In Thailand right now we are seeing a lot of focus on political risk. This is understandable in the run up to what may prove to be a landmark election. However, barring any really ‘Black Swans’ in either the period from now until July 3rd or the aftermath, the external risks are probably of greater concern to the Thai economy which probably ought to be paying equal attention to events in Athens and New York as well as in Isaan. In many ways, global economic risk is at even higher levels currently than Thai political worries and certainly likely to have a greater legacy on the Thai and global economies.

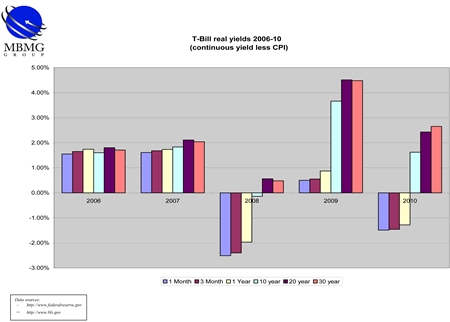

The accompanying chart shows the following phenomena:

1) The typical net return for investors in 2006 (incentive to save), although the flat yield curve reveals future expectations of economic problems.

2) 2007 saw a slightly more normalised curve, but one which was still pretty flat and offered no premium for 30 year bonds – again indicative of nervousness about the economic outlook.

3) The negative yields which appeared in 2008 for all except long duration bonds created a disincentive to save, especially in the short term. The greater disincentive at the short end pushed investors up the risk spectrum, if they wanted to target the same net returns.

4) Even when the immediate crisis passed in 2009, the real incentive was at the longer end of the bond range – having been forced up the risk spectrum since the end of 2008, investors were given no encouragement to come back down again.

5) Last year real yields at the short end became negative again – what had been a very slight incentive to save the year before became a disincentive again. At the same time the incentives to buy long-dated bonds also fell.

The effect of monetary policy, in the US but also in many other developed and developing economies, especially in the last two to three years, has been to push investors in 2 steps from risk-free investments (if, indeed, 30 day T-bills ever were) to longer dated bonds and then from longer dated bonds to riskier assets such as corporate bonds, property, developed and emerging equities and commodities – the assets which have been virtually forced to rally the most. This has also been reflected in currency markets where almost all major currencies are, to varying degrees, inverses of the Greenback – anti-Dollars as it were. The varying extents are largely dictated by the riskiness of the currency, with the highly volatile, carry-trade dominated AUD rising the most.

However, this is almost certainly the wrong reaction – risk is what it is and what it has always been – the probability of a range of satisfactory outcomes as well as a range of unsatisfactory outcomes. The danger with abandoning your risk profile is that generally that risk profile fits because you cannot afford the downside if it goes wrong. When the tide goes out, any investors who have abandoned their risk/reward ration, and comfort area, will find themselves naked at the wrong end of the risk pool. The liquidity trap is like a Ponzi scheme, supported only by confidence and inflows. When it collapses it does so pretty instantly, not in installments.

We will look at some other impacts of this and also the currency issues another time but for now, it is best to realize that this is a time for patience and forbearance – better to stay true to your risk profile and accept a lower real return than to chase return and throw your risk principles to the wind. It can be hard to do but the best professional advice right now should be tempering expectations of returns in the short term rather than getting investors to take on a higher risk than is comfortable. More than anything, please remember my old mantra, diversify and remain liquid.

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]