The recent dip in Eurozone stock markets is a relief from recent inflated prices. Yet it doesn’t necessarily mean that it’s the right time to buy.

Back in 2002, author Michael Lewis shadowed the management of baseball team the Oakland Athletics. In Moneyball: the art of winning an unfair game Lewis explains how, finding themselves unable to compete with the richer clubs, its management had thrown out the mix of statistics and gut feeling conventionally used for recruitment and started from scratch.

The Athletics signed players overlooked by other teams because their faces didn’t fit, their bodies were the wrong shape or they didn’t measure up to traditional statistics. Few seemed to be questioning what chiselled faces, sculpted bodies and favourable century-old calculations actually meant in reality. The Athletics did, though, and their new system of analytics showed important qualities their rivals couldn’t see. Success was immediate and unprecedented – nowadays even the rich clubs follow their methods.

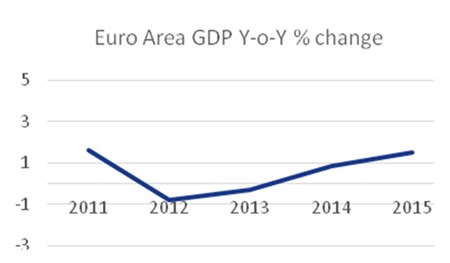

Chart 1 – Source: IMF.

Chart 1 – Source: IMF.

It’s no great surprise that Lewis has also authored books on finance, including last year’s excellent book about high-frequency trading, Flashboys. After all, just as in sport, there are perceived conventional wisdoms in the world of finance, which no longer necessarily apply.

One of those perceived wisdoms is that if there is a significant drop in stock prices, it’s an ideal opportunity to buy. This assumption can be correct in the short term. For example the main German stock exchange index, the DAX, was at 11,492 points on 22nd June, down to 11,058 on 29th June and back up to 11,673 on 13th July.1 So if an investor had taken the opportunity to buy on 29th June and sold again on 13th July, he or she would have made a nice little 5.5% return inside just over a fortnight.

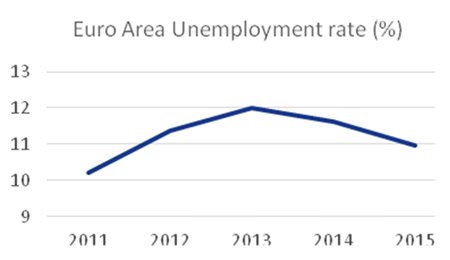

Chart 2 – Source: IMF.

Chart 2 – Source: IMF.

Of course, there are two main complications with this: how to get the timing right to buy; and how to know if the price will go back up in the near future to sell. These are two good reasons why I don’t like short-term investments. The latter of these is particularly relevant in Europe today. Stocks in Europe were experiencing inflated prices during the first half of this year, while key indicators showed – and continue to show – that the economy was faltering.

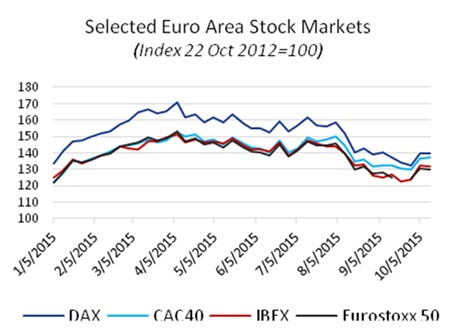

Not surprisingly, Euro Area stock prices are no longer at the level they were back in April. We saw a significant drop in September, followed by what could rather optimistically be called a ‘mild recovery’ since then (see chart 3).

Chart 3 Source: St. Louis Federal Reserve.

Chart 3 Source: St. Louis Federal Reserve.

It’s difficult to say with 100% certainty in which direction those prices will head next. Yet, given the above economic indicators, it wouldn’t come as a great surprise if they were to remain as low as they have been for almost three months.

That’s why I wouldn’t call Eurozone markets a place where investors could make any medium to long-term gain. As long as the ECB insists on its cocktail of public sector austerity measures, quantitative easing and emergency-level interest rates, it looks like a large part of the European Union is headed towards Japanese style debt-deflation.2 Thus any significant rise in stock prices would be without economic basis and therefore short-lived.

Elsewhere, China is showing cracks – ok, let’s face it, huge crevices3 – Japan is still in the doldrums after a quarter-century and the US, as well as other OECD countries, is still not showing concrete signs of recovery.4

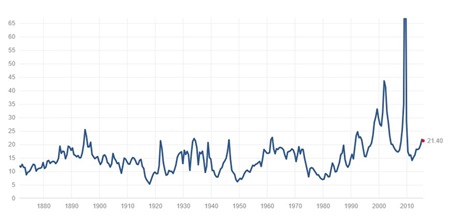

In fact, looking at price/earnings ratios shows that, whilst the US is not currently at the extremes reached during the global financial crisis, the S&P 500 is looking expensive again (see chart 4).

Chart 4 – Sources: Robert Shiller, Irrational Exuberance and multpl.com.

Chart 4 – Sources: Robert Shiller, Irrational Exuberance and multpl.com.

Realistically there are few medium-to-long-term buyers’ markets. As I have said before, what goes down doesn’t necessarily come back up. We can control risk but only influence return.5

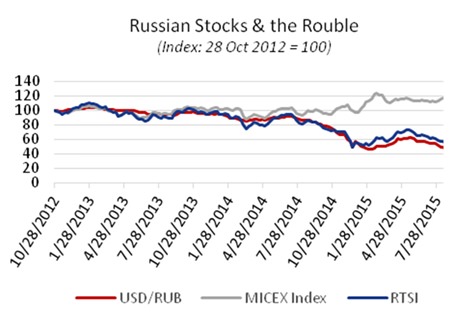

That said, there may be one possible opportunity: Russia. Looking at the Moscow stock exchange index (MICEX) shows that Russian stock prices have remained fairly stable over the last three years or so. However, the Russian Trading System Index (RTSI) – an index of 50 Moscow exchange-traded stocks – which was typically in synch with the MICEX, is considerably cheaper nowadays.

That’s no coincidence. The RTSI is calculated in US dollars. I’ve noticed that ever since the US imposed sanctions on Russia at the beginning of the Ukrainian crisis, the greenback has strengthened significantly against the rouble. In fact if we plot the rouble-dollar rate next to RTSI values, we can see there is a direct correlation (see chart 5).

Chart 5 – Sources: Bloomberg, MICEX & St. Louis Federal Reserve.

Chart 5 – Sources: Bloomberg, MICEX & St. Louis Federal Reserve.

This anomaly makes the Russian stock market a potentially interesting buying opportunity should there be any further weakness either in stocks or in the rouble. That’s because the drop off in prices is because of exchange rates, which are affected by outside events which could change in the long term.

Of course, the big question remains how long will these low prices last? That’s the hard part. The answer possibly lies deep in the bowels of the US state department and, whenever sanctions are lifted, whether this will have any telling effect on the rouble-dollar exchange rate and Russian stocks and to what extent.

I’ll leave those kind of predictions to others. However, I believe there are three vitally important things to remember when investing in shares: spread risk by diversifying; go for market averages, not individual stocks; and seek advice from an independent advisor.

Footnotes:

1 Bloomberg.com

2 Steve Keen’s 2015 Economic Outlook, www.ideaeconomics.org

3 https://confoundedinterest.wordpress.com/2015/10/14/china-syndrome-

china-slowdown-continues-to-drag-down-global-economy-imports-divining/

4 http://www.businessinsider.com.au/global-recession-2015-10

5 http://www.mbmg-investment.com/in-the-media/inthemedia/58

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |