News came through this month that Toyota would be pulling out of Australian manufacturing in 2017, following the advance notice by Ford (2016), followed by General Motors Holden (2017).

This spells the end of the Australian motor industry and will produce closure of many of the parts manufacturers. All very sad, but honestly, the Australian motor manufacturers have been living on government hand-outs for years.

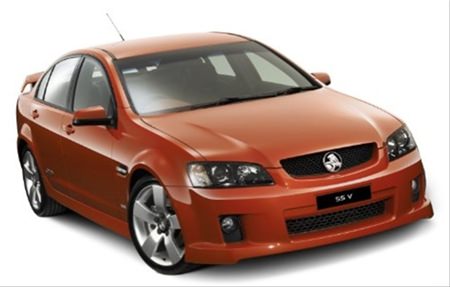

Holden Commodore

Holden Commodore

With a population of around 22 million, this is not enough to keep the industry viable, and everyone knew the axe would fall one day.

“Building cars in this country (Australia) is just not sustainable,” said GM’s Australia chairman Mike Devereux. His colleague, GM’s previous chief executive Dan Akerson, blamed the sustained strength of the Australian dollar, high costs of production, and Australia’s small population for the problem.

Total car production in Australia in 2012 was 178,000. Compare that to Thailand’s 1.5 million plus. In the first half of 2013 Australia built 80,370 passenger cars, while Thailand in the same time frame built 592,101.

The demise of Australian manufacturing has opened new doors for Thai manufacturers, with Toyota Thailand set to export the Camry to Australia, which has been building its own.

It is very obvious that the Australian industry is angry. Parts manufacturers in particular. The Director of OzPress Mark Dwyer said that developing countries experiencing a manufacturing boom, including China, Vietnam and Thailand have long-term strategies to boost their economies and he hit out at successive Australian federal governments for their lack of vision.

“Other countries have developed plans and strategies and have a vision for how their economies will grow, especially developing nations like China. We have got no plans, we’ve got no vision for the future. We have just got these rationalistic economic egg heads in treasury that believe in this open free-market selling us down the drain as far as employment goes.”

Some free-trade agreements have also hurt the industry, with Mark Dwyer highlighting the agreement with Thailand.

“When we signed a free-trade agreement with Thailand, we in the component industry thought this was great, we can sell components. Holden started talking about selling Statesmens and various cars into Thailand and as soon as Thailand realized that was an opportunity, they just turned around and whacked an excise of 40 percent on any component or any vehicle coming from Australia. Where is the free trade?” he said. This complaint is nothing new.

The sheer scale of manufacturing in developing countries makes it even more difficult for Australia to compete globally, with Mark Dwyer highlighting Ford’s plant in Chongqing China that can produce up to 350,000 annually and the Rayong, Thailand factory that builds up to 150,000 a year.

So despite the manufacturers folding up their tents and disappearing, car sales will obviously continue in Australia after 2017, and much of that can be sourced from Thailand, and probably will be giving a greater profit margin to the Thai manufacturers.

For interest, other manufacturers that have already left include British Leyland, Chrysler and Mitsubishi.