www.pewtrusts.org/en/research-and-analysis/

reports/2014/09/a-new-financial-reality

10 Ben Bernanke (2000), Essays on the Great Depression.

Princeton: Princeton University Press.

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |