Recently MBMG discussed “déjà vu” and did this investing environment have a first half of 2008 feeling all over again? Today we have inflation fears in Emerging Markets, raging commodity prices and equity markets shrugging off so called “black swan” events. In the first six months of 2008 the economy was remarkably upbeat on growth, Vietnam had surging double digit inflation, other emerging markets were worried about inflation, Bear Stearns had to be bailed out “a black swan” and the oil price moved from US$100 to US$150 by June. The conclusion on oil is below, but this has much bigger ramifications for our tactical asset allocation over coming months.

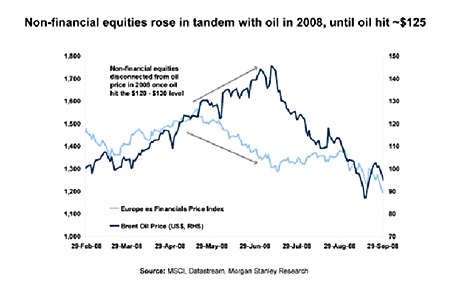

As Scott Campbell says, “In 2008, oil passing $125 acted as a choking point for equities. Morgan Stanley says the threshold could be higher in this cycle and points out the oil price spike in 2008 acted as a drag on equities only once oil rose above $120. As oil crossed the $100 mark in February 2008, non-financial equities continued to rise in tandem with the oil price, up until the middle of May when the correlation reversed.

“The European non-financial index peaked on the 19th May, at which point oil was at $123. Oil rose a further 18% through to mid-July, during which non-financial equities fell 17%. Arguably, the point at which higher oil prices act as a significant drag on equity prices could be higher than in 2008.”

No doubt this time is different and a lot depends how long oil stays high, but at some point markets are going to get pretty scared by what they are seeing. According to our sources, each $10 increase in oil prices reduces OECD growth by 0.1% – 0.5% (depending on who you read), so with growth still fuelled (excuse the pun) by quantitative easing and fiscal spending, higher oil prices are certainly not good news for growth. Couple this with the ECB that seems hell bent on raising interest rates and one gets a horrible déjà vu feeling to 2008.

We touched on commodities above. Whilst many of them are, to say the least, more than a tad volatile there is still a good argument for gold. A couple of years ago, Warren Buffet was asked if central banks around the world would sell off the US Treasury holdings they owned. Buffet said this was very unlikely as they would have to convert them into an alternative currency and, over the long run, nothing was better than the US Dollar.

However, is this the case and is it true? I do not believe it is. More than a few countries are building up their gold reserves – with China leading the way. In 2004, the Chinese had 600 metric tons of gold. A couple of years ago this had grown to over 1,050. It is not a secret that the central bank wants to increase this. It is also interesting to note that China has quietly been selling its US Treasuries recently.

As the Spanish philosopher Santayana once said, “Those who do not remember history are condemned to repeat it.” Without doubt, there have been times when alternatives to gold have come to the fore; e.g., the Greenback in the American Civil War and Roosevelt rejecting gold in the 1930s both come to mind. However, gold has been around for thousands of years and is valued more than ever – remember it has risen dramatically over the last couple of months. Its time is coming again and we do not think it unlikely that by the end of next year gold will be at a minimum of USD2,000 per ounce.

In conclusion, we were overweight risk assets from mid last year until recently. We are currently around benchmark weightings, so neutral risk assets, and watching every day for the flashing red lights. In no way does this mean we are forecasting an H2 like 2008 and notwithstanding equity valuations and a normally positive Year 3 US Presidential cycle, if certain events and policy decisions occur, the second half of this year will be difficult to say the least.

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]