Since the start of World War II, the Foundation for the Study of Cycles (FSC) has been looking at past events and assessing when and if they can be repeated. They also look at if it is possible to forecast when they can be seen again. Over the last sixty years it has managed to forecast most of the major events – good and bad – that have actually happened.

As regular readers know, I am a great believer in cyclical patterns and find research by the likes of Kondratieff fascinating. As the Spanish philosopher Santyana once said, “Those who do not remember the past are condemned to repeat it.” This is so true when it comes to world economic and finances.

As with everything, nothing is perfect. Has the FSC made mistakes? Yes, of course it has but it has got many things right though. It forecast the start of the bull market at the beginning of the 1980s and the Crash of 1987. It also got it absolutely spot on with regards to the Bear market of 2000-2002. The FSC also predicted the massive declines of 2008 and the recovery.

So, know we know about the past, what do we think is going to happen in the future? Well, most western markets will go down but they will bounce back intermittently for the next three years but overall the trend will be downwards.

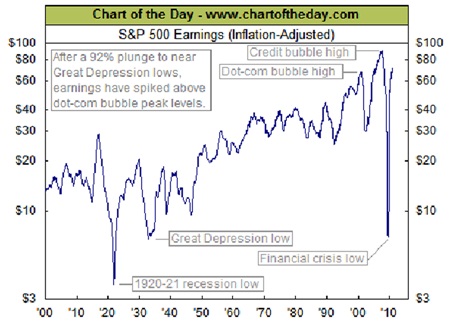

In times gone by, most bear markets and recessions in the west gave good value and there was many an occasion when the Price/Earnings (P/E) ratio was in single digit territory. Well known companies were selling for between five and eight times earnings. This time though, the western governments panicked and the normal nature of things was not allowed to happen this resulting in P/Es being greatly overvalued.

For the normal investor this volatility is nothing short of a disaster. However, for those who are prepared to be more flexible, there can be huge opportunities to make massive profits.

If you studied the FSC research from over a decade ago you would have been prepared and, therefore, got out of the dot.com catastrophe before it happened whilst taking a nice profit at the same time. Naturally, you would have remained liquid and waited for the next opportunity which the FSC correctly forecast as the S&P.

In 2003, you would have placed your money there knowing you should take it out in 2009 having made gains of nearly 150%. Carrying on with this scenario, it you had continued to use the FSC you would have been able to position yourself nicely, avoid all the traps that almost everyone fell into and still be healthily in profit. To end with, you will have also been able to catch the upside of the intermediate rally last year.

Does all this sound too fantastic? Well, yes it does but it is true and the records are there for all to see. Also, please remember this is all done just via the equity markets. As many people know, I believe in liquidity and a multi-asset, multi-management alpha approach. Whilst being a great fan of equities and also the FSC, nothing does well all the time and the good times should be protected by alternative strategies.

Despite the superb returns shown above, it would be just as easy to make even larger profits via the FSC for other assets such as gold. All superpowers have their problems. Rome nearly went bust, Spain would have gone under if it was not for the precious metals from South America and we all know what happened to the UK after the Second World War. What has never happened before in economic history has the world superpower also been the world’s largest debtor at the same time. This one factor will do gold a huge favour. As I have said in this column many times, gold will be an absolute minimum of USD2,000 by the end of next year and could be a lot more. At the time of writing it is USD1,357 per ounce. Why is this so? Well, it will occur in the middle of a declining equity market and western economies in disarray.

This should not come as a shock to many. Over the last few years there have been two equity market declines and the worst recession since the Great Depression. However, gold has gone up in value by fourfold. As I have stated many times before, nothing goes up all the time. Likewise nothing goes down forever either. Nonetheless, the FSC accurately predicted the start of the gold bull market in the 1970s and indicated that the early Eighties would be a good time to make a sharp exit. It also advised to stay well clear of the yellow metal until the start of the new millennium and then get back into it and stay for the foreseeable future.

To be continued…

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]