BANGKOK, 18 November 2013 The Government Pension Fund will shift its investment focus toward stocks in developed countries and China, after deeming that the US, European and Chinese economies will improve next year.

Sopawadi Loetmanatchai, secretary-general of the agency, said the global economy is forecast to expand by 3.1% in 2014, boosted by the recovery of the US economy. The European economy will start to break from its state of decline, and the Chinese economy will start to stably expand because of domestic investments and consumption. At the same time, the Japanese economy is expected to improve as a result of the economic stimulus measures currently in place.

Ms. Sophawadi indicates her agency expects the Thai economy to grow between 4.5-5.0% in 2014, as its export sector receives windfall from the global recovery and the 2 trillion baht infrastructure helps to drive growth.

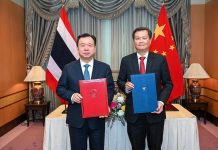

The fund will therefore be increasing its ceiling for foreign investment from 25% to 40%, and real estate from 8% to 12%. She added that for the US market, the fund will place emphasis on low P/E stocks. The fund will also be investing in China, after receiving permission to directly invest in stocks and bonds, within a 100 million US dollars amount.

Ms. Sophawadi added the fund is monitoring emerging market shares, and will make investments once it sees recovery signals for exports and commodities in said countries.